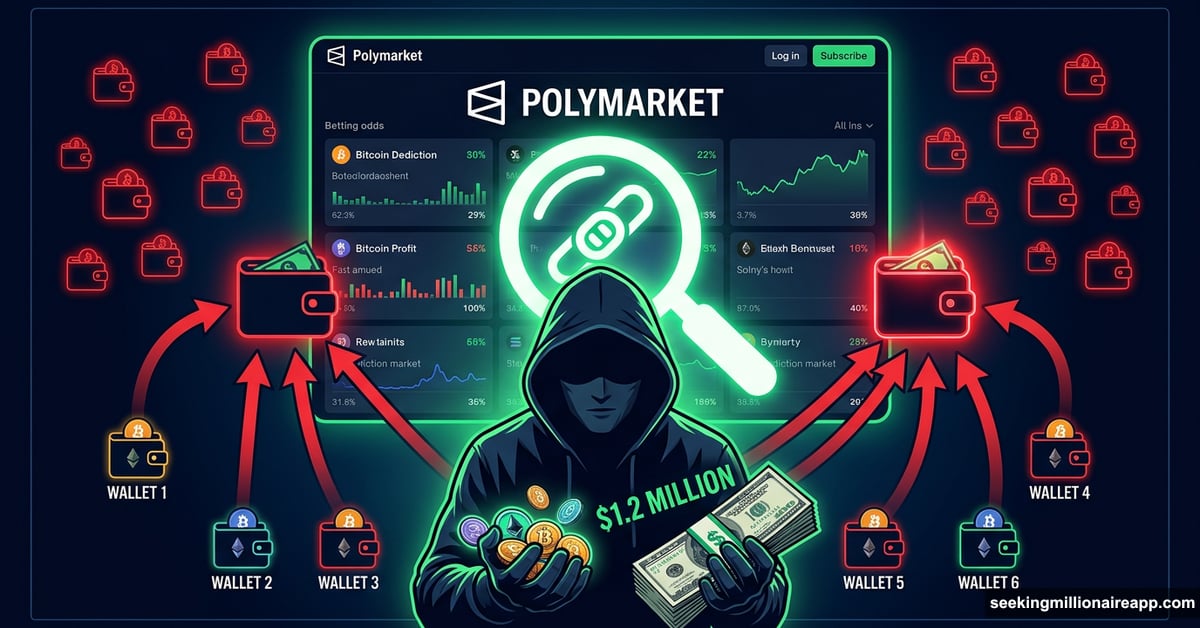

Crypto Insiders Banked $1.2 Million on Polymarket Before ZachXBT’s Axiom Bombshell Dropped

Prediction markets are supposed to level the playing field. Everyone sees the same odds. Everyone takes the same risk. But what happens when some players already know the answer