Prediction markets exploded in 2025. What was once a tiny crypto niche now commands billion-dollar valuations and mainstream attention.

But here’s the real question. Can these platforms actually bring blockchain to regular people? Or is this just another crypto hype cycle dressed in new clothes?

The Money Suddenly Got Real

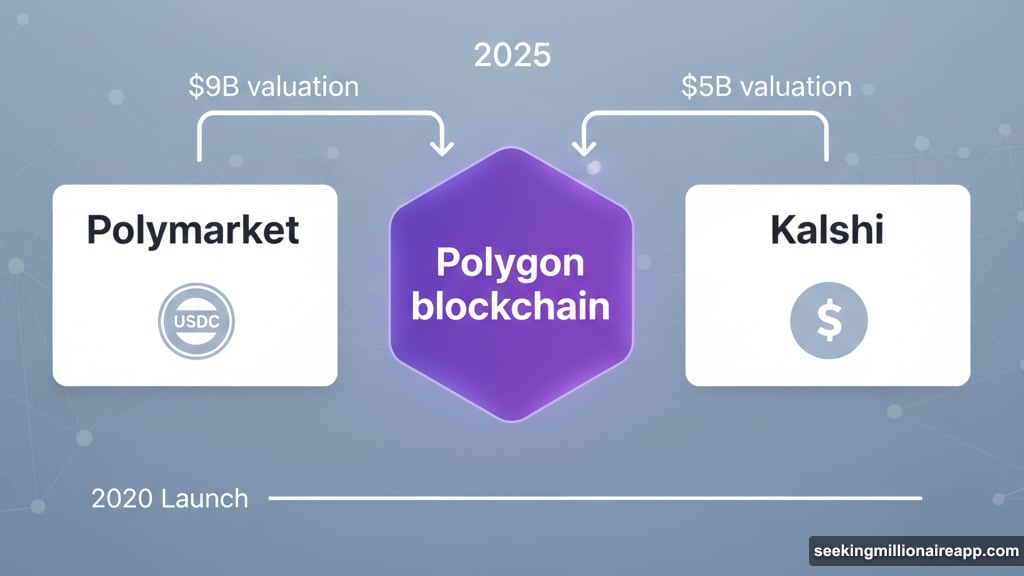

Two massive funding rounds in October made crypto natives sit up straight. Polymarket grabbed $2 billion from Intercontinental Exchange at a $9 billion valuation. Meanwhile, Kalshi raised $300 million at $5 billion.

Those aren’t small numbers. They signal something fundamental shifted in how investors view prediction markets.

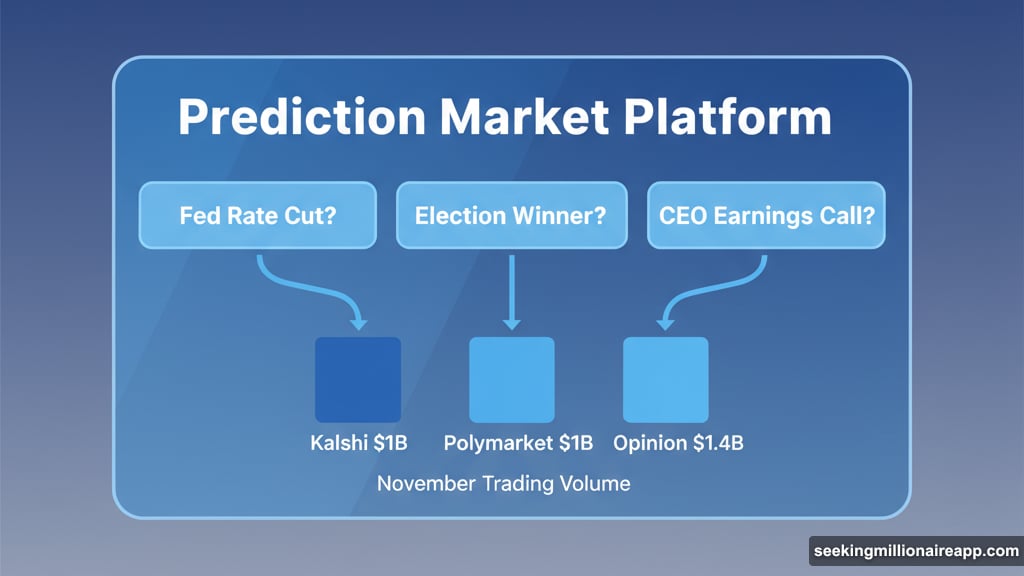

The platforms work simply. Users bet real money on real-world events. Will the Fed cut rates? Who wins the election? What will a CEO say on an earnings call? Everything becomes a market.

Plus, most of these venues run on blockchain infrastructure. Polymarket uses USDC on Polygon. Others deploy on BNB Chain or build custom layer 1s. The crypto rails quietly power the whole operation.

This Wasn’t Built Overnight

Prediction markets aren’t new to crypto. They’ve actually been around since the ICO boom.

Augur raised $5.5 million back in August 2015. Gnosis followed in April 2017, raising $12.5 million in ten minutes. Both platforms tried solving the same problem: creating decentralized venues to bet on future events.

Augur still operates today. Its v2 supports DAI stablecoin, and the REP token jumped 150% over the past year. Not bad for an eight-year-old project.

However, Gnosis pivoted away from predictions entirely. They focused on Safe multisig wallets instead, which scored $100 million in funding in 2022. Smart move, considering Safe became critical DeFi infrastructure.

Then came the regulatory breakthrough. In 2020, Kalshi gained approval from the CFTC as a Designated Contract Market for event contracts. That paved the way for everything that followed.

Polymarket launched the same year, built on Polygon, and became the first onchain prediction market to actually gain mainstream traction. The game changed.

Trading Volume Hit Records Nobody Expected

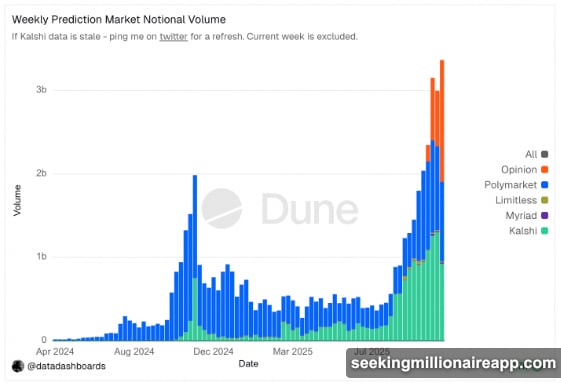

The numbers speak clearly. At the beginning of November, total notional volume across prediction markets hit $3.3 billion according to Dune Analytics.

Kalshi traded roughly $1 billion. Polymarket hit approximately $1 billion. Opinion, a new BNB Chain-based platform, led with $1.4 billion despite just launching.

That’s real money flowing through these markets. Not speculation about tokens. Actual bets on real-world outcomes.

Niraj Pant, an early Polymarket investor, sees this as “the emergence of a new design space for financial and informational markets.” Translation: these platforms create betting opportunities that never existed before.

Take political events. Traditional sportsbooks offer limited political betting options. They keep risk low and menus small. So most people never get the chance to bet on who wins local elections or what policy passes Congress.

Prediction markets change that equation. Now anyone can bet on Fed rate decisions, election outcomes, or Tesla stock movements. The market access gap closed.

The Real Strategy: Hide the Crypto

Here’s where it gets interesting. The most successful prediction markets don’t scream “blockchain” at users.

Vincent Manglietto, founder of Pentagon Pizza Watch, pointed out that “most users who are familiar with Polymarket don’t realize there’s blockchain infrastructure under the hood.”

Pentagon Pizza Watch tracks pizza orders near the Pentagon. Busy pizza joints might signal developing events as employees work late. It’s data for prediction market traders. And it’s exactly the kind of creative thinking these platforms enable.

But users don’t need to understand smart contracts or gas fees. They just bet on outcomes using what feels like a normal app. The crypto rails stay hidden.

Coinbase CEO Brian Armstrong recently demonstrated this perfectly. He read through a prediction market list during his earnings call, mentioning “bitcoin,” “ethereum,” “blockchain,” “staking,” and “web3.” Crypto social media went wild. Yet the format felt natural, almost game-like.

That’s the winning formula. Make it intuitive. Make it entertaining. Make it culturally relevant. Then users adopt without realizing they’re using blockchain.

Can This Actually Scale to Billions?

Weekly users currently sit at 274,000 according to Dune Analytics. That’s promising but nowhere near a billion.

So is “next billion users” just crypto marketing hype? Maybe not.

Shresth Agrawal, CEO of Pod (a layer 1 blockchain), explained the growth potential: “Basically, any kind of information that exists on the internet, or could exist in the future, can become the basis for a market.”

More markets mean more reasons for people to join. It works like new token narratives that historically bring waves of users to blockchain. Each fresh prediction category attracts a different audience.

Plus, blockchain infrastructure improved dramatically. Users genuinely don’t need to know they’re using crypto anymore. As Brian Armstrong said in October: “In 10 years, many more people will use crypto, but they may not know they’re using crypto.”

The prediction market explosion follows that exact playbook.

The Markets Keep Multiplying

New categories develop constantly. “Mention markets” recently gained popularity. Users bet on what celebrities or public figures will say.

That Brian Armstrong earnings call? Perfect example. Traders bet on which crypto terms he’d mention. Then they tuned in to find out if their predictions paid off. Entertainment value meets financial speculation.

Other emerging categories include weather events, product launches, and entertainment outcomes. Basically, if it happens in the future and people care about it, someone will create a market for it.

The variety matters because different markets attract different users. Political junkies bet on elections. Sports fans bet on games. Tech enthusiasts bet on product announcements. Each category becomes an onramp to crypto.

Old Players Never Really Left

Remember those early ICO prediction markets? They’re still building.

Augur launched its v2 with DAI support and continues operating after eight years. The platform proved prediction markets have staying power beyond hype cycles.

Gnosis found product-market fit differently. Safe multisig wallets became essential DeFi infrastructure, processing billions in transactions. Sometimes the best outcome isn’t the original vision.

These veterans provide important context. Prediction markets survived the 2018 crash, the 2020 DeFi summer, and the 2022 bear market. They’re not a fad.

What changed in 2025 was mainstream adoption and serious capital investment. The technology matured. Regulatory clarity improved. User experience simplified. All the pieces finally aligned.

The Regulatory Wild Card

Kalshi’s 2020 CFTC approval opened doors nobody expected. Suddenly, event contracts had legal standing in the United States.

That regulatory green light gave investors confidence to deploy billions. It also gave platforms permission to market aggressively without fear of immediate shutdown.

However, regulation remains a wild card. Different jurisdictions view prediction markets differently. Some consider them gambling. Others see them as information markets. The classification matters enormously for growth potential.

Still, the genie escaped the bottle. Even if U.S. regulators tighten rules, global platforms will continue operating. Blockchain’s permissionless nature guarantees that.

Users Don’t Care About Blockchain

This might be the most important insight. Regular users don’t join prediction markets because they’re onchain. They join because betting on events is fun and potentially profitable.

The blockchain infrastructure matters only to developers and investors. For users, it’s invisible plumbing that makes everything work smoothly.

That’s exactly how mass adoption happens. Not through education campaigns about decentralization benefits. Through apps that solve real problems or provide genuine entertainment.

Prediction markets nail both. They solve the problem of accessing diverse betting markets. And they entertain through gamification of current events.

The crypto part? Users discover that later, if at all.

Billions Still Seems Ambitious

Let’s be realistic. Growing from 274,000 weekly users to one billion requires roughly 3,600x growth.

That won’t happen overnight. It might not happen at all. “Next billion users” has been crypto’s perpetual promise since Ethereum launched.

But prediction markets have advantages previous crypto categories lacked. They don’t require understanding DeFi protocols. They don’t demand managing seed phrases (in many implementations). They don’t involve complex tokenomics.

You just predict outcomes. Win or lose. Simple as that.

If any crypto category can actually onboard mainstream users, prediction markets stand the best chance. The question isn’t whether they’ll grow. It’s whether growth reaches the astronomical levels crypto natives dream about.

My bet? They’ll grow substantially but fall short of a billion users this cycle. Maybe next cycle. Maybe never.

But they’ll definitely change how people interact with information markets. And they’ll do it using blockchain infrastructure most users never notice.

That’s probably the real win.