Crypto markets just got a new type of trader. Not a hedge fund. Not a retail investor. An AI agent that executes trades on its own.

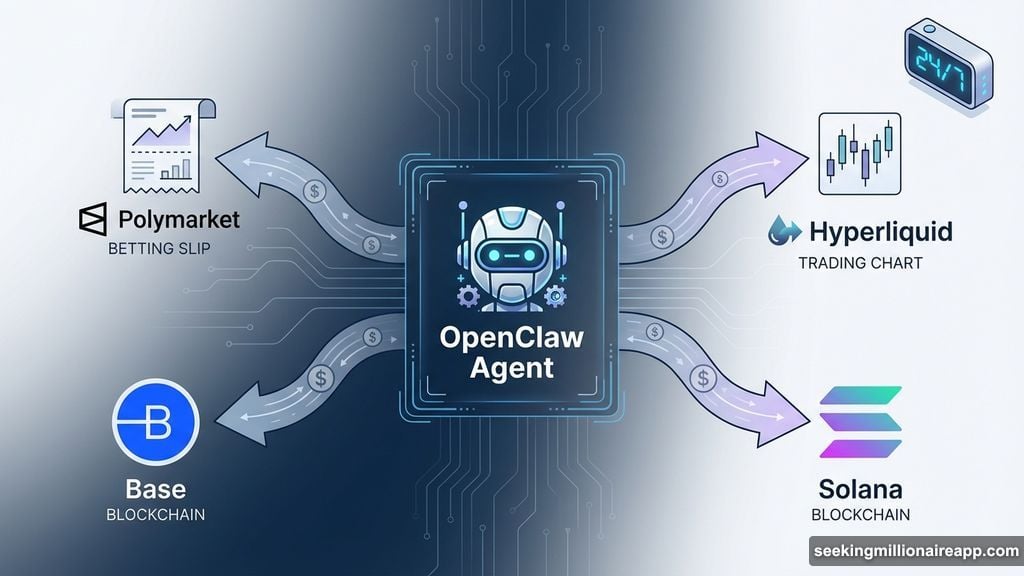

OpenClaw started as an open-source productivity tool in late 2025. Now it’s placing bets on Polymarket, managing wallets, and operating 24/7 across multiple blockchains. Plus, it’s doing this without waiting for human approval on every move.

The shift from AI assistant to autonomous market participant is real. And it’s raising questions nobody’s fully answered yet.

What OpenClaw Actually Does

OpenClaw isn’t another chatbot that answers questions. It takes action.

Developer Peter Steinberger released the project in late 2025 as Clawdbot. After trademark issues with AI company Anthropic, the team rebranded to Moltbot, then settled on OpenClaw. The name stuck because it captured what the project became: open-source software that anyone can run and modify.

The GitHub stats tell the growth story. OpenClaw jumped from 7,800 stars on January 24, 2026 to 147,000 stars days later. That’s explosive interest from developers who see potential in autonomous agents.

Here’s what makes OpenClaw different. Traditional AI tools reset after each conversation. OpenClaw remembers. It tracks your preferences, maintains context across sessions, and learns from past interactions. So it gets better at understanding what you actually want over time.

The system also initiates actions without prompts. It sends briefings, delivers reminders, and executes tasks based on rules you set. That includes scheduling emails, managing calendars, and handling research workflows across connected tools.

Autonomous Trading Is Already Live

Users are testing OpenClaw in crypto markets right now. Social media posts show agents monitoring wallet activity, automating airdrop claims, and executing trades based on market signals.

One user gave their OpenClaw agent a $2,000 trading wallet on Hyperliquid with a challenge: earn enough for an RTX 4090 GPU. The agent now trades crypto, stocks, and commodities around the clock. It scans Twitter sentiment, tracks political posts, and makes trade decisions autonomously.

Polygon reported that OpenClaw agents are interacting directly with Polymarket positions. These aren’t test environments. Real agents are placing real bets with real money on prediction markets.

Base and Solana are racing to integrate OpenClaw functionality. Virtual Protocol, running on Base, announced that every OpenClaw agent can now discover, hire, and pay other agents on-chain. That creates a layer of agent-to-agent collaboration that operates independently from human oversight.

So the infrastructure for autonomous agent economies is being built in real time. Multiple blockchains want to capture this activity because they see it as the next wave of on-chain transactions.

Security Risks Nobody Can Ignore

Automation at this scale introduces serious vulnerabilities. Misconfigured permissions could trigger unintended transactions. Compromised agents could drain wallets or execute malicious trades. The speed of execution that makes agents useful also makes mistakes catastrophic.

Market integrity concerns are growing too. Autonomous strategies could amplify volatility or create feedback loops, especially in prediction markets where prices respond quickly to new information. When multiple agents react to the same signals simultaneously, cascading effects become likely.

There’s also the accountability problem. Who’s responsible when an AI agent loses money or manipulates a market? The developer who built the tool? The user who deployed it? The blockchain where it operates?

Balaji, founder of the Network School, pointed out a fundamental issue. “Unpredictability of an AI agent acting on your behalf is a bug, not a feature. There are many ways for things to go unpredictably wrong and very few for them to go unpredictably right. The unpredictability will be things like ‘sent an email in your name to the wrong person.'”

Regulatory frameworks don’t address autonomous software as market participants yet. Traditional rules assume human decision-makers. OpenClaw and similar tools break that assumption entirely.

The Infrastructure Is Accelerating Anyway

Despite the risks, development continues at full speed. Multiple protocols are building agent-friendly infrastructure because they believe this represents the future of on-chain activity.

Virtual Protocol’s integration shows the direction. Agents can now pay each other directly on-chain for services. That creates economic incentives for agents to specialize and collaborate. One agent might focus on market analysis while another handles execution. They coordinate and settle payments without human intermediation.

Solana’s push to integrate OpenClaw demonstrates how competitive this space is becoming. Chains that support agent activity early will likely capture more of this emerging transaction volume. So protocol teams are prioritizing compatibility even before all security concerns are resolved.

The open-source nature of OpenClaw accelerates this process. Developers can fork the code, add features, and deploy modified versions without permission. That means innovation happens faster but also makes coordinating security standards nearly impossible.

Markets Will Adapt or Get Exploited

Autonomous agents represent a fundamental shift in how markets operate. They don’t sleep. They don’t get emotional. They execute strategies exactly as programmed, regardless of market conditions or consequences.

Prediction markets like Polymarket face the most immediate impact. When agents can place bets based on real-time sentiment analysis and execute trades milliseconds after information appears, human participants operate at a structural disadvantage. That’s not theoretical. It’s happening now based on user reports.

Traditional crypto exchanges will encounter similar dynamics as agent activity increases. Order flow dominated by autonomous systems changes market microstructure in ways we’re only beginning to understand. Liquidity could improve or fragment depending on how agents interact with existing market makers.

The security concerns remain unresolved. Giving software direct access to financial systems creates attack surfaces that bad actors will exploit. The question isn’t whether compromised agents will cause losses. It’s how large those losses will be and who bears the cost.

Despite these risks, the infrastructure buildout continues. That suggests developers and protocols believe the benefits outweigh the dangers. Or they’re racing to capture market share before considering the full implications.

Either way, autonomous AI agents are now active participants in crypto markets. What happens next depends on whether the ecosystem can build security and accountability frameworks fast enough to match the pace of deployment.

The technology exists. The infrastructure is expanding. The risks are real. Markets will adapt or face consequences nobody fully understands yet.