Morgan Stanley stopped testing the waters. Now they’re diving in headfirst.

The $9.3 trillion asset manager appointed Amy Oldenburg as Head of Digital Asset Strategy this week. That’s not a research role. It’s an execution position. Plus, the timing reveals everything about where traditional finance is headed with crypto.

From Cautious Observer to Full Participant

Wall Street’s fourth-largest bank spent two years tiptoeing around digital assets. Those days ended abruptly.

Morgan Stanley now offers Bitcoin ETF access to advisors managing $7.4 trillion in client assets. They’re hiring dozens of crypto-focused employees. And they filed applications for their own Bitcoin, Ethereum, and Solana ETFs.

This isn’t exploration anymore. It’s commitment.

Oldenburg’s appointment makes that crystal clear. She previously worked in emerging markets for Morgan Stanley and understands institutional requirements. Her mandate spans product development, partnerships, and trading across all divisions.

“When institutions turn against you, you want to hold your keys, you want to hold your coins,” Oldenburg stated publicly. That message signals a philosophical shift beyond just offering crypto products.

The Two-Year Journey From Skeptic to Believer

Morgan Stanley’s evolution happened faster than most predicted. But each step followed a deliberate pattern.

Back in 2024, advisors could recommend Bitcoin ETFs only to high-net-worth clients. Minimum account balances applied. Risk disclosures dominated conversations. The bank treated crypto like a speculative experiment.

Then 2025 changed everything. Restrictions vanished. Retirement accounts gained crypto access. Advisors started positioning Bitcoin as “digital gold” with recommended allocations of 2-4% for risk-tolerant portfolios.

By September 2025, Morgan Stanley announced direct crypto trading through E*TRADE. Bitcoin, Ethereum, and Solana would trade alongside stocks and bonds. Not through third-party platforms. Not with special restrictions. Just regular trading.

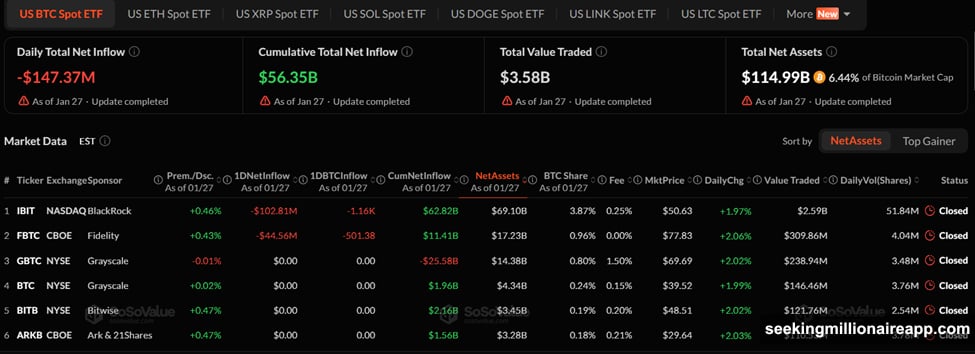

Early 2026 brought the final confirmation. SEC filings revealed Morgan Stanley’s intent to launch proprietary crypto ETFs. They’re not just distributing other firms’ products anymore. They’re competing directly with BlackRock and Fidelity in a market that grew to $114 billion in Bitcoin ETF assets alone.

Wall Street’s Crypto Race Accelerates

Morgan Stanley isn’t alone in this transformation. Yet their moves signal something bigger than one bank’s strategy shift.

CoinMarketCap reports that 60% of the top 25 US banks now offer or announced Bitcoin services. JPMorgan, Wells Fargo, and Citi joined the rush. Trading desks opened. Custody services launched. Infrastructure spending surged.

The regulatory environment helped accelerate this timeline. Clearer stablecoin rules arrived. Guidance on banks acting as crypto intermediaries removed legal uncertainty. Suddenly, compliance teams could greenlight projects that sat on hold for years.

But the real catalyst? Client demand became impossible to ignore.

Financial advisors fielded constant questions about crypto allocation. High-net-worth clients demanded exposure. Institutional portfolios needed diversification beyond traditional assets. Morgan Stanley responded to market pressure that wouldn’t disappear.

Fintech journalist Frank Chaparo captured the momentum perfectly: “2026 is going to be explosive for crypto.” Morgan Stanley’s hiring spree and platform expansion validate that prediction.

The Talent Question Nobody’s Discussing

Wall Street’s crypto push faces one significant obstacle. Compensation structures designed for traditional finance don’t attract top crypto talent.

Industry observer Felix Hartmann raised eyebrows when he spotted Morgan Stanley advertising director-level crypto strategy roles starting at $80,000 annually. That’s entry-level compensation in crypto-native firms. Senior strategists command multiples of that salary, plus token incentives that Wall Street can’t match.

Morgan Stanley needs to adjust quickly. They’re competing against crypto firms that offer equity stakes, token allocations, and startup-style upside. Traditional banking compensation packages won’t cut it.

Still, the firm brings advantages crypto startups lack. Established client relationships. Regulatory compliance expertise. Distribution networks worth trillions. Access to institutional capital markets.

Smart crypto professionals recognize those benefits. But Morgan Stanley must bridge the compensation gap to build teams capable of executing their ambitious strategy.

What This Means for Crypto Markets

Morgan Stanley’s transformation matters beyond one firm’s strategy. It represents Wall Street’s final acceptance of crypto as permanent infrastructure.

The bank manages client assets worth more than most countries’ GDP. When that capital gains crypto exposure, even small allocation percentages move markets significantly. A 2% Bitcoin allocation across Morgan Stanley’s wealth management platform equals roughly $150 billion in potential buying pressure.

Moreover, proprietary ETF filings demonstrate long-term commitment. Banks don’t invest resources into product development for short-term experiments. They build when they believe markets will exist for decades.

Direct trading through E*TRADE normalizes crypto alongside traditional assets. Clients won’t view Bitcoin as exotic speculation when it trades next to Apple and Microsoft. That psychological shift accelerates mainstream adoption faster than any marketing campaign.

The timing also matters. Bitcoin recently traded around $104,000, establishing new price discovery zones. Ethereum’s network upgrades improved scalability. Solana’s ecosystem grew despite past controversies. Morgan Stanley picked its entry point during crypto’s maturation phase, not its speculative peak.

The Risk Everyone’s Ignoring

Wall Street’s enthusiasm creates genuine benefits for crypto adoption. But it also introduces centralization risks that contradict crypto’s founding principles.

Amy Oldenburg’s comment about holding your own keys reveals awareness of this tension. When institutions control custody, they control access. That’s convenient for compliance. But it undermines the permissionless ethos that made crypto revolutionary.

Most Morgan Stanley clients won’t self-custody Bitcoin. They’ll trust the bank’s infrastructure. If that infrastructure faces regulatory pressure, government seizure, or technical failure, clients lose access regardless of blockchain’s decentralization.

Plus, Wall Street’s involvement subjects crypto to traditional finance’s systemic risks. When banks treat Bitcoin like any other asset, they apply the same fractional reserve practices, rehypothecation strategies, and leverage ratios that caused 2008’s financial crisis.

That’s not paranoia. It’s historical pattern recognition. Financial institutions optimize for their interests, not technology’s original vision. The question isn’t whether this tension exists. It’s whether crypto can maintain its core properties while absorbing institutional capital.

Where This Goes Next

Morgan Stanley’s commitment signals the beginning, not the end, of Wall Street’s crypto transformation. Other banks will follow with similar announcements. Competition will drive innovation in products, custody solutions, and trading infrastructure.

Regulatory clarity should improve as banks deploy lobbying resources to protect their crypto investments. That’s good for removing uncertainty but might entrench incumbent advantages over nimbler crypto-native competitors.

The real test comes during crypto’s next major correction. Will Morgan Stanley maintain conviction when Bitcoin drops 40%? Will advisors keep recommending crypto allocations when clients panic? Will proprietary ETFs survive redemption pressure during market stress?

Those questions matter more than today’s enthusiastic announcements. Any bank can embrace crypto during bull markets. Staying committed through bear markets separates strategic vision from opportunistic positioning.

For now, Morgan Stanley deserves credit for decisive action. They appointed leadership. Opened distribution channels. Filed product applications. Hired talent. These aren’t reversible moves made lightly.

Wall Street opened the pipes. Now let’s see if crypto infrastructure can handle the flood.