Bitcoin just flipped a crucial metric that hasn’t changed in 30 months. Short-term holders now control more unrealized profits than long-term holders.

That’s a big deal. This shift last happened in March 2023, and it signals both opportunity and danger for BTC’s current recovery attempt. Plus, the timing couldn’t be more critical as Bitcoin fights to break free from a downtrend that’s held since late October.

Let’s explore what this means for Bitcoin’s next move and whether the bulls can reclaim momentum.

Short-Term Holders Take the Lead

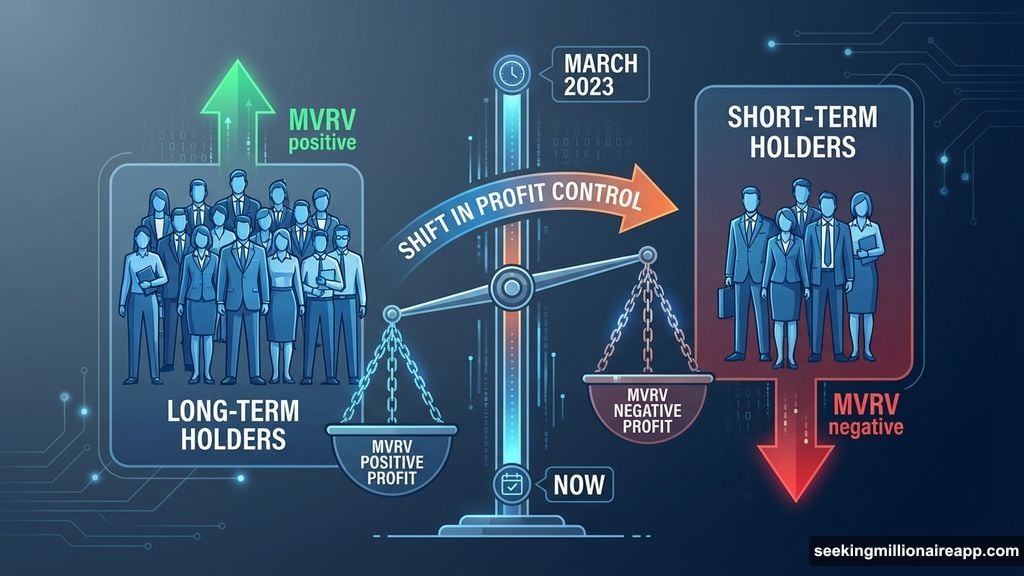

The MVRV Long/Short Difference metric tells a fascinating story right now. This indicator compares unrealized profits between long-term and short-term Bitcoin holders.

When the reading stays positive, long-term holders dominate profits. But a negative value means short-term traders hold more gains. Bitcoin’s metric just dipped negative for the first time since March 2023.

That’s 30 months of long-term holder dominance ending in one swift move. And this creates immediate volatility concerns. Short-term holders historically sell aggressively when markets wobble.

So if Bitcoin faces renewed selling pressure, these profit-takers could amplify the downturn. Their behavior becomes especially critical as BTC tests key resistance levels while trying to escape its downtrend pattern.

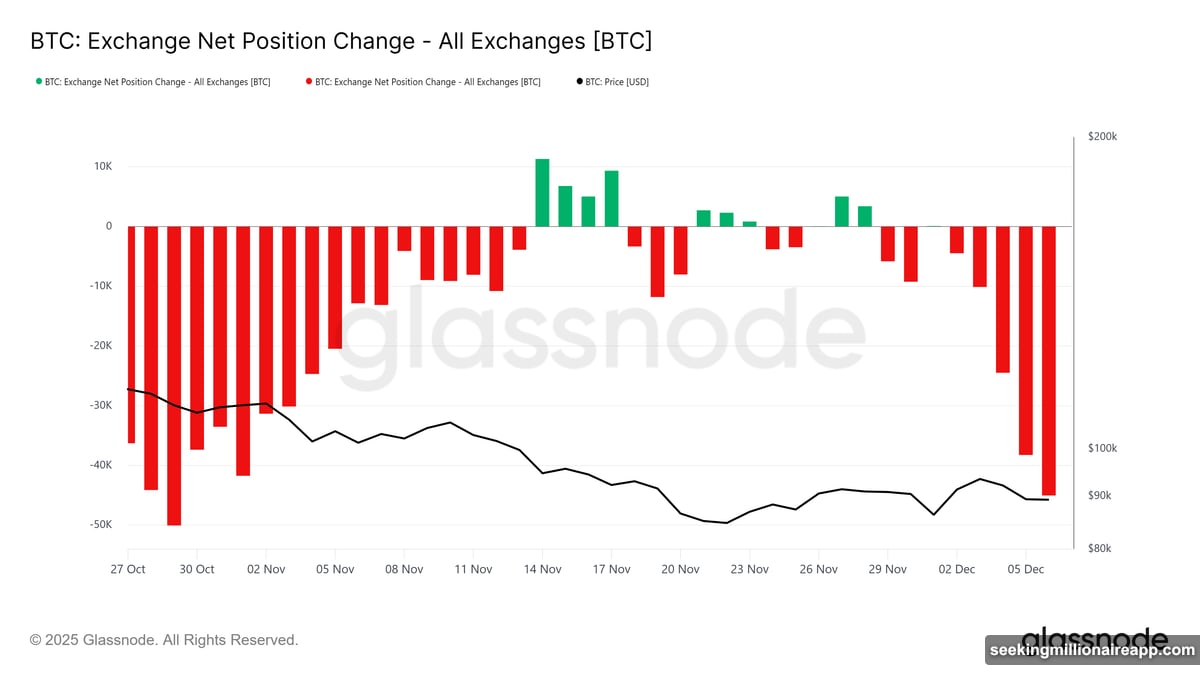

Exchange Outflows Signal Growing Confidence

Here’s the good news. Bitcoin exchange outflows jumped significantly in recent weeks.

Exchange net position change data shows BTC leaving major platforms at an accelerating pace. This typically signals accumulation behavior from investors who prefer cold storage over keeping coins on exchanges.

Rising outflows suggest many traders view current prices around $90,000 as attractive entry points. They’re moving Bitcoin off exchanges because they expect long-term appreciation. That builds confidence in potential recovery scenarios.

Moreover, sustained outflows reduce available supply on exchanges. This creates natural support for price stability and strengthens Bitcoin’s chances of breaking above immediate resistance. The accumulation trend directly contradicts panic-selling narratives.

However, this positive signal exists alongside the short-term holder profit shift. So the market faces competing forces that could determine Bitcoin’s direction over coming weeks.

Critical Price Levels Bitcoin Must Hold

Bitcoin trades at $91,330 as of this writing. The immediate challenge sits just above at $91,521 resistance.

Reclaiming that level and holding it as support opens the door for BTC to challenge its month-and-a-half downtrend. Without this breakout, upside remains capped and momentum stays limited.

If short-term holders resist taking profits and exchange outflows continue, Bitcoin could push toward $95,000. Breaking that barrier would send BTC toward $98,000 and confirm renewed bullish strength across the market.

But there’s a darker scenario. If short-term holders start selling aggressively, pressure mounts quickly.

BTC could drop back to $86,822 support in that case. Falling to this level would invalidate the bullish setup entirely and keep Bitcoin trapped in its downtrend for longer. The bulls need sustained buying pressure to prevent this outcome.

Two Competing Forces Battle for Control

Bitcoin faces a tug-of-war between bullish accumulation and bearish profit-taking. Exchange outflows point to growing investor confidence and long-term thinking. That’s clearly positive for recovery prospects.

Yet short-term holders now dominate unrealized profits for the first time in years. Their tendency to sell during volatility creates genuine downside risk. This dynamic makes the next few weeks especially important for BTC’s trajectory.

The outcome depends largely on whether accumulation pressure outweighs profit-taking impulses. If exchange outflows continue while short-term holders hold steady, Bitcoin breaks the downtrend decisively. But if those newer investors start cashing out, the rally stalls before it gains momentum.

Market participants should watch both the $91,521 resistance and $86,822 support closely. These levels determine whether Bitcoin escapes its October downtrend or remains range-bound through year-end. The metric flip after 30 months adds extra uncertainty to an already pivotal moment for cryptocurrency markets.