Pi Coin just dodged a breakdown. Barely.

The price sits 20% lower than three months ago. That downtrend hasn’t reversed. Yet something changed in the past week that stopped what looked like an inevitable collapse. Dip buyers showed up at the exact moment technical patterns screamed “sell.”

Now the question isn’t whether Pi avoided the breakdown. It’s whether this last-second rescue becomes a real recovery—or just delays the inevitable 25% drop.

Dip Buyers Appeared Right on Time

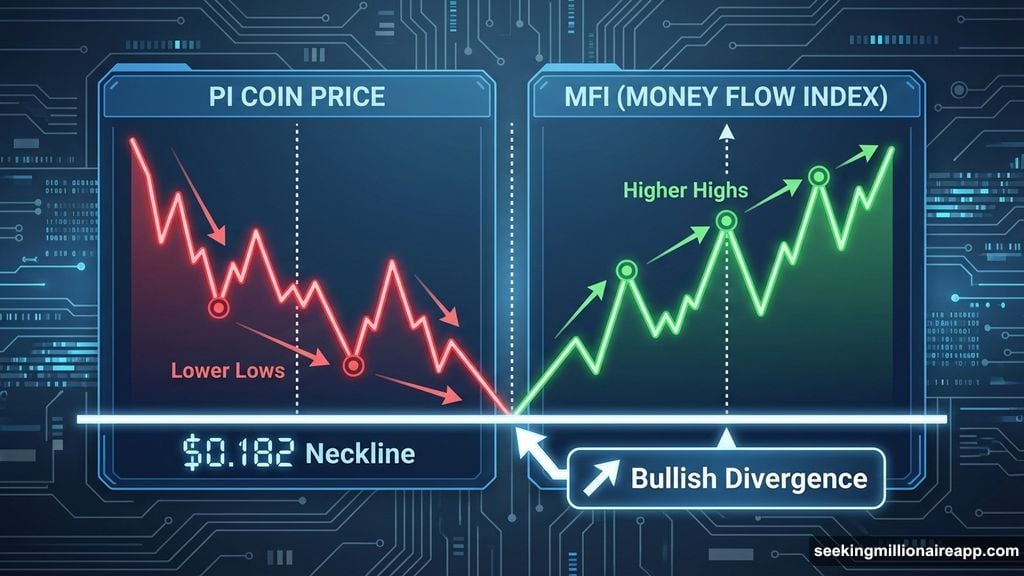

Between December 19 and December 25, Pi Coin’s price kept falling. No surprise there. But the Money Flow Index told a different story.

MFI tracks whether capital flows in when prices drop. During Pi’s recent decline, MFI made higher highs while the price made lower lows. That’s called bullish divergence. It means dip buyers absorbed selling pressure before it triggered a full breakdown.

The timing matters. MFI curved upward precisely when Pi’s price approached the neckline of its head and shoulders pattern. That pattern still points toward lower prices. But the MFI reaction prevented the immediate collapse everyone expected.

So dip money arrived. That’s confirmed. But dip buyers alone can’t flip this trend. They just bought time.

Big Money Holds the Real Power

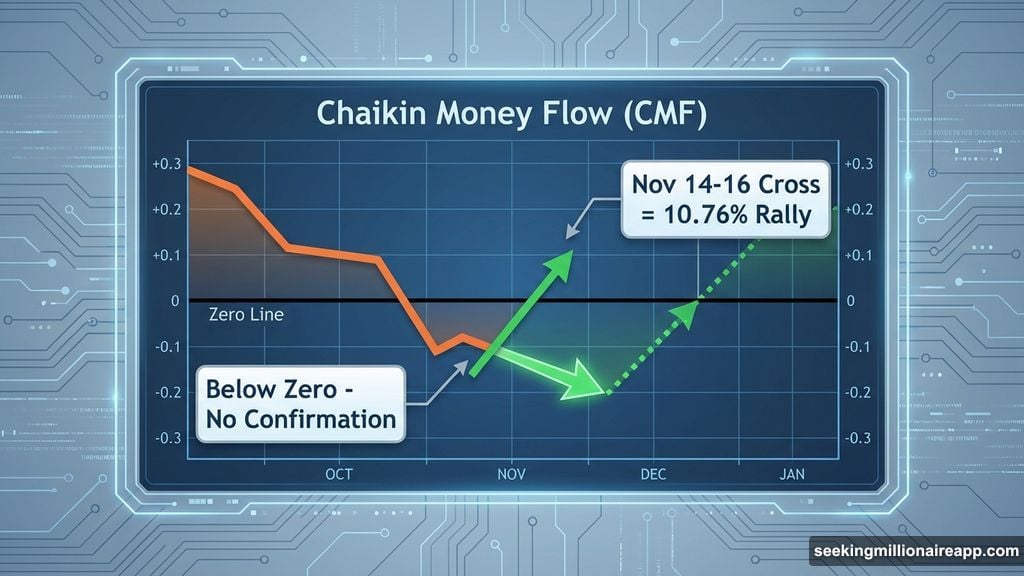

This is where Chaikin Money Flow becomes critical. CMF measures deep liquidity and large orders—the kind that actually move markets.

Pi Coin’s CMF recently broke above its descending trend line. Now it’s pushing toward the zero line for the first time since mid-November. That matters because the last time CMF crossed above zero was between November 14 and 16. After that break, Pi rallied 10.76% in the following sessions.

The current setup looks similar. But there’s a catch. CMF hasn’t actually crossed above zero yet. Until that happens, the move stays incomplete.

Without big money confirmation, Pi remains stuck in limbo. Dip buyers showed up. Large investors haven’t—at least not convincingly. That’s the difference between a dead cat bounce and an actual trend reversal.

Three Price Levels That Decide Everything

The neckline of Pi’s head and shoulders pattern sits at $0.182. As long as the price holds above this level, the bearish pattern isn’t confirmed. So technically, Pi hasn’t broken down yet.

A move above $0.218 would mark a 6% gain and break above the right shoulder of the pattern. That would weaken the breakdown theory significantly. It would also suggest the CMF shift is real, not just noise.

Below $0.192 sits the warning zone. That’s where the breakdown story restarts. A daily close under $0.182 confirms the neckline break and opens the door to $0.137. That’s the measured move target based on the head-to-neckline distance—a potential 25% drop from current levels.

The math isn’t forgiving. But it’s also not guaranteed. Charts show probabilities, not certainties.

MFI Acted. CMF Hasn’t. That’s the Problem.

Pi Coin is trapped between two types of money right now. Dip buyers stepped in, as confirmed by MFI. Large institutional flows haven’t confirmed the move yet, as shown by CMF still sitting below zero.

Both need to align for this to work. MFI already played its part. CMF is the laggard. Until CMF crosses and holds above the zero line, Pi remains suspended between survival and continuation of the downtrend.

The pattern is clear. The divergence is real. But confirmation is missing. That’s what makes this moment critical.

What Happens Next Depends on Money Flow

If CMF breaks above zero in the next few sessions, Pi has a realistic shot at pushing past $0.218 and invalidating the bearish setup. That would confirm big money is entering, not just dip buyers trying to catch a falling knife.

If CMF stalls below zero while the price drifts toward $0.182, the breakdown theory comes back into play. A close below that neckline opens the path to $0.137—and that 25% measured move becomes the most likely outcome.

Right now, Pi Coin sits in technical purgatory. Dip buyers bought time. Big money needs to buy conviction. One happened. The other hasn’t. Until both align, this rally attempt remains unfinished business.