Wall Street’s titans are done watching from the sidelines. Morgan Stanley just posted a job opening that reveals how serious traditional finance has become about crypto.

The $9 trillion banking giant is hunting for a lead blockchain engineer. But this isn’t some token diversity hire to check a box. The role focuses on building actual DeFi infrastructure and real-world asset tokenization systems.

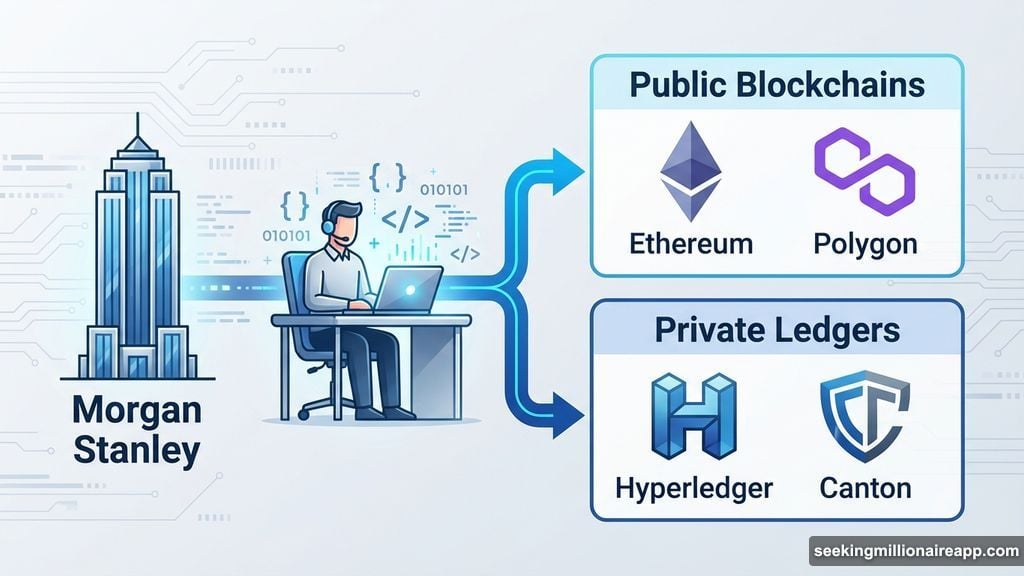

Here’s why that matters. Most banks dabble in crypto with pilot projects and press releases. Morgan Stanley is hiring engineers to connect public blockchains like Ethereum and Polygon with private ledgers like Hyperledger and Canton. That’s production-level infrastructure, not experimentation.

DeFi Meets Traditional Banking Infrastructure

The LinkedIn job posting spells out exactly what Morgan Stanley wants to build. The successful candidate will create “scalable, secure, and regulatory-compliant solutions” that bridge traditional banking with digital assets.

Translation? Morgan Stanley plans to move real money through DeFi protocols while keeping regulators happy. That’s the holy grail traditional finance has chased for years.

The blockchain requirements tell the full story. Engineers need expertise in four distinct platforms. Ethereum and Polygon handle public network liquidity and Layer-2 scaling. Meanwhile, Hyperledger and Canton provide institutional-grade privacy for permissioned transactions.

This split architecture makes sense. Public chains offer access to DeFi’s $100 billion in total value locked. Private ledgers satisfy compliance departments and enterprise security requirements. Combining both creates infrastructure that actually works for a regulated bank.

Plus, Morgan Stanley isn’t building this infrastructure for fun. The timing connects directly to their E*Trade crypto launch planned for the first half of 2026. That platform will support Bitcoin, Ethereum, and Solana trading for retail customers.

Tokenization Gold Rush Accelerates

Real-world asset tokenization has exploded recently. According to DeFiLlama, DeFi protocols and RWA tokenization projects now control over $100 billion in combined value. That’s real capital deployed in these systems.

Morgan Stanley clearly sees the opportunity. Their job posting explicitly lists both DeFi and tokenization as core focus areas. These aren’t side projects. They’re strategic priorities driving major infrastructure investments.

Other Wall Street giants are making similar moves. BlackRock and Fidelity already tokenize institutional funds. JPMorgan Chase increased blockchain-related job postings significantly. The pattern is obvious.

Traditional finance is transitioning from pilot programs to production systems. Banks are building permanent revenue-generating digital asset products. The experimental phase is over.

What changed? Regulatory clarity improved under the current US administration. More importantly, the numbers became impossible to ignore. When $100 billion flows into DeFi and tokenization, banks can’t afford to sit out.

Skills Gap Creates Opportunity

The Morgan Stanley job posting highlights a critical shortage. Traditional banks need engineers who understand both institutional finance and blockchain technology. That combination is rare.

Most blockchain engineers came up through crypto-native companies. They understand smart contracts and consensus mechanisms. But they often lack experience with banking compliance, settlement systems, and institutional risk management.

Conversely, traditional bank technologists know regulatory requirements inside and out. However, they typically have little exposure to DeFi protocols, tokenization standards, or blockchain architecture patterns.

Morgan Stanley needs someone who speaks both languages fluently. That person must architect systems connecting Ethereum’s permissionless environment with Canton’s permissioned ledger. They need to satisfy both DeFi users and compliance officers.

This skills gap creates massive opportunity for engineers who invest in learning both domains. The compensation for roles bridging traditional finance and crypto reflects the scarcity. Senior positions at major banks often offer seven-figure packages.

What This Means for Crypto Markets

Morgan Stanley’s aggressive hiring signals confidence in crypto’s institutional future. Banks don’t build production infrastructure for trends they expect to fade.

The ETrade integration is particularly significant. When a major retail brokerage adds crypto trading, it expands access dramatically. ETrade serves millions of customers who trust traditional financial brands.

Many of those customers wouldn’t touch standalone crypto exchanges. But they’ll trade Bitcoin through their existing E*Trade account. That’s how crypto achieves mainstream adoption. It gets embedded in platforms people already use.

Moreover, Morgan Stanley’s infrastructure choices validate specific blockchain networks. By requiring Ethereum and Polygon expertise, they’re betting on those ecosystems. Engineers will build real products on those chains, not just experiments.

The combination of public and private blockchains matters too. It proves that banks can participate in DeFi without abandoning regulatory compliance. That framework could accelerate institutional adoption significantly.

Competition Intensifies Among Traditional Banks

Morgan Stanley isn’t alone in this race. Every major bank is evaluating similar strategies. Some are further ahead. Others are playing catch-up.

JPMorgan Chase operates its own blockchain network called Onyx. They’ve processed hundreds of billions in transactions through that system. However, Onyx is primarily permissioned. It doesn’t directly integrate with public DeFi protocols.

Goldman Sachs launched its Digital Assets Platform in 2022. They’ve issued bonds and facilitated repo transactions on blockchain. But they’ve been slower to embrace tokenization and DeFi integration.

BlackRock made aggressive moves through its acquisition of crypto infrastructure firms. Their tokenized money market fund attracted significant assets. Fidelity similarly expanded digital asset custody and trading services.

The competitive dynamic is clear. Banks that move fastest gain first-mover advantages in this emerging market. Those advantages include relationships with crypto-native companies, technical expertise, and regulatory clarity earned through real deployments.

Morgan Stanley’s hiring push suggests they’re accelerating to catch up with early movers. The specific focus on DeFi and tokenization indicates they’re targeting the highest-growth segments.

Risks Still Loom Large

Despite the enthusiasm, significant challenges remain. Building compliant DeFi infrastructure is genuinely difficult. Regulators haven’t provided complete clarity on how traditional banks should interact with decentralized protocols.

Smart contract risks pose another concern. DeFi protocols have suffered numerous hacks and exploits. Banks can’t afford those failures. One major security incident could set institutional adoption back years.

Additionally, the technology itself is still maturing. Blockchain networks face scalability limitations. Transaction costs fluctuate unpredictably. Interoperability between different chains remains clunky.

Morgan Stanley’s multi-chain strategy addresses some of these issues. By supporting both public and private blockchains, they build redundancy and flexibility. If one network encounters problems, they can route transactions through alternatives.

Still, complexity creates its own risks. More moving parts mean more potential failure points. Coordinating transactions across Ethereum, Polygon, Hyperledger, and Canton requires sophisticated orchestration.

The regulatory environment could shift again too. A new administration might reverse the current pro-crypto stance. Banks investing heavily in this infrastructure face political risk alongside technological challenges.

The Talent War Heats Up

Morgan Stanley’s aggressive recruiting reflects broader competition for blockchain talent. Demand far exceeds supply. Engineers with relevant skills can command premium compensation.

This talent shortage will likely intensify before it improves. Educational institutions are only beginning to offer blockchain-focused programs. Most experienced professionals learned through self-study or working at crypto-native companies.

Traditional banks face a particular disadvantage in this competition. They’re competing against well-funded crypto startups offering equity upside. Many engineers prefer crypto’s culture and mission over traditional finance.

To overcome this gap, banks are offering higher salaries, remote work flexibility, and more interesting projects. Morgan Stanley’s focus on cutting-edge DeFi infrastructure makes the role more appealing than typical bank technology jobs.

The competition benefits engineers significantly. It’s pushing compensation higher and creating more career opportunities. For talented professionals, this is an ideal time to develop blockchain expertise.

However, it creates headaches for banks trying to execute their strategies. They can’t build infrastructure without engineers. Delays in hiring translate to delays in product launches and competitive disadvantages.

Long-Term Industry Transformation

Morgan Stanley’s infrastructure buildout represents more than one bank’s strategy. It signals a fundamental shift in how traditional finance views digital assets.

Five years ago, most banks dismissed crypto as a fad. Two years ago, they acknowledged it but remained cautious. Now they’re building production systems and hiring specialized teams.

This transition will reshape both traditional finance and crypto markets. Banks bring capital, compliance expertise, and customer relationships. Crypto brings innovation, efficiency, and new financial primitives.

The combination could unlock massive value. Tokenizing real-world assets makes them more liquid and accessible. DeFi protocols offer 24/7 operation and transparent pricing. Traditional banks provide regulatory compliance and institutional trust.

Of course, challenges remain significant. Culture clashes between traditional finance and crypto are real. Regulatory frameworks are still evolving. Technology risks persist.

But the momentum is undeniable. When $9 trillion banking giants hire engineers to build DeFi infrastructure, the industry has crossed a threshold. We’re past the question of whether traditional finance will embrace crypto. Now it’s just a race to see who executes fastest.

Choose wisely. For engineers, this creates incredible opportunities. For banks, it’s existential. The next five years will determine which institutions successfully navigate this transition and which get left behind.