Pi Coin just survived a critical test. After crashing to $0.20 on November 4, the token stabilized instead of collapsing further. That stability isn’t random.

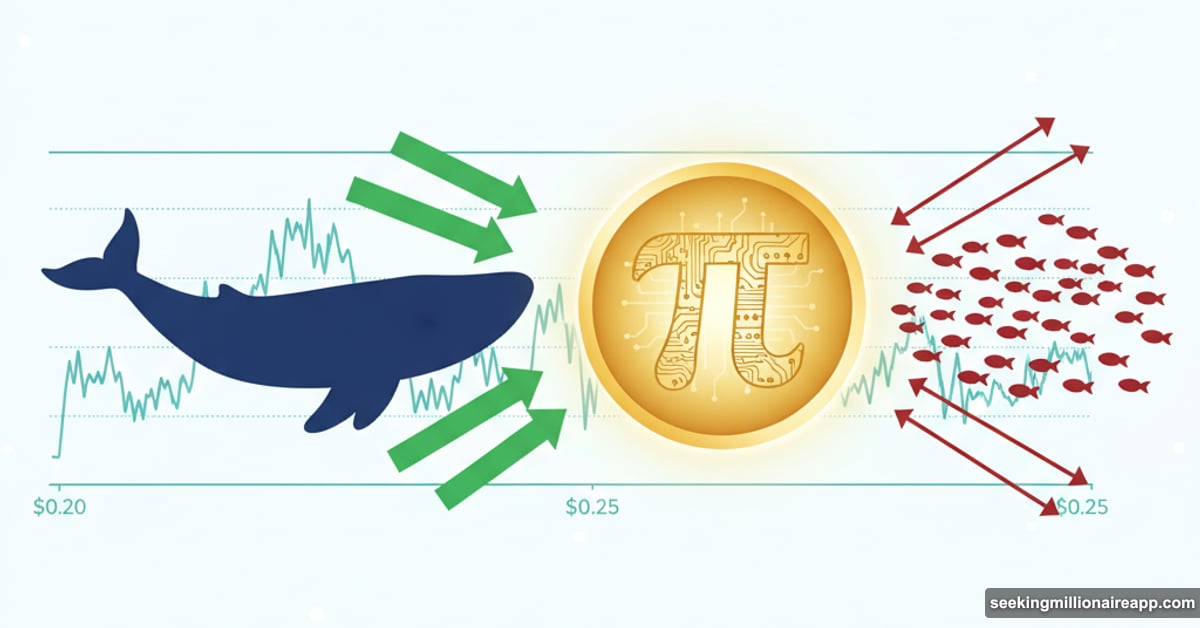

Large holders are defending key price levels. Meanwhile, retail traders seem to be losing interest. This divergence between whale behavior and retail sentiment could determine Pi Coin’s next major move.

So which side breaks first? The charts tell a fascinating story about money flow, momentum, and what happens when different investor classes move in opposite directions.

Retail Traders Hit Pause on Pi Coin

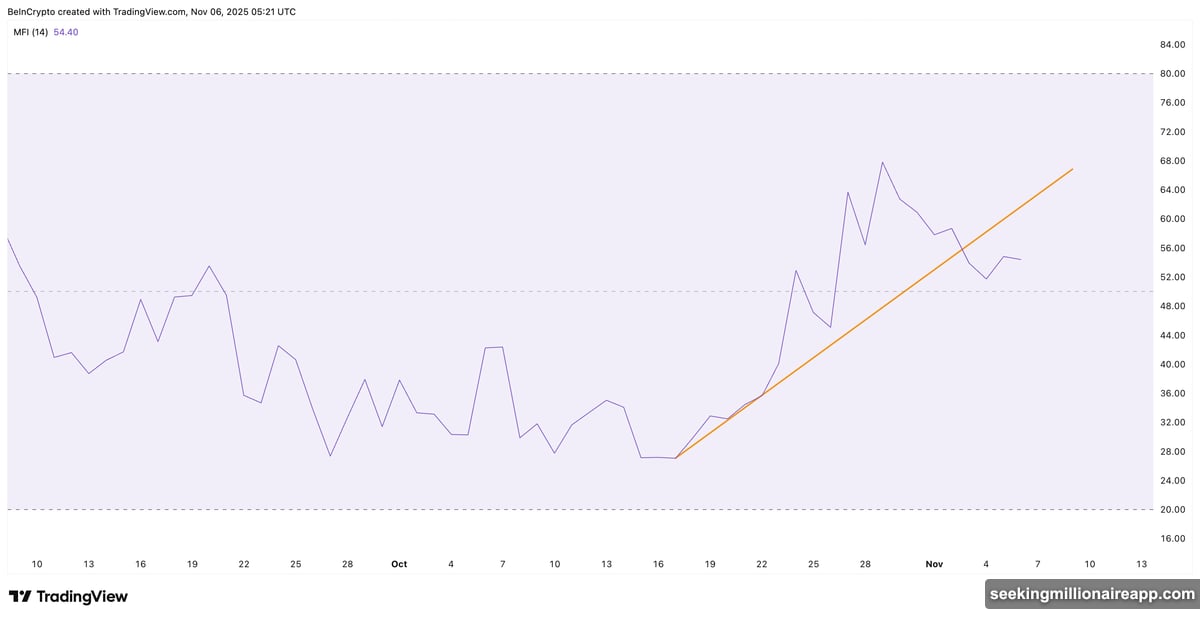

The Money Flow Index reveals why Pi Coin’s rally stalled. This indicator combines price action with volume to measure buying and selling pressure. On November 2, it broke below an important upward trendline.

That breakdown suggests retail interest is cooling off. Smaller traders who drove earlier gains appear to be stepping back. Volume patterns confirm this shift. Daily trading activity has decreased compared to late October’s surge.

But here’s where it gets interesting. While retail slows down, another group is doing the opposite.

Whales Quietly Accumulate Near Support

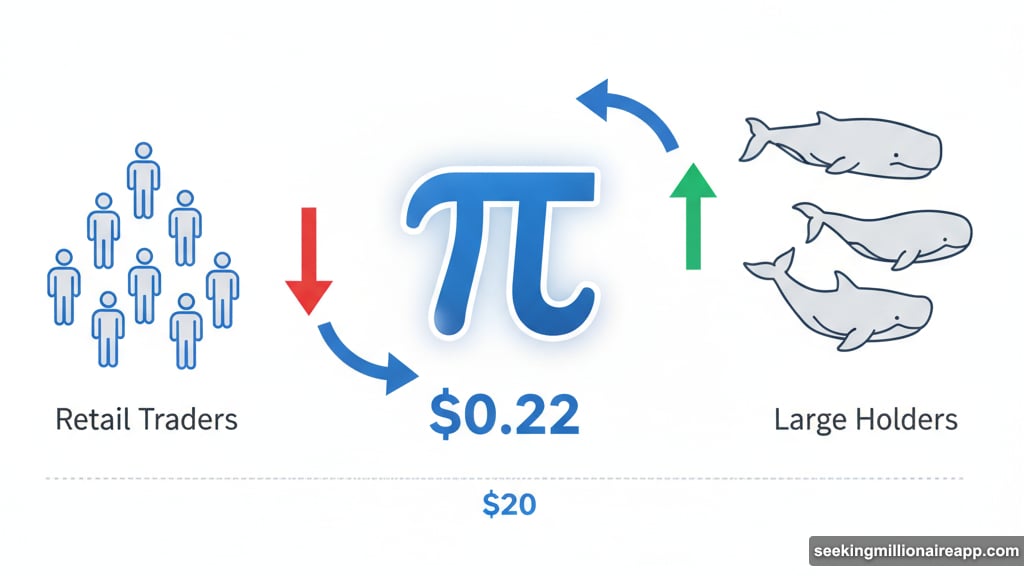

The Chaikin Money Flow indicator tracks whether large investors are moving money into or out of an asset. For Pi Coin, CMF found support at its lower trendline on November 3 and started turning upward.

CMF still sits below zero, which technically indicates distribution. However, the reversal from support levels hints that whales are stepping in to buy. They’re preventing deeper price declines by absorbing selling pressure.

This creates an unusual dynamic. Retail activity fades while large holders accumulate. That’s not necessarily bearish. In fact, it often precedes significant moves.

When both groups eventually align, the resulting momentum can be powerful. The question is whether whales can stabilize price long enough for retail interest to return.

Hidden Momentum Builds Beneath the Surface

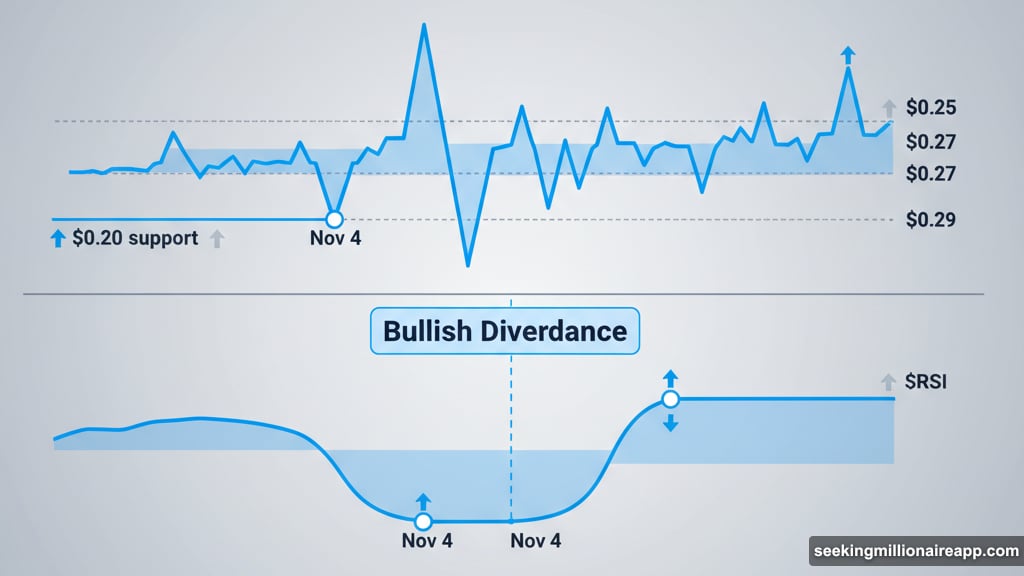

Technical indicators reveal early signs of potential recovery. Between October 25 and November 4, Pi Coin made a lower low in price. But the Relative Strength Index made a higher low during that same period.

This bullish divergence suggests selling pressure is weakening. When price makes new lows but momentum doesn’t follow, it often signals an exhaustion point. Buyers are quietly stepping in at lower levels.

For confirmation, Pi Coin needs to hold above $0.22 and break through $0.25. That would represent a 17% gain from current levels. Beyond $0.25, next targets sit at $0.27 and potentially $0.29.

However, failure to hold $0.20 could trigger deeper losses. A break below that level might push Pi Coin toward $0.19 or even $0.15. The range between $0.20 and $0.25 now defines the battleground.

What This Range Really Means

Pi Coin’s tight trading range reflects a standoff between two forces. Retail traders are taking profits or sitting on the sidelines. Whales are defending support levels and accumulating positions.

Neither side has won yet. But the technical setup favors patient holders. The bullish divergence, combined with CMF’s reversal, creates conditions for a breakout if volume returns.

Plus, the longer price consolidates in this range, the more significant the eventual move could be. Narrow ranges often precede volatile breakouts in either direction.

The Critical Levels to Watch

Three price points matter most right now. First, $0.22 serves as immediate support. Losing that level would signal weakening whale conviction and could accelerate selling.

Second, $0.25 represents the key breakout level. Clearing this resistance would confirm renewed buying pressure and potentially attract retail traders back into the market.

Third, $0.20 acts as the line in the sand. A decisive break below this level would invalidate the bullish case and open paths to much lower prices.

For now, watch the money flow indicators closely. If CMF crosses above zero while MFI reverses higher, both retail and institutional money would be flowing in the same direction. That alignment typically precedes sustained rallies.

Patience May Determine the Winner

Crypto markets reward patience more often than they reward panic. Pi Coin’s current range feels frustrating for traders seeking quick gains. But this consolidation might be building energy for the next leg up.

Whales appear committed to defending current levels. Their accumulation creates a floor that retail selling hasn’t broken. If institutional buying continues while retail interest gradually returns, Pi Coin could break higher.

The alternative scenario matters too. If whales give up and CMF turns sharply negative, the support floor disappears. That would likely trigger rapid moves to $0.19 or lower.

Either way, the outcome depends on whether large holders maintain conviction or retail traders return first. The next few weeks will reveal which side controls Pi Coin’s direction. For now, the range holds, and the accumulation continues quietly beneath the surface.

Post Title: Pi Coin Price Range: Whales Buy While Retail Exits

Meta Description: [Pi Coin](https://minepi.com) just survived a critical test. After crashing to $0.20 on November 4, the token stabilized instead of collapsing further. That stability isn’t