Zcash holders just moved over 200,000 ZEC from private wallets into the open. That’s 1.2% of total supply suddenly visible and potentially heading to exchanges.

This mass unshielding happened during the first week of January 2026. Plus, a whale immediately dumped 74,000 ZEC worth $35.75 million onto Binance. So investors are asking the obvious question: Are privacy coins dying?

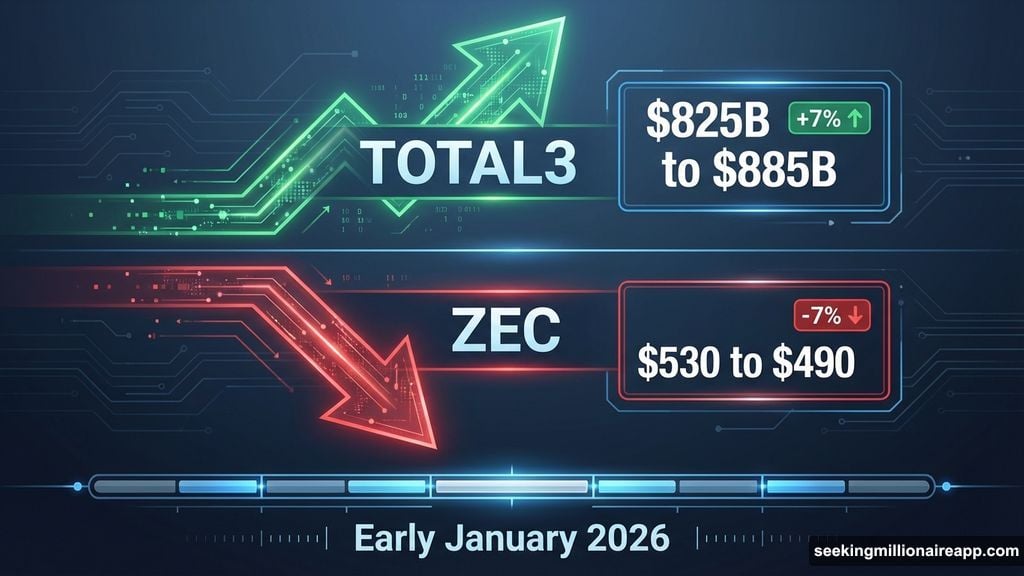

The timing couldn’t be worse. While most altcoins rallied 7% in early 2026, ZEC dropped 7% in the opposite direction. That divergence tells a story about shifting sentiment.

What Unshielding Actually Means

Unshielding converts funds from Zcash’s private pools to transparent addresses. Think of it like moving money from a secure vault to your checking account.

Why do holders unshield? Usually to prepare for trading or selling. Private pools protect anonymity. But exchanges require transparent transactions. So unshielding often signals exit preparation.

Data from zkp.baby shows the total shielded value peaked above 5 million ZEC in late December. Then it dropped back to 4.86 million after the massive unshielding event. That’s a clear reversal of the growth trend seen in Q3 2025.

Moreover, the same holder who unshielded 200,000 ZEC had deposited those coins just two weeks earlier. That rapid turnaround suggests changed plans or deteriorating confidence.

Whale Moves Trigger Sell-Off Fears

One day after the major unshielding, a whale transferred 74,002 ZEC to Binance. LookOnChain flagged this $35.75 million move as potentially significant.

“Seeing a whale send 74,000 ZEC to Binance definitely makes me pause. Moves like this are rarely random, usually positioning or liquidity prep,” investor Ted noted on social media.

Indeed, large exchange deposits typically precede selling. Whales don’t move millions to Binance for long-term storage. They do it to access liquidity and exit positions.

Furthermore, derivative data shows mounting bearish pressure. ZEC experienced some of the largest capital outflows among altcoins last week, according to CoinAnk. Short positions continue climbing even as the broader market recovers.

That combination of unshielding, whale transfers, and rising shorts paints a concerning picture. Each data point individually might mean little. Together, they suggest weakening conviction among major holders.

Privacy Coins Lag the Market

The altcoin market showed resilience in early January. TOTAL3, which measures total altcoin market cap excluding Bitcoin and Ethereum, climbed from $825 billion to $885 billion. That’s a 7% gain.

Yet ZEC fell 7% during the same period, dropping from $530 to $490. This inverse relationship stands out. When most altcoins rise and privacy coins fall, it signals sector-specific weakness.

Zcash isn’t alone. Monero (XMR) and Dash (DASH) also underperformed the broader market in early 2026. Artemis data ranks privacy as the weakest-performing crypto sector right now.

Several factors might explain this divergence. Regulatory pressure on privacy features continues mounting globally. Exchanges face increasing demands to delist or restrict privacy coins. Plus, many investors worry about compliance risks.

However, the narrative isn’t entirely bearish. Grayscale recently highlighted Zcash as a promising altcoin for 2026. The investment firm expects growing institutional interest in privacy technology despite near-term headwinds.

Declining Shield Deposits Signal Weakening Demand

The chart of shielded pool deposits tells an important story. Throughout Q3 2025, deposits accelerated rapidly. Holders were actively moving coins into private storage, signaling long-term conviction.

But that trend stopped in Q4. Deposits flatlined and now move sideways. While this doesn’t confirm a reversal, it shows bullish momentum has stalled.

Think of it this way: When investors believe in an asset’s future, they lock it up in long-term storage. When confidence wavers, they keep funds liquid and accessible. The shift from accelerating to sideways shield deposits reflects exactly that psychology change.

Additionally, the rapid unshielding of recently deposited coins suggests holders changed their minds quickly. Two weeks from deposit to withdrawal indicates reactive decision-making, not planned strategy.

Market Structure Shows Bearish Positioning

Derivative markets provide another warning signal. Short interest on ZEC continues rising despite recent price weakness. That’s unusual. Typically, shorts cover after significant declines.

The persistent short growth suggests traders expect further downside. They’re willing to maintain bearish bets even after ZEC already fell 7%. That confidence in continued weakness speaks volumes.

Moreover, capital flows from derivatives markets show net outflows from ZEC positions. Investors are closing positions and withdrawing funds rather than adding exposure. This represents diminishing participation, not just directional positioning.

The combination of rising shorts and capital outflows creates a challenging environment. Without fresh buying interest, any selling pressure from unshielded coins could push prices lower.

Institutional Outlook Remains Optimistic

Despite near-term headwinds, some institutional players maintain bullish views. Grayscale’s recent report emphasized privacy coins as a growth sector for 2026.

Their reasoning focuses on evolving regulatory frameworks and increasing institutional adoption. As compliance solutions improve, privacy technology might become more acceptable to traditional finance.

Plus, technological improvements continue. Zcash’s development team regularly enhances privacy features and performance. Better technology could eventually overcome current regulatory concerns.

However, institutional optimism hasn’t translated to market strength yet. Grayscale’s bullish outlook represents long-term potential, not immediate price support. The gap between future promise and current performance remains wide.

What This Means for Privacy Coin Investors

The 200,000 ZEC unshielding event highlights a critical inflection point. Privacy coins face mounting pressure from multiple directions: regulatory scrutiny, exchange restrictions, and weakening investor confidence.

Yet the technology and use cases remain valid. Privacy represents a fundamental need in digital finance. Long-term believers argue current weakness creates buying opportunities before mainstream adoption arrives.

Short-term traders see different signals. Whale exits, declining shield deposits, and rising shorts suggest further downside risk. The divergence from broader altcoin performance indicates sector-specific problems, not just general market weakness.

My take? Privacy coins face real challenges that won’t resolve quickly. Regulatory headwinds will persist throughout 2026. Exchange access will likely continue deteriorating before improving.

But writing off privacy technology entirely seems premature. The same features that create regulatory problems also provide genuine value. As compliance frameworks mature, privacy coins might find their place in the mainstream ecosystem.

For now, though, the data points to continued underperformance. Until shield deposits start accelerating again and whales stop dumping millions onto exchanges, caution makes sense.