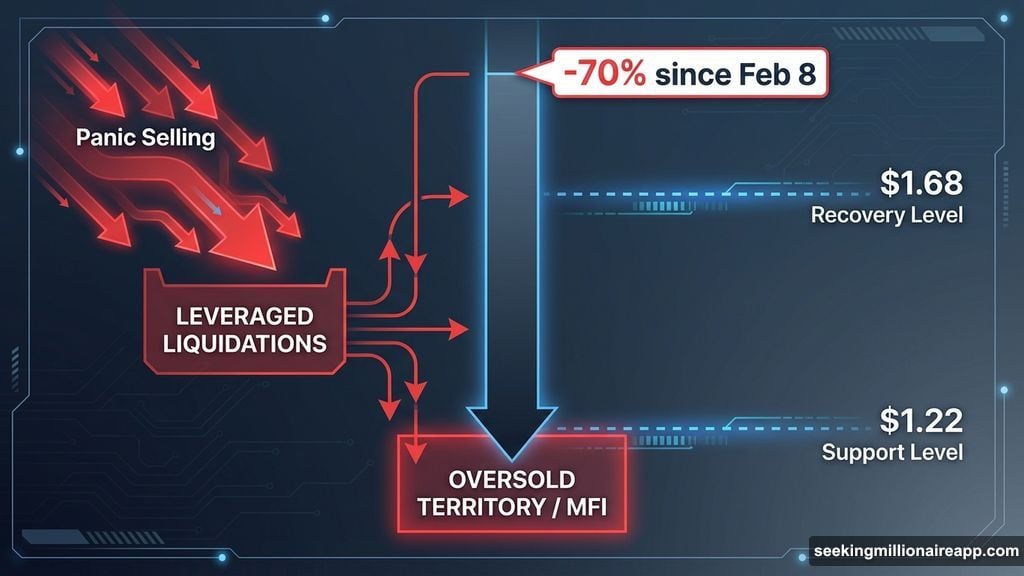

MYX Finance just crossed a milestone nobody wanted to see. For the first time in its entire trading history, the token has entered oversold territory — and traders aren’t celebrating.

After weeks of brutal selling pressure, MYX has dropped nearly 30% in the past 24 hours alone, trading around $1.50. That follows a staggering 70% decline since February 8. So while oversold readings usually hint at a potential bounce, the bigger picture here is a lot more complicated.

Bitcoin Correlation Flipped — and That’s Bad News

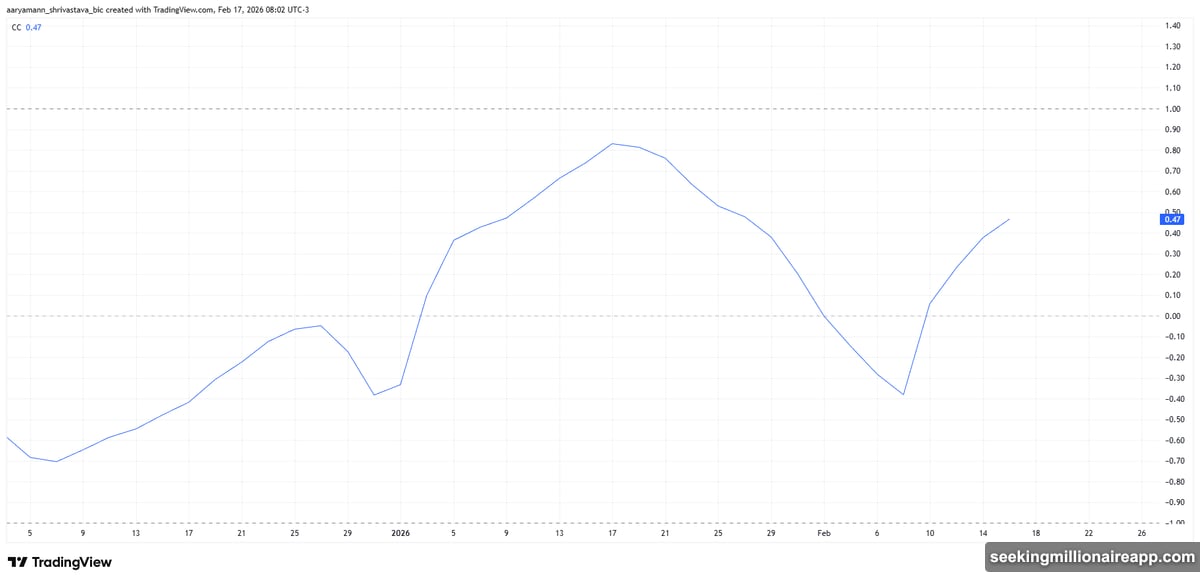

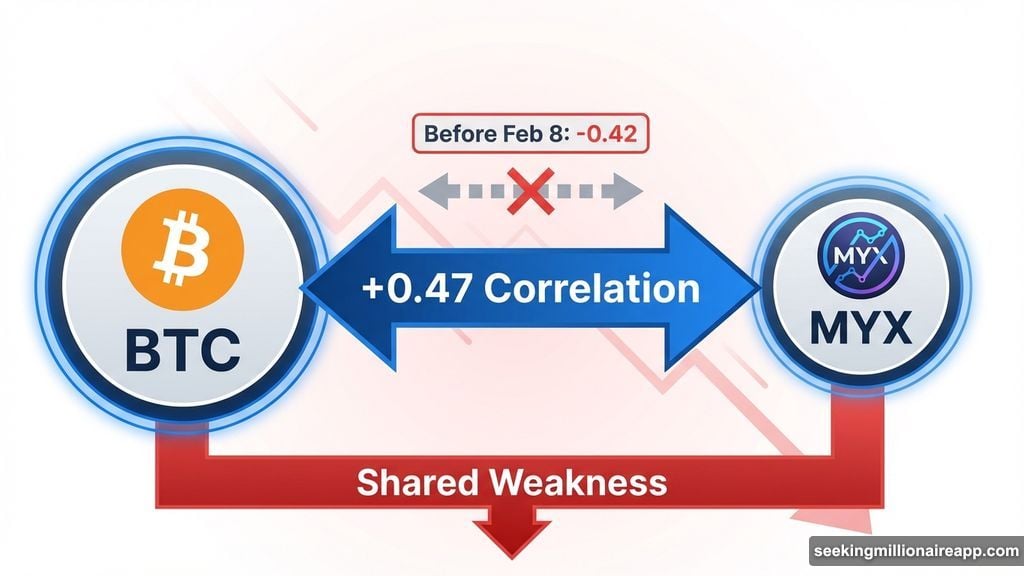

Here’s where things get interesting. MYX’s relationship with Bitcoin did a complete reversal recently.

Before February 8, MYX carried a negative 0.42 correlation with Bitcoin. That means when Bitcoin dropped, MYX sometimes moved independently. But since then, the correlation swung to a positive 0.47. Now MYX is increasingly tracking Bitcoin’s price movements step for step.

That sounds fine, except Bitcoin hasn’t recovered. It’s been stuck in consolidation with no meaningful breakout. So instead of independence giving MYX room to breathe, the new tight link to Bitcoin means MYX inherits all of Bitcoin’s weakness too.

Without a clear Bitcoin recovery, that positive correlation becomes a drag anchor rather than a lifeline.

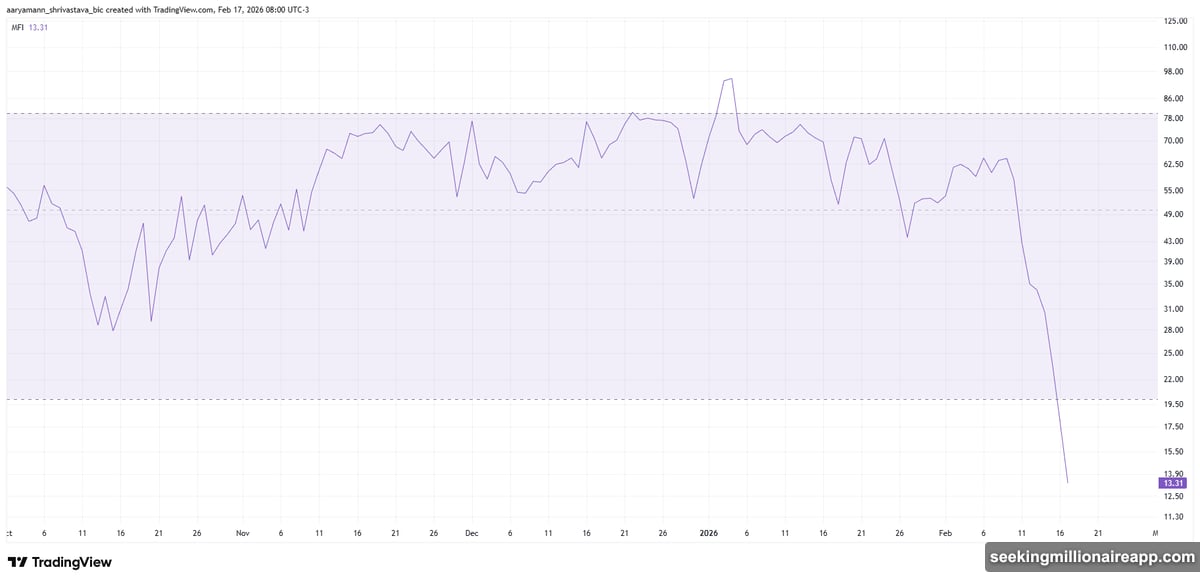

The Money Flow Index Tells a Grim Story

The Money Flow Index (MFI) — a tool that measures buying and selling pressure — paints a stark picture of what’s been happening.

Capital has been rushing out of MYX at a severe rate. Panic selling combined with leveraged liquidations created a feedback loop that kept pushing prices lower. Each forced exit triggered more selling, which triggered more exits.

That chain reaction is what pushed MYX into oversold territory for the first time ever in its trading history. Normally, reaching this zone signals that sellers are exhausted and value-focused buyers might start stepping in.

But “normally” assumes broader market conditions are cooperating. Right now, they aren’t.

Oversold Doesn’t Mean Bounce — Not Yet

Oversold conditions can precede short-term relief rallies. That’s textbook technical analysis. The problem is that textbooks don’t account for fragile market sentiment and Bitcoin sitting on the fence.

Fresh capital needs a reason to flow in. Right now, potential buyers are watching the same weak macro signals and hesitating. A 70% drawdown from earlier highs might look attractive on paper, but cautious investors want confirmation before committing.

The realistic downside scenario points toward a retest of the $1.22 level. That’s where some analysts expect oversold conditions might finally trigger meaningful stabilization, assuming selling pressure starts to fade.

What a Recovery Would Actually Need

For the bearish trend to flip, MYX needs to reclaim the $1.68 level. That’s the first real checkpoint that would signal something is changing.

If buying pressure picks up at current levels and holders stop selling into weakness, momentum could shift faster than expected. A confirmed bounce above $1.68 would put $2.01 back in focus as the next meaningful target. Clear that, and the broader bearish outlook starts looking shakier.

But that’s a conditional scenario. It requires Bitcoin to stabilize or break higher, sentiment to shift, and active accumulation to replace the current wave of exits. That combination hasn’t appeared yet.

The Honest Take

MYX entering oversold territory for the first time ever is a significant technical event. In a healthy market environment, that would probably generate excitement about a recovery setup.

This isn’t a healthy market environment. Bitcoin is stalling, selling pressure remains heavy, and leveraged positions continue unwinding. Oversold can always get more oversold when macro conditions stay unfavorable.

Watching the $1.68 level is the clearest way to gauge whether sentiment is genuinely shifting. Until that level gets reclaimed, the path of least resistance still points downward. Patience and caution seem warranted before drawing any recovery conclusions.

This article is for informational purposes only and should not be considered financial or investment advice. Always conduct your own research and consult a professional before making financial decisions.