Billionaire investor Ray Dalio just dropped a warning that’s hard to ignore. The global system built after World War II is breaking down. We’ve entered what he calls “Stage 6” of the Big Cycle.

So what does that mean for cryptocurrency? The answer isn’t simple. But it’s worth understanding.

The Big Cycle Reaches Its Breaking Point

Dalio built his career studying how empires rise and fall. His Big Cycle framework tracks this pattern across history. Stage 6 marks the dangerous part.

“We are in a period in which there are no rules, might is right, and there is a clash of great powers,” he wrote. That’s not subtle.

Unlike domestic politics, international relations lack enforcement. No global police force exists. No binding arbitration settles disputes. Instead, power decides outcomes.

When dominant countries weaken and rivals strengthen, tensions spike. History shows this pattern repeats across centuries. Right now, the United States faces China’s rise. That creates friction.

Five Types of Conflict Already Underway

Dalio identifies five escalating conflict types. Each builds on the previous stage.

Trade wars come first. Countries impose tariffs and restrict market access. Then technology battles emerge. Nations compete for innovation leadership while blocking rivals’ advances.

Capital wars follow. Sanctions freeze assets. Financial systems become weapons. Cross-border payments face restrictions. This stage already impacts millions.

Geopolitical conflicts over territory and alliances intensify next. Finally, military confrontation becomes possible. Most major wars start with economic pressure long before shooting begins.

Sound familiar? The 1930s followed this exact sequence. Debt crisis. Protectionist policies. Rising nationalism. Eventually, World War II.

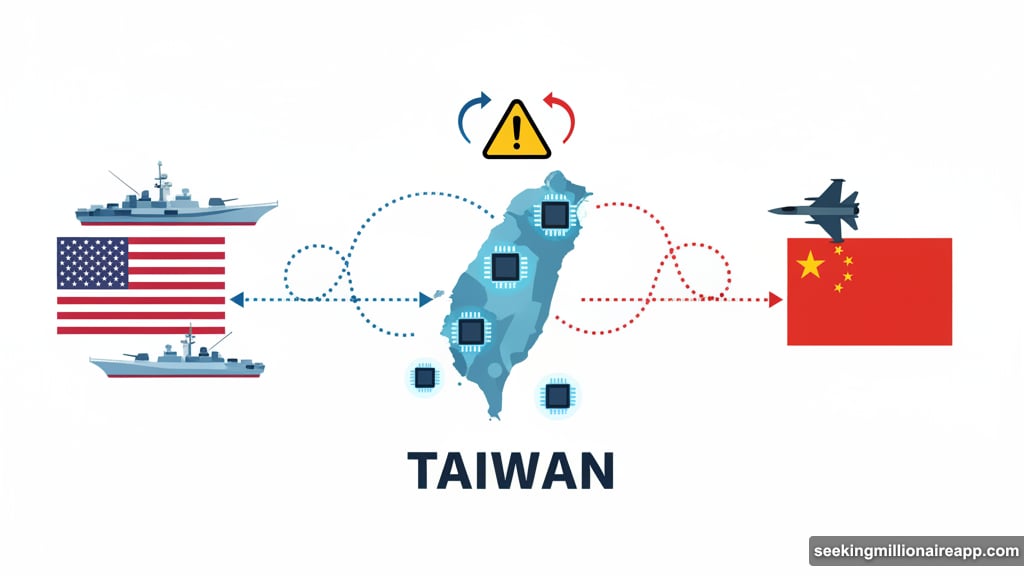

The Taiwan Question Looms Large

Dalio points to one flashpoint above all others. The strategic rivalry between America and China over Taiwan.

Both sides face impossible choices. Fighting costs lives and money. Backing down shows weakness and invites future challenges. Neither option looks attractive.

“When two competing entities each have the power to destroy the other, both must have extremely high trust that they won’t be unacceptably harmed,” Dalio explained. That trust doesn’t exist today.

But here’s context that matters. Dalio has warned about changing world order for years. This isn’t sudden panic. It’s consistent with his decade-long thesis about structural shifts.

Still, the conditions he describes are real. Whether war erupts or not, the financial system is already fragmenting.

Crypto’s Complex Role in Financial Fragmentation

Bitcoin and other cryptocurrencies could benefit long-term from this breakdown. When governments freeze assets and restrict payments, alternatives gain appeal.

Cryptocurrencies operate outside traditional banking rails. That resistance to censorship and capital controls becomes valuable during financial warfare. Bitcoin can cross borders without permission.

Plus, if sanctions proliferate and monetary systems fragment, digital assets offer neutral settlement layers. Countries locked out of SWIFT or facing dollar restrictions might explore crypto alternatives.

However, short-term volatility tells a different story. Crypto markets remain sensitive to global liquidity conditions. When risk appetite collapses, Bitcoin often falls alongside stocks.

Geopolitical stress typically triggers broad sell-offs. Investors flee to safety. That means crypto could face severe price swings even as its long-term narrative strengthens.

Gold Still Wins the Safe Haven Battle

Recent months proved one thing clearly. When real fear hits markets, investors choose gold over crypto.

Gold surged to record highs recently. Meanwhile, Bitcoin struggled after October’s tariff shock. That divergence matters.

Despite Bitcoin’s “digital gold” narrative, most investors still treat physical gold as the primary hedge during acute stress. Thousands of years of history back that preference.

“Sell out of all debt and buy gold because wars are financed by borrowing and printing money,” Dalio advised. That recommendation doesn’t include Bitcoin.

If tensions deepen, capital could continue favoring established defensive assets. Crypto’s volatility works against it during panic moments.

Monetary Debasement Favors Crypto Eventually

But look beyond immediate crisis reactions. The mechanisms Dalio describes ultimately benefit Bitcoin.

Wars get financed through borrowing and money printing. That devalues currencies and debt. Central banks expand balance sheets during conflicts. Inflation follows.

Bitcoin’s fixed supply becomes increasingly attractive as fiat currencies lose purchasing power. Long-term holders understand this dynamic.

Financial fragmentation also drives crypto adoption. As traditional systems become unreliable or restricted, alternatives gain users. Sanctions accelerate this trend.

So the crypto outlook splits between timeframes. Near-term volatility seems likely. Long-term fundamentals potentially strengthen.

What This Means for Your Portfolio

Dalio’s warning suggests higher volatility across all markets. Stocks face lower valuations and sharper swings. Crypto magnifies those moves.

Weakening trust in traditional money could eventually drive crypto interest. But short-term stress may trigger severe drawdowns first. That creates tough timing decisions.

Diversification matters more during periods of geopolitical instability. No single asset class provides perfect protection. Gold offers stability but limited upside. Crypto offers growth potential but extreme volatility. Traditional stocks face valuation pressure.

Smart positioning means accepting tradeoffs. Some exposure to defensive assets makes sense. Some allocation to growth opportunities balances the portfolio. Overconcentration in any single bet increases risk.

The Prisoner’s Dilemma Goes Global

Dalio references the prisoner’s dilemma when discussing great power conflict. Both sides benefit from cooperation. But each fears the other will defect first.

Without trust, cooperation breaks down. Both sides choose defensive strategies that leave everyone worse off. This dynamic drives arms races and economic warfare.

Crypto exists partly as a response to this trust breakdown. Blockchain technology replaces institutional trust with cryptographic verification. That philosophical foundation becomes more relevant as traditional institutions lose credibility.

However, implementation remains messy. Regulatory uncertainty continues. Infrastructure gaps persist. User experience challenges limit mainstream adoption.

So crypto’s theoretical advantages face practical obstacles. That gap explains the disconnect between long-term optimism and short-term price action.

No Rules Means Opportunity and Danger

“There are no rules, might is right” describes an unstable environment. Financial markets hate uncertainty. Asset prices reflect that anxiety.

But chaos also creates opportunity. New systems emerge when old ones fail. Bitcoin launched during the 2008 financial crisis for good reason.

If Dalio’s Stage 6 assessment proves accurate, we’re entering a period that reshapes global finance. Crypto could play a significant role in whatever comes next. But the transition won’t feel smooth.

Expect volatility. Prepare for multiple scenarios. Stay informed about geopolitical developments. Most importantly, understand that unprecedented conditions produce unexpected outcomes.

Dalio’s warning isn’t really about predicting war. It’s about recognizing structural conditions that historically precede major transitions. Whether military conflict erupts or not, the financial system is already changing.

Crypto investors should pay attention to these shifts. The assets you hold today might perform very differently depending on how Stage 6 unfolds.