Monad jumped 29% last week. Traders celebrated the breakout. But something’s off.

Three critical signals now flash warning signs just as the market heads into Boxing Day. Smart money is backing away. Capital flows are reversing. And the technical setup that triggered this rally is starting to crack.

Here’s what’s happening behind the chart patterns that most traders miss.

The Breakout Works, But Nobody’s Funding It

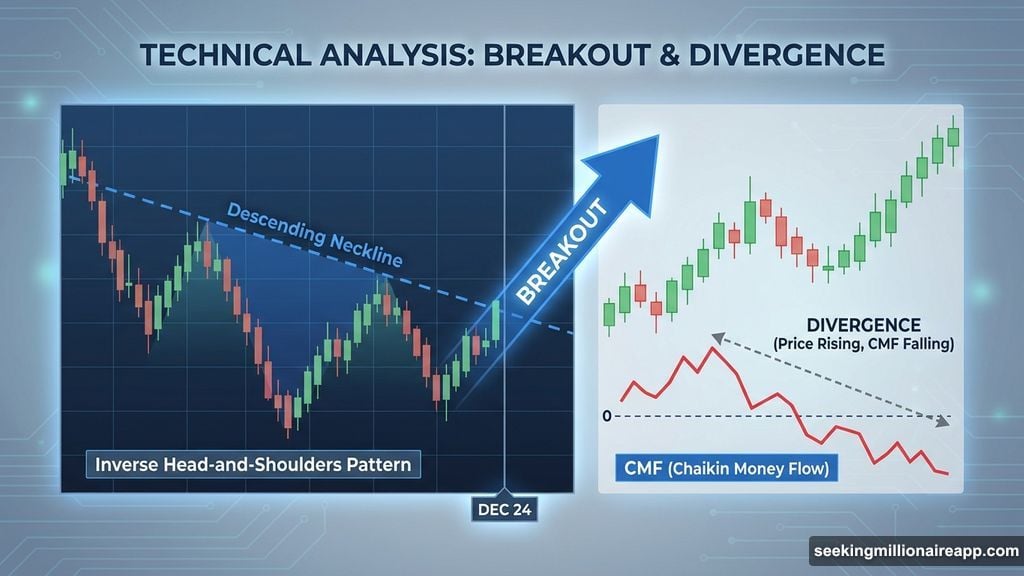

Monad cleared a textbook inverse head-and-shoulders pattern on December 24. That’s usually bullish. The price broke above the descending neckline that had capped rallies for weeks.

But look closer at those recent candles. Long wicks everywhere. That’s sellers pushing back hard every time MON tries to climb higher.

The Chaikin Money Flow (CMF) tells the real story. CMF measures whether big capital supports a price move. When Monad broke out, CMF tried to cross above zero. It failed.

Now CMF is trending lower while the price keeps rising. That’s a classic divergence pattern. Breakouts without CMF confirmation usually run on fumes, not fuel.

The last time CMF failed at zero and dropped was December 11. Monad’s price tanked soon after. History might be repeating itself right now.

Spot Traders Are Taking Profits Fast

The exchange flow data confirms what CMF is showing. Since December 22, MON’s spot activity flipped from $1 million in outflows to roughly $2 million in inflows.

Inflows mean tokens moving to exchanges. That usually signals selling pressure. Traders who bought the dip are now cashing out at these levels.

Plus, a breakout needs fresh capital to sustain momentum. Instead, Monad is seeing the opposite. Early buyers are taking profits while new money stays on the sidelines.

This creates a supply problem. More tokens available for sale, fewer buyers willing to step in at higher prices. That imbalance doesn’t favor continuation rallies.

Smart Money Just Cut Perpetual Exposure

The derivatives market shows the sharpest reversal in sentiment. Over the last seven days, smart money on perpetuals added aggressively. Long positions hit $89.36 million, up more than 99%.

That surge lined up perfectly with the December 24 breakout. Big traders were betting on follow-through to the upside.

Then everything changed in the last 24 hours. Smart money long exposure dropped more than 12%. The top 100 perpetual addresses cut positions by over 216%. Even public traders, who usually chase trends late, reduced exposure by nearly 29%.

When smart money fades a rally this fast, it sends a clear message. They don’t trust the breakout anymore. The risk-reward shifted against holding long positions into Boxing Day.

This matters because perpetuals funding helped fuel the initial rally. Without that support, Monad’s price faces serious resistance at current levels.

Two Price Zones Decide What Happens Next

Monad sits at $0.024 right now. That’s a critical inflection point.

Above $0.026, MON can attempt another leg higher. A 12-hour close above that level opens the path to $0.030. Clearing $0.030 would finally break the downward-sloping neckline that’s pressured every rally attempt for weeks.

But the downside risk is real. If the rally loses momentum, $0.021 acts as first support. Dropping below $0.018 would damage the breakout structure. A close under $0.016 would invalidate the entire inverse head-and-shoulders pattern.

That would send Monad back toward mid-December lows. All those breakout gains would evaporate in days.

Boxing Day, December 26, becomes the testing ground. Either Monad proves the breakout is real with sustained buying pressure, or it hands most of these gains back to sellers.

The Uncomfortable Truth About This Rally

Monad’s 29% rally looks impressive on the surface. But the underlying structure is weak.

CMF never confirmed the move. Spot flows show profit-taking, not accumulation. Derivatives positioning reversed fast as smart money backed away.

These three signals don’t guarantee an immediate reversal. Monad could still push higher if buyers step in aggressively. But the odds shifted. This rally now depends on new momentum that isn’t showing up in the data yet.

For traders holding MON, the next 48 hours matter more than the last week’s gains. Watch those key levels closely. Above $0.026, the rally might survive. Below $0.021, the breakout story starts falling apart.

Boxing Day will deliver the verdict on whether this breakout had real legs or just ran on hype that’s already fading.