Bitcoin’s newest mega-holders are underwater. That’s a problem for everyone.

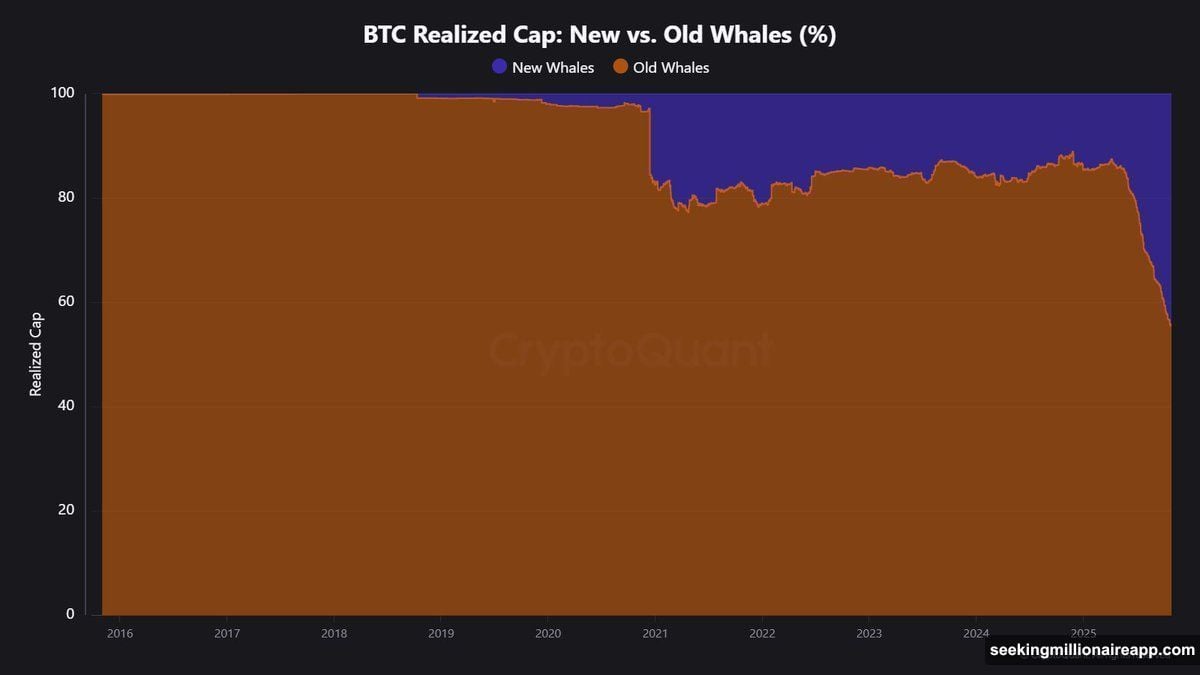

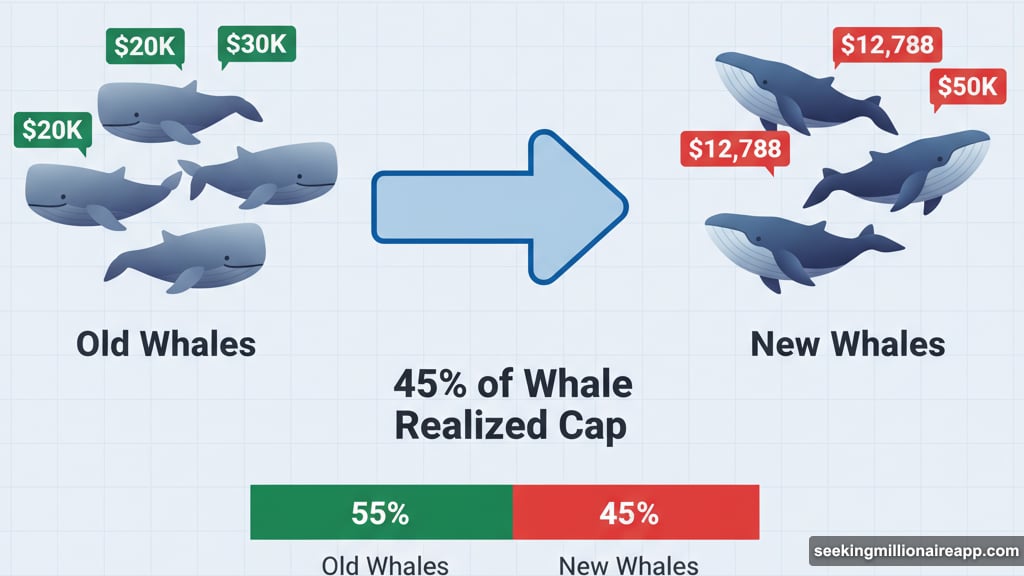

A fresh generation of Bitcoin whales—investors holding over 1,000 BTC—now controls 45% of the total Whale Realized Cap. But here’s the twist: they’re losing money for the first time since October 2023. Meanwhile, Bitcoin dropped below $110,000, putting these new whales in the red and raising serious questions about what happens next.

Who Are These New Whales?

These aren’t your battle-tested Bitcoin veterans. New whales accumulated their massive holdings in recent months, mostly during Bitcoin’s rally through 2024. They represent fresh capital flowing into crypto—institutional players, newly wealthy tech founders, and large-scale investors jumping in during the hype.

The Realized Cap measures total Bitcoin value based on when each coin last moved on-chain. Think of it as the collective “cost basis” for all Bitcoin. When new whales control 45% of this metric, they’ve effectively become the dominant force among large holders.

That’s a massive shift from previous years. Older whale cohorts, who bought Bitcoin at much lower prices, are gradually distributing their holdings to these newcomers. So the market’s biggest players are changing hands during a precarious moment.

The $112,788 Problem

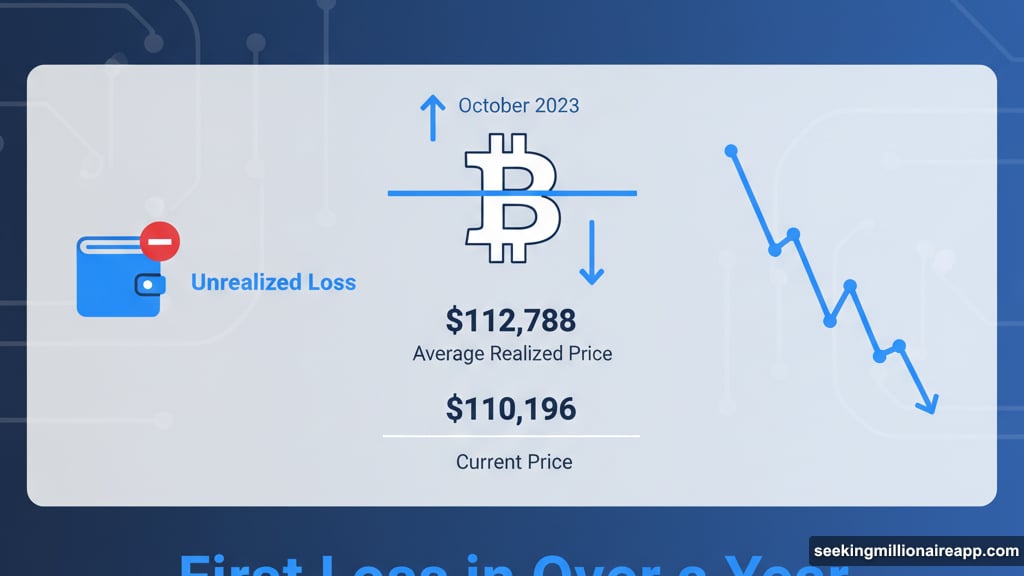

New whales paid an average of $112,788 per Bitcoin. That’s their Realized Price—the weighted average acquisition cost for this group.

Bitcoin recently dropped below $110,196. So for the first time in over a year, these massive holders are sitting on losses. Not huge losses yet, but losses nonetheless. Plus, this psychological threshold matters more than the actual dollar amount.

When big investors see red in their portfolios, they face a choice. Hold through the pain and wait for recovery. Or cut losses and preserve capital for better opportunities. Their decision determines Bitcoin’s near-term direction.

Older whales still show positive unrealized profits. They bought Bitcoin much cheaper, giving them cushion against downturns. But new whales lack that buffer. Every dollar Bitcoin drops puts them deeper underwater.

Why This Makes Everyone Nervous

New whales typically have less conviction than veterans. They haven’t lived through multiple Bitcoin winters or experienced the gut-wrenching volatility of previous cycles. That makes them more likely to panic sell when prices fall.

Distribution from experienced holders to newcomers during weak momentum creates a dangerous dynamic. Imagine passing the baton to a runner who’s never finished a marathon—right as the course gets harder. If new whales start selling to limit losses, it accelerates the decline.

Moreover, futures Open Interest dropped significantly. Traders are exiting positions and sitting on the sidelines. Lower Open Interest means reduced market conviction. Fewer people are willing to bet on Bitcoin’s direction right now.

This combination—new whales at a loss, declining futures interest, and ongoing distribution—sets up potential volatility. The market is essentially testing whether this new generation of large holders has the stomach for crypto’s wild swings.

What Happens Next?

Two scenarios play out from here.

Scenario One: New whales hold firm. They accept short-term losses and maintain conviction in Bitcoin’s long-term value. Prices stabilize around current levels. The market eventually recovers as selling pressure fades. This outcome requires patience and strong hands among large holders.

Scenario Two: New whales capitulate. They sell to prevent deeper losses, flooding the market with Bitcoin. Prices fall further, potentially breaking through key support levels. Panic spreads to smaller investors. The decline deepens until buying interest returns at much lower prices.

Which scenario is more likely? Nobody knows for certain. But the data suggests new whales face a critical test. Their behavior in the coming weeks could set Bitcoin’s trajectory for months.

Historical patterns show that when new capital enters at cycle peaks and immediately faces losses, volatility increases. Markets need time for investors to build conviction. New whales haven’t had that time yet.

The Bigger Picture

This isn’t just about price swings. It’s about Bitcoin’s evolving investor base and what that means for market structure.

Bitcoin’s early adopters—the cypherpunks, libertarians, and tech visionaries—mostly held through brutal downturns. Their conviction stemmed from ideological beliefs, not just profit motives. So they rarely sold during crashes.

Today’s whales are different. Many are institutional investors, family offices, and wealth managers seeking returns. They’re less ideological and more profit-focused. That changes market dynamics fundamentally.

When profit-focused holders control a larger share of Bitcoin supply, price becomes more sensitive to short-term performance. Good news drives buying. Bad news triggers selling. The market becomes more reactive and potentially more volatile.

Plus, this transition from old to new whales represents a maturation of Bitcoin markets. Institutional capital is replacing early adopter holdings. That’s probably inevitable as Bitcoin gains mainstream acceptance. But it comes with tradeoffs in terms of stability and long-term conviction.

The question now is whether Bitcoin can absorb this generational shift without major disruption. New whales are getting their first real test. How they respond will reveal whether they’re built for crypto’s volatility or just chasing the latest investment trend.

Watch the $110,000 level closely. If Bitcoin holds above new whales’ average cost basis, confidence may return. If it breaks decisively lower, the psychological impact could trigger cascading sells. Either way, this marks a pivotal moment for Bitcoin’s newest and largest investors.