Real-world asset tokenization isn’t a maybe anymore. It’s happening. And according to Robinhood CEO Vlad Tenev, it’s coming faster than most people think.

Tenev doesn’t mince words. He calls tokenization an unstoppable freight train that will eventually consume the entire financial system. Bold claim? Maybe. But Robinhood already made its first move.

What Actually Happened

Robinhood launched tokenized U.S. stocks in Europe this past June. Over 200 stocks became available to EU customers as digital tokens on blockchain infrastructure.

The market responded immediately. Robinhood’s stock price surged to record highs. But the real story isn’t about one company’s stock performance. It’s about what this signals for global finance.

Speaking at Singapore’s Token2049 conference in October, Tenev laid out his vision. He predicts most major markets will adopt tokenization frameworks within five years. Full implementation might take longer—perhaps more than a decade—but the direction is clear.

“Tokenization is like a freight train. It can’t be stopped,” Tenev told attendees. “Eventually it’s going to eat the entire financial system.”

How Tokenization Actually Works

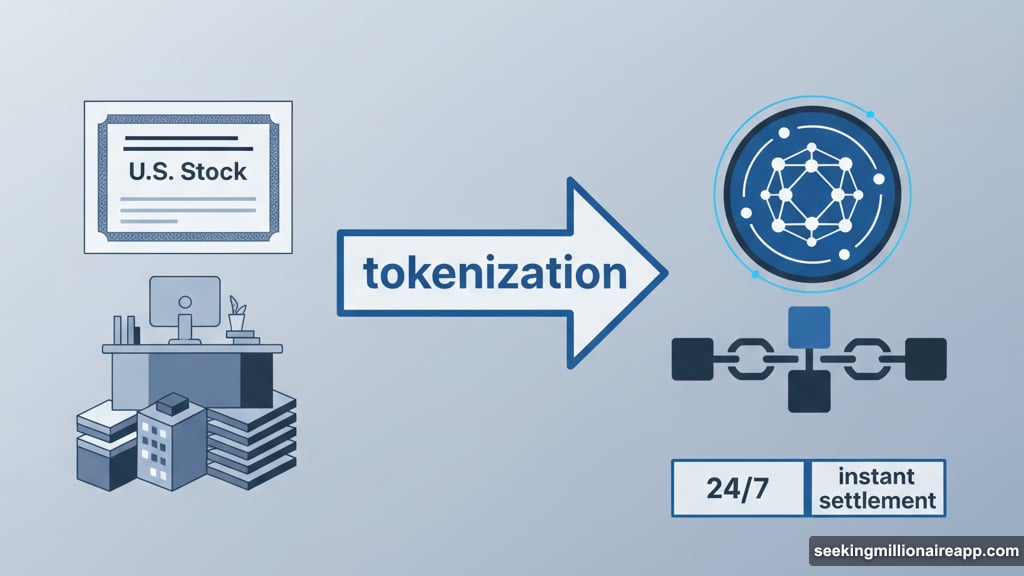

Here’s the simple version. A tokenized asset is a digital twin of something real—stocks, bonds, real estate, commodities. That digital version lives on a blockchain or distributed ledger.

Why does this matter? Traditional stock trading involves multiple intermediaries. Each adds cost and friction. Tokenized assets can trade 24/7, settle instantly, and cross borders without the usual banking headaches.

Think of it like the difference between mailing a check and Venmo. Same end result. Completely different infrastructure. And one is objectively faster and cheaper.

Robinhood’s EU launch proved the concept works at scale. Over 200 tokenized stocks now trade on their platform. Customers get exposure to U.S. equities without traditional brokerage limitations.

Europe First, America Last

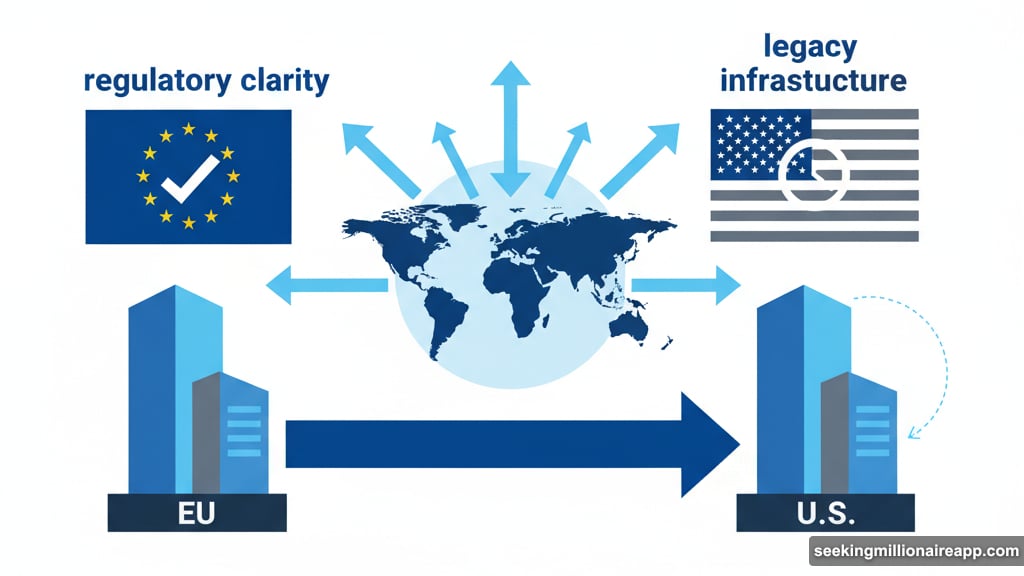

Tenev sees a clear geographic pattern emerging. Europe will lead adoption. The U.S. will lag behind.

Why? America’s existing financial infrastructure has massive sticking power. Banks, clearinghouses, and regulatory frameworks all benefit from the current system. Change threatens established interests.

“I think that will come, starting in Europe, but then expanding to the rest of the world,” Tenev explained. “I think the U.S. will actually be among the last economies to fully tokenize.”

Europe faces fewer legacy constraints. Plus, EU regulators have shown more willingness to establish clear crypto frameworks. That regulatory clarity accelerates institutional adoption.

Meanwhile, U.S. institutions move cautiously. But even here, giants like Morgan Stanley and BlackRock are exploring tokenization. So the question isn’t if America adopts this technology. It’s when.

Stablecoins Paved the Way

Tenev points to stablecoins as proof that tokenization already works. These digital currencies peg to assets like the U.S. dollar. They’re essentially tokenized fiat currency.

And they’ve exploded in usage. Billions of dollars flow through stablecoins daily. They enable instant cross-border payments without traditional banking rails. In fact, stablecoins demonstrate every advantage Tenev claims for broader tokenization.

“I actually think cryptocurrency and traditional finance have been living in two separate worlds for a while, but they’re going to fully merge,” he said.

That merger isn’t theoretical anymore. It’s actively happening. Robinhood’s tokenized stocks represent just one example. More are coming.

Why This Matters for Regular Investors

Forget the blockchain hype for a second. Focus on practical implications.

Tokenization means 24/7 trading. No more waiting for market hours. Want to buy stock at 3 AM on Sunday? Go ahead.

It means instant settlement. Currently, stock trades take two business days to settle. Tokenized assets settle immediately. That frees up capital faster.

It means fractional ownership gets easier. Want to own $50 of Amazon stock? Simple. No need to buy a full share. Plus, the same technology works for expensive assets like real estate.

Most importantly, it means lower costs. Fewer intermediaries means fewer fees. That directly benefits investors.

The Infrastructure Battle Ahead

Not everyone welcomes this change. Traditional financial institutions built massive businesses on existing infrastructure. They won’t surrender without a fight.

Regulatory battles are coming. Legacy players will lobby to slow adoption. They’ll argue about investor protection and market stability. Some concerns are legitimate. Others are just protectionism.

But Tenev believes the advantages are too significant to resist. “I think that crypto technology has so many advantages over the traditional way we’re doing things that in the future there’s going to be no distinction,” he said.

Technology wins these battles eventually. Remember when banks claimed mobile check deposit was too risky? Now it’s standard. Tokenization will follow a similar path.

What Comes Next

Five years from now, Tenev predicts major markets will have tokenization frameworks in place. That’s a conservative timeline by crypto standards. But it’s aggressive for traditional finance.

Watch for these signs that adoption is accelerating:

- More major brokerages launching tokenized offerings

- Regulators publishing clear frameworks in multiple countries

- Traditional assets like real estate getting tokenized at scale

- Banks integrating blockchain settlement systems

- 24/7 trading becoming standard expectation

The freight train metaphor fits. This change builds momentum slowly at first. Then it becomes inevitable.

Robinhood made its bet. Now the question is who follows. And more importantly, who gets left behind trying to preserve systems that are becoming obsolete.

Asset tokenization won’t replace traditional markets overnight. But the direction is set. The technology works. The benefits are real. And companies like Robinhood are proving it at scale.

The merge between crypto and traditional finance isn’t coming someday. It’s happening right now. Most people just haven’t noticed yet.