Almost $5 billion worth of Bitcoin and Ethereum options contracts expire today at 8:00 UTC on Deribit. That’s real money on the line, and traders are watching closely.

The timing couldn’t be more intense. Bitcoin just fell below $100,000 for the second time this week. Ethereum hovers near $3,224. Plus, both assets face critical “max pain” levels that could pull prices in specific directions as contracts settle.

Today’s expiry is slightly smaller than last week’s $5.4 billion event. But the stakes feel higher. Market volatility is rising, and uncertainty dominates short-term sentiment.

Bitcoin Traders Bet on Recovery

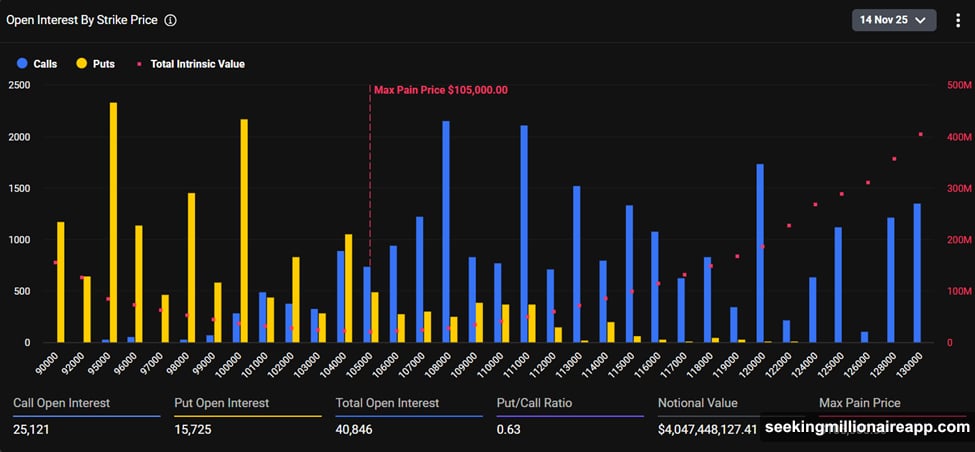

Bitcoin options data reveals cautious optimism despite recent price weakness. The notional value exceeds $4.04 billion across 40,846 contracts.

Here’s what the positioning shows. Call options total 25,121 contracts, while puts sit at 15,725. That creates a put-to-call ratio of 0.63, meaning traders are buying significantly more calls than puts.

The max pain level sits at $105,000. That’s the strike price where most option holders would lose the most money. Therefore, price action often gravitates toward this level as expiration approaches due to hedging pressures from market makers.

Bitcoin currently trades at $99,092, down nearly 3% in 24 hours. So the asset needs to climb about 6% to reach the max pain point. That’s a significant move in just hours.

However, the options positioning suggests active hedging rather than panic. Open interest concentrates heavily near $95,000 and $100,000 for puts. Meanwhile, calls cluster around $108,000 and $111,000. These price levels become battlegrounds as traders adjust their positions ahead of settlement.

Ethereum Shows Strong Bullish Tilt

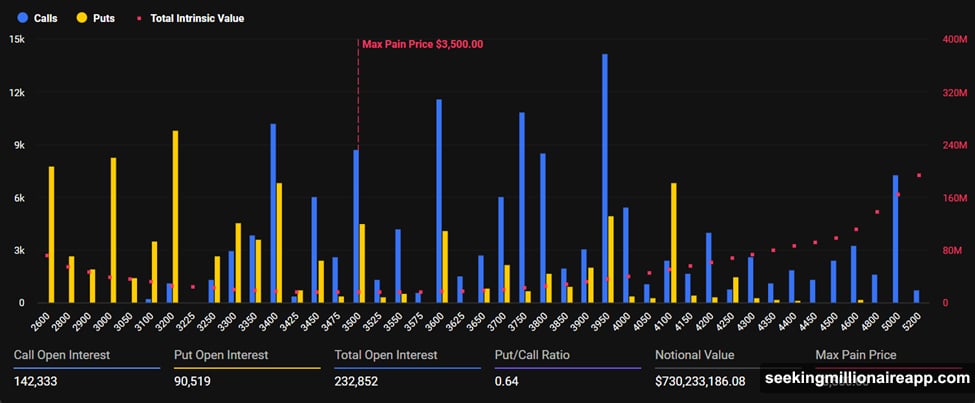

Ethereum options display even more aggressive bullish positioning. The notional value tops $730 million across 232,852 contracts.

Call options dominate at 142,333 contracts compared to just 90,515 puts. That creates a put-to-call ratio of 0.64, similar to Bitcoin but with more lopsided absolute numbers. In fact, calls outnumber puts by 1.5x, indicating traders expect upward price movement.

The max pain level sits near $3,500. Ethereum currently trades at $3,224, meaning it would need to rally about 8.5% to hit that strike price before expiration. That’s a tall order in such a short timeframe.

Yet the positioning suggests traders aren’t worried. The heavy call bias shows confidence that ETH can climb or at least hold current levels. This contrasts with more defensive positioning we’ve seen in previous expirations during market downturns.

Rising Volatility Signals Bigger Moves Ahead

Beyond today’s options expiry, broader market conditions suggest increased turbulence coming. Analysts at Greeks.live highlight several catalysts driving uncertainty.

First, the US government just ended a 43-day shutdown. During that period, critical economic data wasn’t released on schedule. Now economists must rely on projections rather than hard numbers. Plus, the latest CPI data didn’t publish, amplifying the importance of the next release.

Second, the December Federal Reserve meeting looms large. Interest rate decisions could swing crypto markets dramatically. But with incomplete economic data, the Fed’s decision becomes harder to predict.

Third, implied volatility is rising across major maturities. That means traders expect bigger price swings in the near term. Open interest and trading volume continue climbing, especially in out-of-the-money options. This divergence signals market participants can’t agree on where prices head next.

Greeks.live analysts also note that block trades have become more active. Meanwhile, the skew is moving toward equilibrium, and the short-term curve has fragmented. All these technical indicators point to heightened uncertainty about near-term price direction.

What Happens After Expiration

Options expiries often create short-term volatility followed by market stabilization. Here’s why.

As contracts approach settlement, market makers must hedge their positions. This creates buying or selling pressure that pushes prices toward max pain levels. Once expiration passes, that hedging pressure disappears. Markets can then trade based on fundamental factors rather than options mechanics.

Today’s expiry also clears the deck for new positioning. Traders will establish fresh bets based on current market conditions. That usually means reduced volatility in the immediate aftermath as the market digests the settlement and finds new equilibrium.

However, this time might be different. The combination of incomplete economic data, Fed uncertainty, and geopolitical tensions creates a volatile backdrop. So even after today’s expiry settles, markets might remain choppy.

Smart Money Watches These Levels

Several key price levels matter for Bitcoin and Ethereum today.

For Bitcoin, watch $95,000 and $100,000 on the downside. Heavy put open interest at these strikes means defending them is crucial for bulls. On the upside, $105,000 (max pain) becomes the first target, followed by $108,000 and $111,000 where call interest concentrates.

For Ethereum, $3,200 represents current support. Breaking below could trigger stops and accelerate selling. Meanwhile, $3,500 (max pain) sits as the primary upside target. Beyond that, call positioning suggests bulls want to defend $3,000 as a psychological floor.

The put-to-call ratios for both assets indicate traders expect upward movement or at least stability. But rising implied volatility warns that achieving those targets might involve significant intraday swings.

The Real Risk Nobody Mentions

Here’s what worries me. The market is showing classic signs of uncertainty, yet positioning remains aggressively bullish.

That disconnect creates risk. If prices break down instead of rallying toward max pain levels, the unwinding of bullish positions could accelerate selling. Traders holding calls would face losses, potentially forcing them to sell spot holdings to cover.

Moreover, the macroeconomic picture isn’t exactly supportive. Incomplete government data, Fed uncertainty, and geopolitical tensions typically drive investors toward safety, not risk assets like crypto.

So while the options positioning suggests optimism, the broader context demands caution. Markets can stay irrational longer than traders can stay solvent. Today’s expiry could go smoothly, or it could trigger unexpected volatility.

Either way, the next few hours matter. Watch those max pain levels closely. They’ll tell you whether smart money is positioning correctly or about to get caught wrong-footed.