Pi Coin dropped below $0.200, shaking investor confidence. But technical indicators suggest holders aren’t giving up just yet.

Recent momentum signals show a potential shift. After weeks of decline, buying activity picked up in the past 24 hours. Now traders face a crucial question: Can Pi Coin reclaim key resistance and confirm a reversal?

The answer depends on whether current support levels hold. Plus, capital flows need to stay positive for any rally to stick.

Bulls Finally Show Up After 20-Day Decline

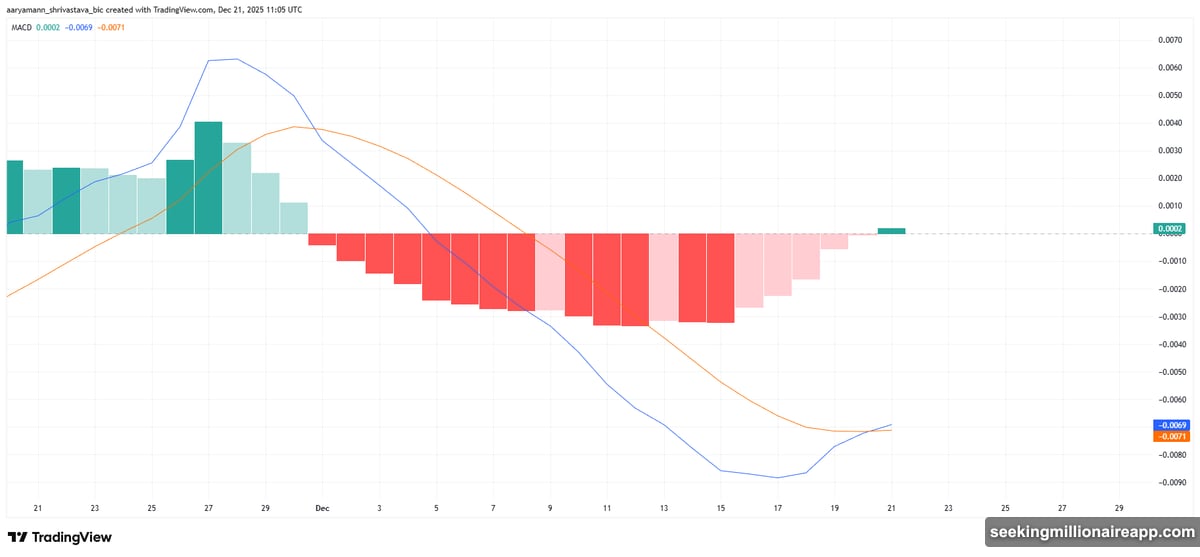

The MACD indicator just flashed its first bullish signal in weeks. The MACD line crossed above the signal line after nearly 20 days of bearish momentum. That’s a technical turning point.

This crossover often precedes short-term recoveries. But it only works when buyers actually commit capital. For Pi Coin, the signal suggests momentum is shifting from sellers to buyers at these levels.

However, momentum alone doesn’t guarantee recovery. The crossover needs confirmation from actual buying pressure. Without sustained demand, these technical signals fade quickly.

Still, it’s the first encouraging sign Pi Coin has shown since its recent slide began. So sentiment appears to be improving, even if cautiously.

Capital Flows Flip Positive For First Time This Month

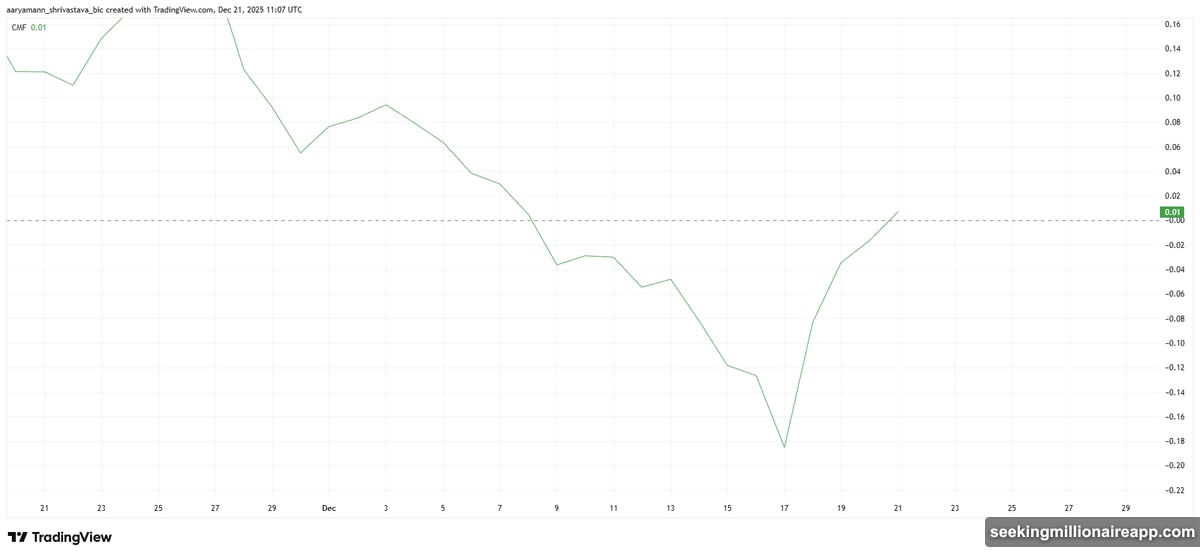

The Chaikin Money Flow tells a more concrete story. Net outflows dominated earlier this month as holders rushed to exit positions. But CMF just crossed above the zero line in the past 24 hours.

That means money is flowing back into Pi Coin. Real capital, not just momentum indicators. The CMF shift confirms buyers are returning and accumulating at current prices.

This matters because price moves need fuel. Technical patterns mean nothing without actual buying activity backing them up. For Pi Coin, positive inflows suggest holders believe current levels offer value.

Moreover, the timing aligns with the MACD crossover. When multiple indicators confirm each other, the signal strength increases. So both momentum and capital are pointing in the same direction for now.

$0.213 Fibonacci Level Holds the Key

Pi Coin trades at $0.207 right now. Just above sits $0.213, which aligns with the 23.6% Fibonacci retracement level. That’s the line in the sand.

Reclaiming $0.213 as support would validate the recovery attempt. Fibonacci levels act as important technical markers. Holding this level often signals continuation in an uptrend.

If buyers can push above and maintain $0.213, the next target sits at $0.224. Beyond that, further gains become possible if buying pressure persists. But each level must hold as support on pullbacks for the structure to remain bullish.

Conversely, failure to reclaim $0.213 weakens the recovery thesis. A rejection would suggest resistance remains too strong at current levels. That scenario keeps Pi Coin range-bound near recent lows.

Downside Risk Still Exists Below Support

Bulls face immediate resistance. But bears haven’t disappeared either. If sentiment shifts again, Pi Coin could drop below its current $0.207 support.

A breakdown would expose $0.199 as the next support level. Losing that opens the door to $0.188. Those levels would invalidate the bullish setup entirely.

So the recovery remains fragile. One negative catalyst or renewed selling pressure could erase recent gains quickly. Technical improvements mean little if support levels fail to hold.

For now, bulls have momentum and capital flows on their side. But they need to prove it by reclaiming resistance and building a base above $0.213. Until then, the recovery remains a work in progress.

Recent Signals Offer Hope But No Guarantees

Pi Coin’s technical picture improved significantly in the past day. The MACD crossover and positive CMF both suggest accumulation is underway. Those are real signals, not speculation.

Yet caution remains warranted. Short-term momentum shifts don’t always lead to sustained recoveries. Pi Coin needs consistent buying pressure, not just a brief squeeze.

The $0.213 Fibonacci level will determine near-term direction. Reclaiming it validates the bullish case. Failing to hold current support invalidates it. So watch that level closely.

Holders seem ready to fight for recovery. Whether they succeed depends on follow-through in the coming days. Technical setups create opportunity. Execution determines results.