Shiba Inu crashed 70% this year. Most meme coins are bleeding. So naturally, everyone’s asking: Is SHIB finished?

Not so fast. While speculation collapsed, the on-chain data tells a completely different story. Whales keep buying. Holders keep growing. And massive amounts of SHIB just left exchanges.

Let’s dig into what’s actually happening beneath the panic.

The Meme Coin Massacre Hit SHIB Hard

Meme coins got destroyed in 2024. CryptoQuant data shows dominance dropped to early-2024 lows. Speculation evaporated across the board.

Shiba Inu took the hit. The token sits more than 90% below its all-time high. Price keeps failing at resistance levels. Meanwhile, smart money wallets steadily dumped SHIB throughout the year.

Those are the wallets that belong to experienced traders. They track market momentum better than most retail investors. And they’ve been walking away from SHIB for months.

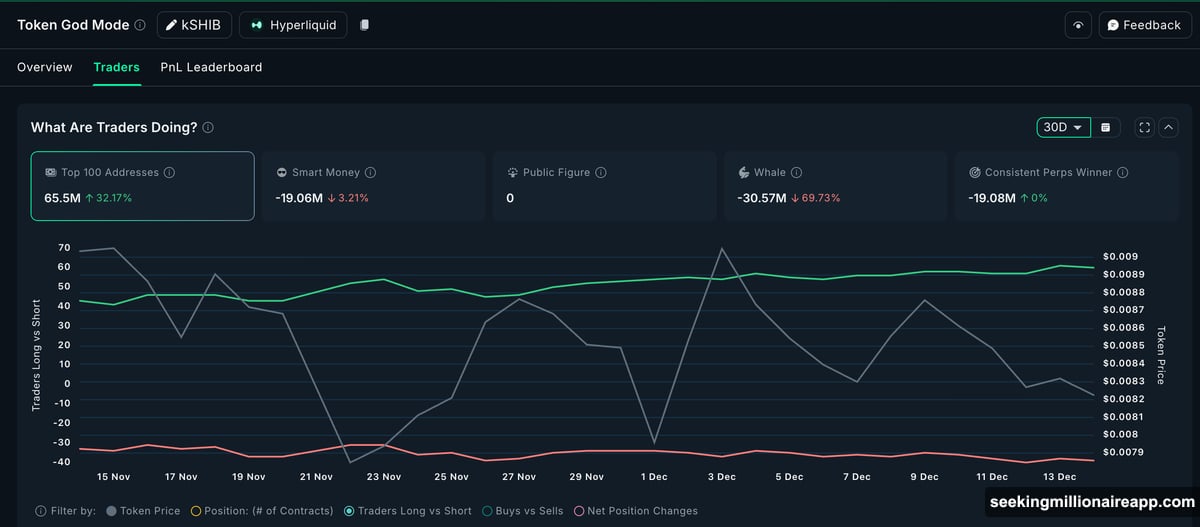

Plus, derivatives data confirms the exodus. Over the past 30 days, most futures traders cut their positions. Outside of whale addresses, leverage barely exists. Nobody’s betting on quick gains anymore.

CryptoQuant CEO Ki Young Ju even declared meme coins “dead” on December 11. Based on surface data, he’s got a point. Speculation dried up. Rallies fizzled. Most traders moved on.

But that’s only half the picture.

Whales Keep Accumulating While Others Panic

Here’s where things get interesting. Despite brutal price action, long-term holder count keeps rising.

Shiba Inu started the year with roughly 1.46 million holders. Now it’s near 1.54 million. That’s not explosive growth, but it’s steady and consistent even as prices tanked.

More telling? Whale behavior. Large holders increased SHIB balances by about 249% over the past year. Mega-whales added roughly 28.5%. At the same time, exchange balances dropped nearly 22%.

Fewer coins on exchanges means less immediate selling pressure. That’s basic supply dynamics. And the trend accelerated recently.

Over just the past 30 days, whale balances jumped more than 61%. Most exchange outflows happened during that same period. Someone with deep pockets is quietly stacking SHIB while retail traders flee.

That doesn’t look like a dying coin. It looks like smart money positioning before everyone else notices.

However, derivatives traders aren’t joining the party yet. Outside of top addresses, leverage positioning stays muted. Whales are early but cautious. They’re buying the dip, not betting on immediate moonshots.

Price Action Weak But Reversal Setup Exists

SHIB price structure remains fragile. No sugar-coating that reality.

On the three-day chart, Shiba Inu trades inside a long-term falling wedge. These patterns often turn bullish if price breaks upward. But the key word is “if.”

Recently, a technical signal emerged. Between December 3 and December 12, SHIB made a lower low while the Relative Strength Index made a higher low. That’s called bullish divergence.

It suggests selling pressure is weakening. Doesn’t guarantee a reversal, but it raises the odds.

Now levels matter more than narratives. First major resistance sits at $0.0000092. A clean break above that level would signal a breakout from the upper trendline that’s capped price since September.

If that happens, next resistance zones appear near $0.000010, $0.000011, and $0.000014. Only a sustained move past $0.0000092 would fully invalidate the “dead coin” thesis.

On the downside, structure breaks below $0.0000075. Drop under that level and the reversal setup fails. Downside risk reopens immediately.

The Altcoin Cycle Wildcard

Here’s what most analysis misses. Shiba Inu’s fate doesn’t depend solely on fundamentals or technicals.

It depends on whether an altcoin cycle returns. During the last cycle, meme coins exploded as retail money flooded into high-risk assets. SHIB hit its all-time high during that frenzy.

Right now, that cycle is dormant. Speculation shifted elsewhere. Bitcoin dominance rose while altcoins stagnated. But cycles always return eventually.

If Bitcoin consolidates and altcoin season reignites, SHIB could catch a massive bid. The accumulation happening now positions whales for exactly that scenario. They’re buying before the crowd realizes the cycle turned.

But timing remains uncertain. Could be months. Could be longer. That’s why derivatives traders stay cautious despite whale buying.

Is SHIB Dead or Just Hibernating?

Shiba Inu isn’t dead. But it’s definitely not thriving either.

Speculation vanished. Traders remain cautious. Quick gains look unlikely. The token sits in survival mode, waiting for confirmation of a broader trend shift.

Yet the on-chain story contradicts the panic. Holder count keeps rising. Whales accumulated heavily. Exchange balances dropped sharply. That’s not abandonment. That’s preparation.

If an altcoin cycle returns, SHIB still has a path to revival. The accumulation phase is happening now while prices stay depressed. Smart money positions early, not during the pump.

For now, the question isn’t whether SHIB will die. It’s whether you’re patient enough to wait for the cycle to turn. Because based on whale behavior, someone’s betting it will.