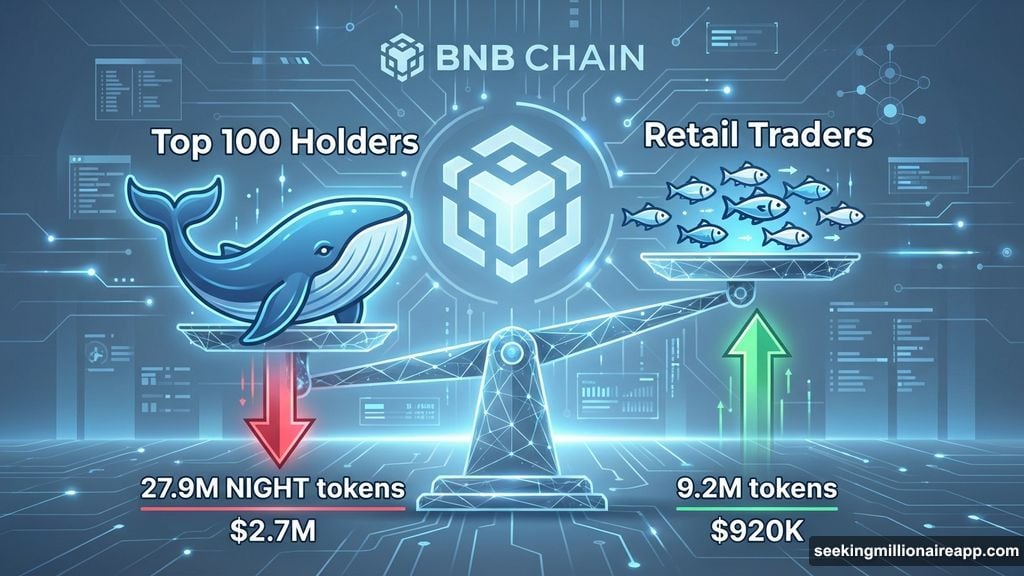

Midnight just hit a dangerous inflection point. Retail traders are buying the dip. But mega whales dumped $2.7 million worth of NIGHT tokens in seven days.

That’s not a fair fight. And the chart shows it.

NIGHT trades near $0.093 right now. It’s up 7% in 24 hours but down 6% over the past week. That split tells you everything about the tug-of-war happening underneath. Retail optimism can’t overcome whale distribution at this pace. Plus, the next move depends entirely on whether price reclaims $0.101 soon.

If it doesn’t, the breakdown could accelerate fast.

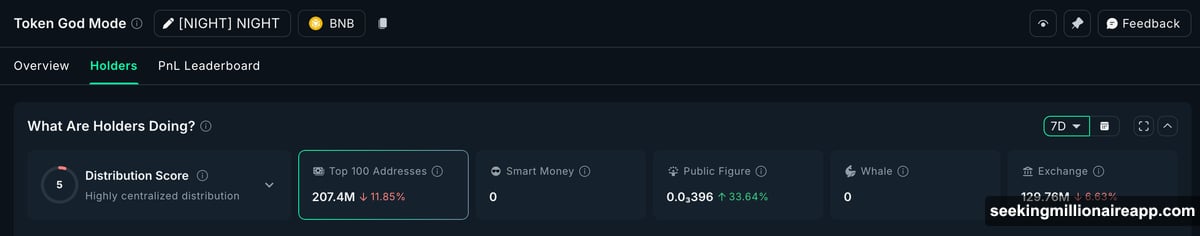

Mega Whales Exit While Small Fish Accumulate

Here’s what the on-chain data reveals. The top 100 NIGHT holders on BNB Chain reduced their balances by 11.85% over seven days. Their holdings dropped from 235.3 million NIGHT to 207.4 million NIGHT. That’s 27.9 million tokens gone.

At current prices, that equals roughly $2.7 million in selling pressure from the biggest wallets. These aren’t retail panic sellers. These are mega whales taking profit or repositioning. Either way, it’s supply hitting the market that retail can’t absorb.

Now look at the other side. Exchange balances tell a different story. NIGHT on exchanges fell 6.63% in the same timeframe. That’s 9.2 million tokens, or about $920,000 worth, leaving exchanges. Retail is buying.

But do the math. Whale selling outweighs retail buying by nearly three times. That’s a structural problem. Retail sentiment might be positive, but the capital flows don’t match the enthusiasm.

On-Balance Volume (OBV) confirms retail participation. OBV tracks buying pressure using volume direction. It just broke its trendline and made a higher high while NIGHT price made lower highs between December 21 and December 29. That’s a bullish divergence.

However, divergences don’t override whale distribution. They show retail interest exists. But interest alone won’t hold price if whales keep unloading supply.

Long Positions Create A Liquidation Trap

Derivatives data paints an even riskier picture. On Bybit, NIGHT-USDT perpetuals show $3.45 million in long liquidation leverage versus $2.54 million in shorts. Longs make up 57% of total liquidation exposure.

That means more traders are betting on upside. But it also means there’s a fat target for a liquidation cascade if price dips.

The liquidation map highlights a critical zone at $0.082. If NIGHT drops to that level, nearly $2.91 million of long positions face forced liquidation. That’s over 84% of the current long cluster. A move into that zone would trigger automatic selling that pushes price even lower.

This setup is common when retail enthusiasm builds while whales distribute. Retail goes long. Whales sell into strength. Then price corrects, liquidations trigger, and the move accelerates downward faster than most traders expect.

So far, NIGHT hasn’t broken down. But the risk is visible. And it’s growing as long as mega whales keep selling while derivatives remain skewed long.

Critical Levels Decide The Next Move

NIGHT trades near $0.093. The first test is $0.101. That level sits at the 0.618 Fibonacci retracement. It’s psychological and technical at the same time. A daily close above $0.109 would confirm momentum and set up a run toward $0.119.

Above $0.119, NIGHT enters fresh price discovery for this range. That’s where the trend has room to extend. But mega whale selling would need to slow or stop for that scenario to play out. Right now, nothing suggests whales are done distributing.

If NIGHT fails to reclaim $0.101, the path turns downward. Losing $0.082 triggers the liquidation cluster. From there, $0.071 becomes the invalidation zone for any near-term recovery attempt. That’s a 24% drop from current levels.

The chart shows retail accumulation. The derivatives show retail optimism. But the on-chain flows show mega whales unloading supply faster than retail can absorb it. That’s the setup right now.

One Side Will Win Soon

Midnight sits between two opposing forces. Retail traders see the dip and buy. Mega whales see the rally and sell. One side will dominate soon.

For bulls, reclaiming $0.101 with volume is the only path forward. Without that, the trend stays vulnerable. And if price dips toward $0.082, the liquidation cascade could drag NIGHT below $0.071 before most traders react.

Retail sentiment doesn’t move markets when whales control supply. That’s the lesson here. NIGHT might rally. But the odds tilt against it as long as mega whales keep distributing and retail remains underleveraged to offset the selling pressure.

The Midnight Express could derail before it reaches the next station. Watch $0.101. That’s the line that matters now.