The 40-day government gridlock just ended. While traditional markets stayed flat, three crypto tokens exploded.

Zcash climbed 756%. Virtuals Protocol doubled. Soon rocketed 462%. Now the question is whether these gains hold after normal operations resume.

Here’s what drove each rally and where they’re headed next.

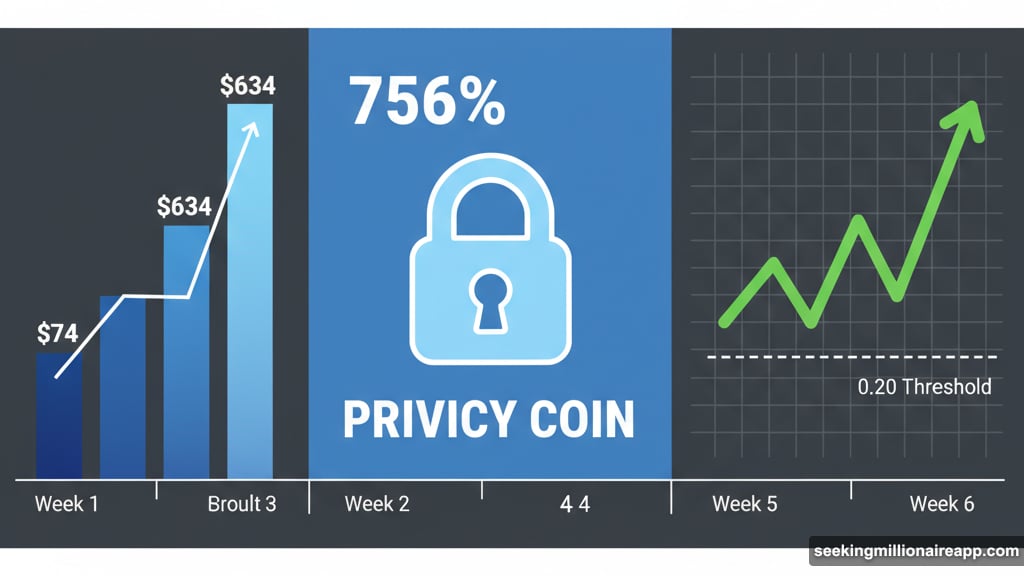

Zcash Rides Privacy Wave to $634

Privacy became valuable during political uncertainty. Makes sense. When government operations freeze, people want financial anonymity.

ZEC capitalized on this perfectly. The token jumped from $74 to $634 in just six weeks. That’s not normal altcoin volatility. Something bigger shifted in market psychology.

The Chaikin Money Flow indicator shows sustained buying pressure. Money keeps flowing into ZEC even at these elevated prices. Plus, the momentum suggests $700 is within reach this week.

But here’s the catch. CMF readings above 0.20 typically signal reversal zones. Traders start taking profits. So far that hasn’t happened with ZEC, which makes this rally unusual.

If inflows continue, $800 becomes the next logical target. Beyond that, $1,000 sits as a psychological barrier. Breaking through requires more than just shutdown drama though.

The real risk? Profit-taking could start any day. A drop below $600 would break key support at $478. From there, ZEC could slide to $400 or lower. That would erase half the gains in days.

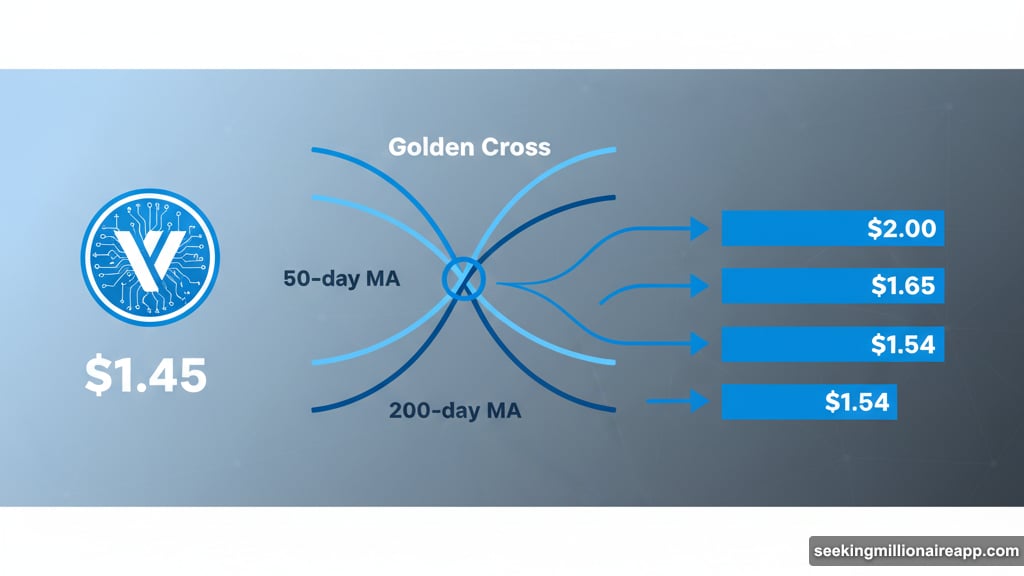

AI Agent Token Eyes Golden Cross

Virtuals Protocol carved out a unique position during the chaos. The AI-powered crypto project gained 101% since late October.

Why did AI tokens perform well? Investors rotated into tech narratives while political uncertainty kept them away from traditional finance. Smart money moved early.

VIRTUAL now trades at $1.45. More importantly, it’s approaching a Golden Cross formation. That’s when the 50-day moving average crosses above the 200-day average. Technical traders watch this signal closely.

Golden Crosses typically trigger buying waves. If VIRTUAL completes the pattern, $1.54 and $1.65 become immediate targets. After that, $2.00 looks achievable before year-end.

The AI Agent sector itself keeps expanding. Demand for autonomous crypto trading bots and AI-powered DeFi tools isn’t slowing down. So VIRTUAL benefits from both technical setup and fundamental growth.

However, profit-taking poses real danger here too. Investors who bought at $0.70 now sit on massive gains. Some will cash out regardless of technicals.

A break below $1.37 would invalidate the bullish setup. From there, $1.14 becomes the next support level. That would erase most recent gains and kill the Golden Cross narrative.

Solana Rollup Gains 462% on Cross-Chain Tech

Soon delivered the biggest percentage gain of the three. The token surged 462% since October 1.

What makes Soon different? It’s a Solana Virtual Machine Rollup that connects multiple blockchains. Think of it as a highway system for crypto transactions across Ethereum, Solana, and other chains.

This cross-chain approach matters more as the industry fragments. Projects can’t assume everyone uses one blockchain anymore. Soon solves that problem with Layer 2 integration.

Currently trading at $2.12, Soon shows strong technical support. The Parabolic SAR indicator confirms an uptrend. As long as $2.03 holds, the path to $3.00 stays open.

Adoption metrics back up the price action. More developers are building on Soon’s infrastructure. Transaction volume keeps climbing. Those fundamentals support higher valuations.

Still, the same profit-taking risk applies. Early buyers are up 4x or more. Many will exit to lock gains. If selling pressure builds, Soon could drop to $1.39.

Losing that level would open the door to $1.04. At that point, the bullish case falls apart completely.

Shutdown Ending Changes Everything

Markets hate uncertainty. The shutdown created chaos. Now that chaos is ending.

Traditional finance will likely stabilize. Government operations resume. Budget negotiations move forward. That’s generally bad news for volatility-driven crypto rallies.

These three tokens gained specifically because normal markets weren’t working. When regularity returns, that catalyst disappears. So the real test comes in the next two weeks.

If ZEC, VIRTUAL, and Soon can hold gains without shutdown drama driving them, it proves their rallies had substance. If they collapse back to pre-shutdown levels, it confirms they were just political trade plays.

My take? Watch support levels religiously. ZEC at $600. VIRTUAL at $1.37. Soon at $2.03. Those numbers determine whether this was a real breakout or just temporary chaos trading.

The market will decide fast. Government resuming operations removes the excuse for extreme volatility. Either these projects justify their valuations with actual utility, or traders move on to the next narrative.

Choose your exits carefully. The shutdown trade is over.