A year ago, Argentine President Javier Milei posted a tweet that sent hundreds of thousands of people rushing to buy a meme coin. Within hours, those same people watched their money vanish.

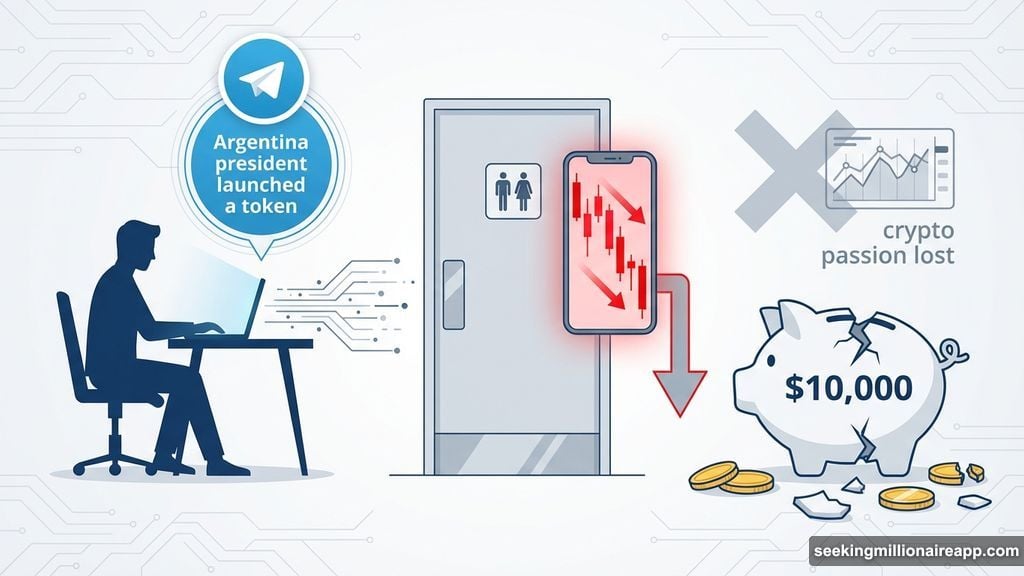

For Alfonso Gamboa Silvestre, a 25-year-old trader from Chile, that day cost him $10,000. It also cost him something he hadn’t expected to lose — his passion for crypto altogether.

Valentine’s Day Turned Into a Financial Nightmare

Gamboa Silvestre was at his computer on February 14, 2025, doing what he normally did. Then a Telegram notification changed everything.

Someone in one of his many crypto group chats had posted a message saying Argentina’s president had just launched a token. He jumped onto X to check. His first thought? Milei’s account had been hacked.

But the tweet was real. The verified account, the linked “Viva La Libertad Project” website — it all checked out. So he bought in.

“I made two purchases,” he told BeInCrypto in an interview. “First, a smaller one. When I was totally sure it was his tweet, I made a bigger one.” His total investment: $5,000.

Then he left for a family dinner. And that’s when things got bad.

Locked in a Bathroom, Watching It Collapse

He couldn’t focus on dinner. LIBRA’s price was dropping in real time, and Gamboa Silvestre kept checking his phone under the table.

Eventually, he locked himself in the restaurant bathroom to watch the charts. “At first I thought the token was going to go down and then go back up to infinity,” he said. “But that didn’t happen. I saw it going down and down, and my February 14th ended up being a nightmare.”

By the time he pulled out, he had lost double his original investment. The final damage: $10,000 gone.

From Successful Trader to Walking Away Entirely

This wasn’t someone with no experience. Gamboa Silvestre first got into crypto back in 2016 and became a serious, active trader by 2022.

He had actually done well with political meme coins before. He was an early investor in both TRUMP and MELANIA — the tokens launched by Donald Trump and Melania Trump just before Trump’s inauguration — and came out ahead on both.

So when Milei’s tweet appeared, he saw a familiar pattern. “Milei had been meeting with Trump and Elon Musk,” he said. “I thought they were going to do things right, and I was going to make money.”

That logic made sense on the surface. But LIBRA wasn’t TRUMP.

Beyond the money, though, Gamboa Silvestre lost something harder to replace. “After what happened with Libra, I completely stepped away from that world,” he said. “I stopped doing something I really liked, that had generated a lot of profitability for me. In the future, I saw myself living from that. But I lost all confidence.”

Today, the only connection he still has to crypto is his name on a class action lawsuit against Milei.

Over 1,300 Argentines Affected — And That’s Just One Exchange

Milei has repeatedly tried to minimize the fallout, suggesting only a small number of Argentine investors lost money. But the data tells a very different story.

Ripio, just one centralized exchange operating in Argentina, recorded 1,329 users who lost money on LIBRA. That single data point directly contradicts Milei’s earlier claims.

And the damage wasn’t limited to Argentina. Investors from Bosnia, Lebanon, Australia, and dozens of other countries got caught in the collapse. In the United States, a separate class action lawsuit is moving forward against Hayden Davis — the American CEO of Kelsier Ventures — who prosecutors allege was the mastermind behind the project.

Milei’s Explanations Keep Changing

A full year later, Milei still hasn’t provided a clear or consistent account of his role in the LIBRA launch. According to Agustín Rombolá, one of the lawyers representing the complainants in the Argentine class action, the president’s story has shifted repeatedly.

“He first told us it was a casino, that you don’t cry in the casino,” Rombolá said. “Then he told us he had the right to sell his opinions. Then he said he was not working as president at the moment of the tweet. After that, he told us he was scammed.”

Congressman Maximiliano Ferraro, one of the most vocal critics in the case, says one question still hasn’t been addressed. “Who approached the president, and how did they give him that smart contract address — which had more than 40 characters and did not have a public status?” Ferraro asked.

That question remains unanswered.

A Turning Point That Went Beyond Money

For Gamboa Silvestre, the LIBRA collapse wasn’t just a bad trade. It was the moment he stopped believing in the space he had spent years building a future in.

Thousands of others share that experience. The financial losses are still being tallied. So is the trust that evaporated when a presidential endorsement turned into a rug pull.

Some of those people may come back to crypto eventually. Gamboa Silvestre hasn’t, and says he doesn’t plan to.