Money printer went brrr. Except this time, nobody meant to push the button.

On Wednesday afternoon, Paxos accidentally minted $300 trillion worth of PayPal USD (PYUSD) tokens. That’s more money than exists on Earth. For about 20 minutes, the blockchain showed a number so absurd it looked like someone added too many zeros as a joke.

Blockchain watchers on Etherscan spotted it first. Screenshots flew across social media. And crypto Twitter did what crypto Twitter does best: freaked out, asked questions, and made memes.

What Actually Happened

Paxos blamed a “technical error” during an internal transfer. The company caught the mistake fast and burned the excess tokens within 20 minutes.

“This was an internal technical error. There is no security breach. Customer funds are safe. We have addressed the root cause,” Paxos wrote on X.

Translation? Someone’s code did something it absolutely should not have done. And the blockchain recorded every embarrassing second of it.

But here’s what makes this wild. Those tokens existed, even briefly. The minting process created them. No reserves backed them. No dollars sat in a vault somewhere. Just digital tokens appearing out of nowhere because the system allowed it.

Why This Glitch Matters More Than It Seems

Stablecoins are supposed to be stable. The name literally says so. Each PYUSD token should represent one actual U.S. dollar backed by cash or Treasury bills.

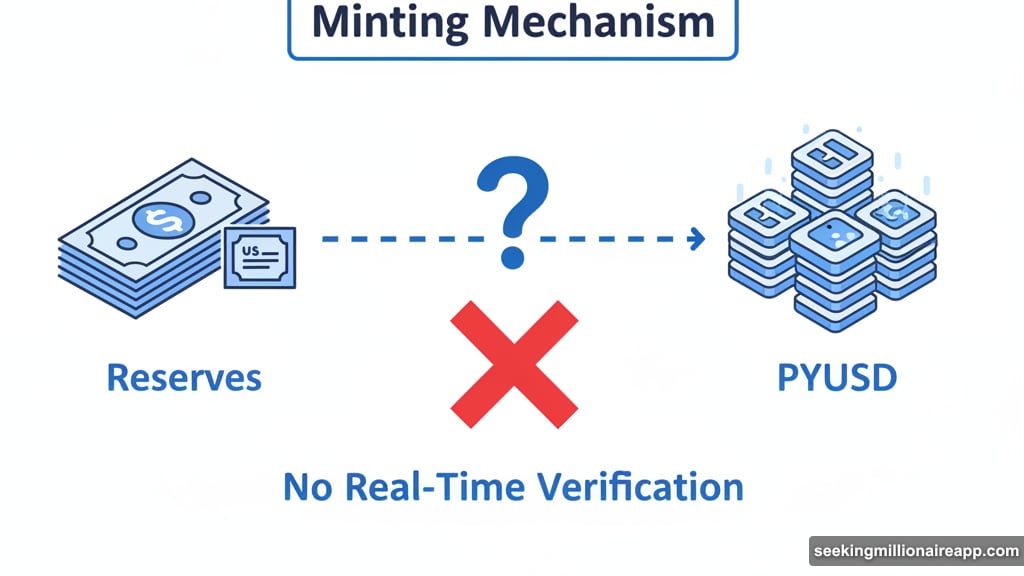

Yet this incident revealed something uncomfortable. The minting mechanism itself doesn’t verify backing in real time. It trusts the issuer to match tokens with reserves. So a technical error can create trillions of unbacked tokens before anyone notices.

Had those tokens entered circulation somehow, chaos would follow. However, the error stayed contained within Paxos’ internal systems. No user wallets got flooded. No exchanges saw the fake supply. Still, the potential for disaster was real.

Plus, this raises obvious questions. If $300 trillion can appear by accident, what stops it from happening deliberately? What other safeguards exist beyond “we promise we caught it fast?”

Stablecoins Keep Growing Despite Risks

PYUSD ranks as the sixth-largest stablecoin globally with a market cap above $2.6 billion. That’s real money, and real businesses rely on it for payments.

Paxos issues stablecoins for major players like PayPal. The company previously issued Binance USD (BUSD) until New York regulators shut that down over oversight concerns. Now Paxos focuses on regulated blockchain infrastructure through its Bankchain platform.

Meanwhile, stablecoins are becoming mainstream fast. Payment companies and banks are integrating crypto rails with traditional finance. The sector is professionalizing. But incidents like this prove the technology still has sharp edges.

The Bigger Problem Nobody Wants To Discuss

Stablecoins promise the stability of dollars with the speed of blockchain. Great pitch. But the infrastructure underlying that promise remains fragile in ways traditional banking systems aren’t.

Banks can’t accidentally create trillions of dollars. Wire transfers don’t multiply funds by accident. Yet blockchain systems, for all their transparency, can produce these surreal glitches where impossible amounts of money briefly exist.

And once created, those tokens are real until someone burns them. The blockchain doesn’t distinguish between legitimate mints and technical errors. It just records what happened.

So what’s the solution? Better safeguards, obviously. Multi-signature minting. Real-time reserve verification. Automated checks that flag impossibly large amounts. These protections exist in traditional finance for good reasons.

But implementing them on blockchain requires sacrificing some of the speed and autonomy that makes crypto attractive. That’s the trade-off nobody wants to make explicitly.

Paxos Dodged A Bullet

This time, the glitch stayed contained. Paxos caught it. Burned the tokens. Issued a statement. Crisis averted.

But imagine if those tokens had somehow entered circulation before anyone noticed. Imagine if automated trading bots started buying them. Or if exchanges briefly showed that inflated supply. The chaos would cascade through multiple systems before anyone could stop it.

Traditional banks have entire departments dedicated to preventing precisely these scenarios. Crypto companies move faster and break things. Sometimes that means breaking really expensive things in really public ways.

The good news? No customer funds were at risk. The bad news? This incident proves that even regulated, professional crypto companies can have embarrassing technical failures that briefly defy economic reality.

Your stablecoin might be stable. But the systems managing it are still very much works in progress.