Bitcoin dropped under $100,000. That’s bad news for everyone holding crypto. But it’s especially brutal for MicroStrategy.

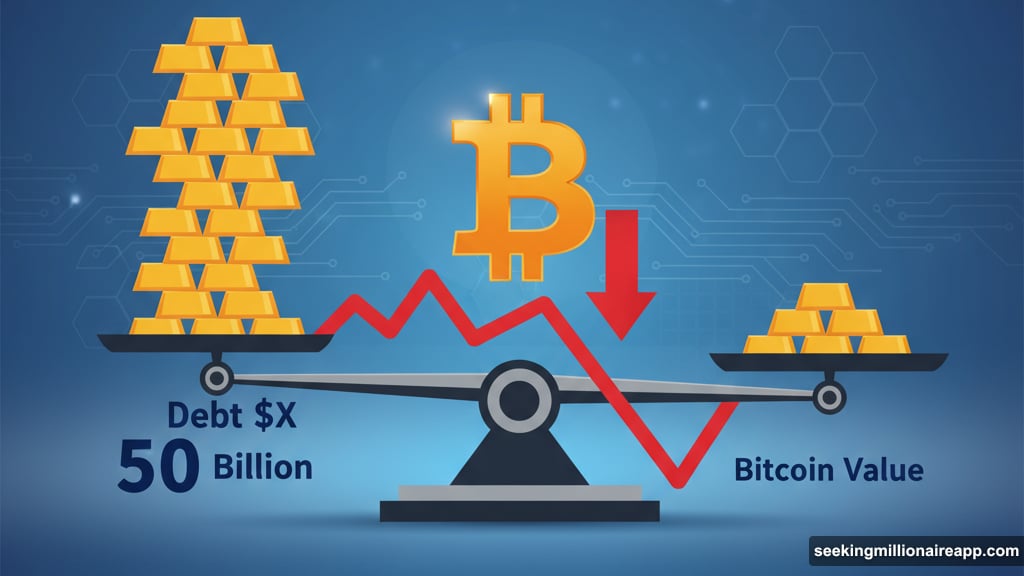

The company now owes more than its Bitcoin is worth. For the first time ever, their debt load exceeds the value of their massive crypto stash. That’s not just a bad quarter. It’s a structural crisis waiting to happen.

The Leverage Trap Snaps Shut

MicroStrategy built its entire strategy on borrowed money. Chairman Michael Saylor took out billions in loans to buy Bitcoin. When prices rose, this looked brilliant. Those gains multiplied fast.

But leverage cuts both ways. Now Bitcoin trades near $95,562, down from its peak above $100,000. That seemingly small drop created massive problems.

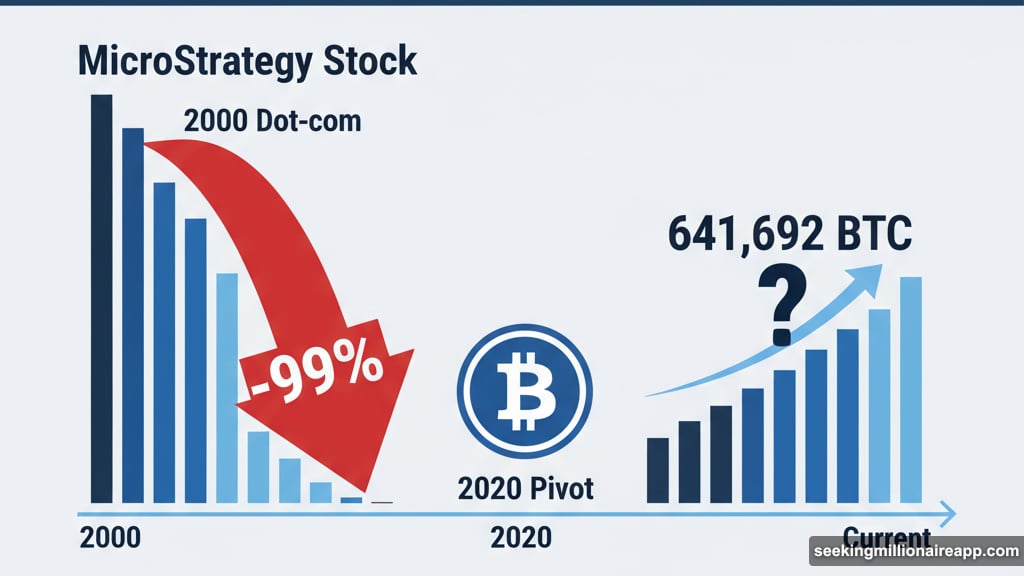

Here’s why. MicroStrategy owns 641,692 BTC. That’s roughly 3% of all Bitcoin in circulation. They used debt to buy most of it. So when prices fall, the value of their collateral shrinks while their debt stays constant.

The math turned ugly fast. Their market value just fell below the net asset value of their Bitcoin holdings. In plain terms, they owe more than they own.

Death Spiral Fears Grip Markets

Traders are now front-running what some call a “death spiral.” The logic is simple and terrifying.

Falling Bitcoin prices erode MicroStrategy’s collateral value. If prices drop far enough, lenders could demand more collateral or force asset sales. That means dumping Bitcoin onto the market.

But selling 3% of circulating supply would tank prices further. Which would require more selling. Which would drive prices even lower. You see the problem.

This scenario might never happen. Saylor insists it won’t. But the mere possibility spooked enough traders to trigger selling pressure. Markets don’t wait for disasters. They price in the risk immediately.

Plus, the company’s aggressive accumulation strategy now looks less like genius and more like recklessness. Borrowed billions amplify gains during bull runs. They also magnify losses when sentiment shifts.

Saylor Pushes Back Hard

Michael Saylor took to social media and CNBC to address the panic. His message: MicroStrategy isn’t selling anything.

“My view is Bitcoin is going to outperform gold, it’s going to outperform the S&P,” Saylor told CNBC. He called Bitcoin “digital capital” and the best place for long-term investors.

His confidence never wavers. But confidence doesn’t change the underlying math. When your debt exceeds your asset value, you’ve got a problem regardless of future price predictions.

Moreover, Saylor’s track record includes being spectacularly wrong before. He ran MicroStrategy during the dot-com crash when the stock lost 99% of its value. He pivoted to Bitcoin after that disaster. Now some wonder if history might repeat.

The company continues buying Bitcoin even now. Saylor posted “We are buying” alongside a Bitcoin logo. That’s either conviction or doubling down on a losing bet. Time will tell which.

Market Impact Spreads Fast

Bitcoin’s drop below $100,000 didn’t happen in isolation. MicroStrategy’s vulnerability amplified bearish sentiment across the market.

Traders know the math. If MicroStrategy faces forced selling, that supply shock would hammer prices. So some are selling preemptively to avoid getting caught in the downdraft.

This creates a feedback loop. Selling begets more selling. Fear feeds on itself. Even if MicroStrategy never touches its holdings, the speculation alone moves markets.

The situation also raises questions about other leveraged Bitcoin plays. How many other entities borrowed heavily to buy crypto? What happens to them if prices keep falling? Nobody knows the full extent of leveraged exposure.

Meanwhile, retail investors watch nervously. Many bought Bitcoin believing big institutional adoption made it safer. MicroStrategy was supposed to be proof that corporate America backed crypto. Now that thesis looks shakier.

Structural Vulnerabilities Exposed

This mess exposes real problems with aggressive leverage strategies in volatile markets. Bitcoin swings wildly. Using massive debt to amplify exposure works brilliantly in bull markets. But it creates catastrophic risk in downturns.

MicroStrategy bet everything on perpetual Bitcoin appreciation. That’s not a strategy. It’s speculation dressed up in corporate language.

The company provides software services. But nobody talks about that anymore. They’re essentially a leveraged Bitcoin fund wearing a business suit. The transformation happened so gradually that many missed how extreme it became.

Now the risks are impossible to ignore. Falling below net asset value means markets are pricing in real default risk. Investors worry the debt burden could force asset sales or restructuring. Neither outcome is good for shareholders or Bitcoin holders.

What Happens Next

Three scenarios could play out from here.

Bitcoin recovers quickly above $100,000. That would ease immediate pressure and restore some confidence. MicroStrategy stays solvent and Saylor looks vindicated. But this scenario requires renewed bullish momentum that might not materialize.

Bitcoin trades sideways near current levels. MicroStrategy stays underwater on its leverage but avoids forced selling. The situation becomes a slow bleed rather than acute crisis. Markets remain jittery about the overhang.

Bitcoin falls further toward $80,000 or below. This triggers the death spiral traders fear. Lenders demand collateral. MicroStrategy sells Bitcoin. Prices crash. More selling follows. Catastrophic losses spread across the market.

Nobody knows which path we’re on. But the fact that scenario three is even plausible shows how precarious things have become.

Saylor built a massive leveraged bet on Bitcoin using shareholder capital and borrowed billions. That bet is now severely underwater. His confidence might prove justified long-term. But short-term, the structural risks are undeniable and growing.

This isn’t about whether Bitcoin has value. It’s about whether borrowing billions to buy a volatile asset makes sense. Right now, the answer looks increasingly like no.