Pi Coin just can’t catch a break. The token dropped 28% over three weeks, continuing its slide from recent highs.

Yet beneath the selling pressure, one metric quietly shifted. Capital started flowing back in. Not massive amounts, but enough to suggest some holders see value at these prices.

The question now: Is this early accumulation the foundation for recovery, or just a temporary pause before another leg down?

Accumulation Signals Emerge Despite Losses

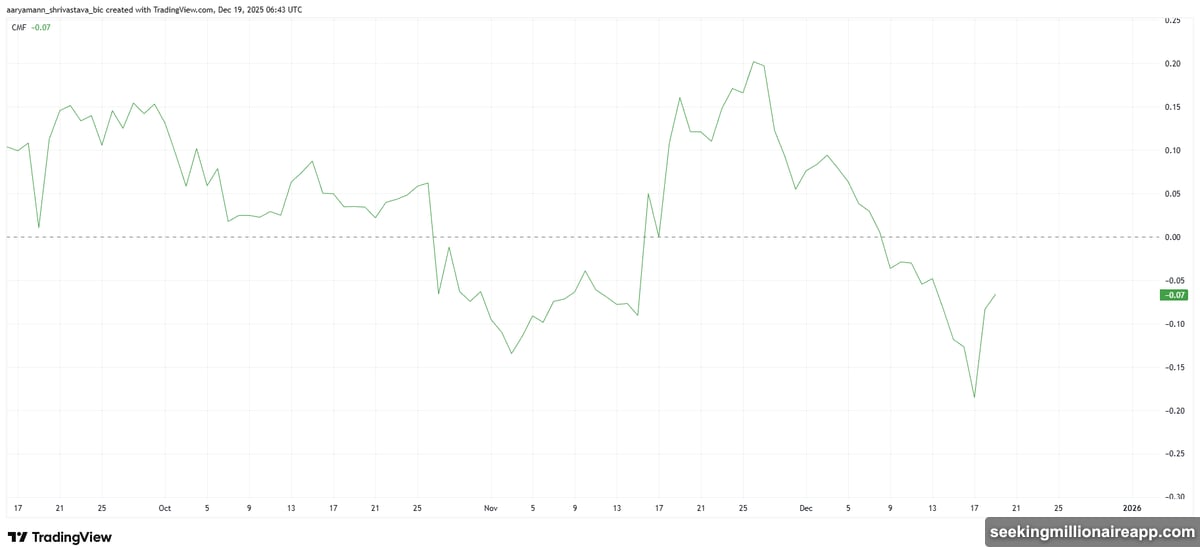

The Chaikin Money Flow indicator ticked upward over recent days. That’s significant. CMF tracks capital moving in and out of an asset, and rising readings mean money is returning to Pi Coin.

Investors appear to be adjusting their positions. Current prices likely look attractive compared to the $0.284 local top from three weeks ago. When CMF rises, it typically reflects growing conviction among existing holders and new buyers entering the market.

But here’s the reality check. Rising CMF helps absorb selling pressure. However, it doesn’t guarantee immediate recovery. Pi Coin needs sustained inflows to stabilize first, then momentum to push through resistance levels.

So far, the trend looks cautiously positive. If capital continues flowing in, Pi Coin gains the fuel needed for a potential rebound. Yet momentum alone won’t cut it against stronger bearish forces.

Bearish Momentum Threatens to Strengthen

The average directional index tells a different story. ADX measures trend strength, and Pi Coin’s reading hovers dangerously close to the 25.0 threshold.

What happens if ADX crosses above 25.0? The downtrend officially strengthens. Sellers would gain dominant control, making recovery much harder. That scenario keeps Pi Coin trapped in its current decline.

But there’s a flip side. If ADX fails to break through 25.0, the bearish trend weakens instead. Selling pressure would fade, giving accumulating buyers room to push prices higher.

Think of it this way: ADX acts as a referee. Right now, it’s deciding whether to award the match to sellers or call a draw. A draw gives Pi Coin a fighting chance to recover, especially with improving capital inflows backing the effort.

Still, timing matters. The longer ADX stays near this critical level without resolution, the more uncertainty lingers. Markets hate uncertainty, and prolonged indecision often leads to range-bound trading rather than decisive moves.

Price Action Suggests Consolidation, Not Recovery

Pi Coin trades at $0.203 at press time. That puts it above $0.198 support and below $0.208 resistance. It’s stuck in a narrow range, down 28% from its $0.284 peak.

This price action screams consolidation, not momentum. The token isn’t breaking out or breaking down. Instead, it’s moving sideways, testing investor patience as broader market conditions remain uncertain.

If the downtrend strengthens, Pi Coin likely stays trapped between $0.198 and $0.208. That limits upside potential and delays any meaningful recovery. Range-bound trading frustrates holders hoping for quick gains but also prevents further catastrophic losses.

Now, here’s the bullish scenario. Sustained accumulation could help Pi Coin reclaim $0.208 as support rather than resistance. A successful breakout from there opens the path toward $0.217, with potential extension to $0.224.

That move would invalidate the bearish thesis entirely. But it requires two things: continued capital inflows and weakening selling pressure. Both need to happen simultaneously, which is a tall order in current market conditions.

Mixed Signals Create Uncertainty

Pi Coin faces a crossroads. Rising CMF indicates capital is returning, which is encouraging. Yet ADX threatens to confirm stronger bearish momentum, which is discouraging.

These opposing forces create a stalemate. Neither bulls nor bears have decisive control. The outcome depends on which signal dominates in coming days.

For holders, the strategy is clear. Watch CMF for continued improvement and ADX for confirmation of trend direction. If CMF keeps rising while ADX fails to break above 25.0, Pi Coin gains a realistic shot at recovery.

But if ADX crosses that threshold while CMF stalls, expect more consolidation or even another leg down. The data doesn’t lie, even when it tells an uncomfortable story.

One thing’s certain: Pi Coin won’t recover quickly. This isn’t a V-shaped bounce. It’s a slow grind that requires patience, sustained buying interest, and favorable market conditions. All three need to align for a genuine turnaround.

Until then, Pi Coin remains stuck between hope and reality. Accumulation signals offer hope. Bearish momentum represents reality. Which one wins determines whether holders celebrate or capitulate in the weeks ahead.