Hyperliquid’s HYPE token spiked to $34 this week. That’s a 22% jump in 24 hours. But the reason behind it isn’t what you’d expect.

Silver futures trading is driving the surge. Yes, the precious metal. And the connection reveals how Hyperliquid’s new market structure creates unexpected price catalysts for its native token.

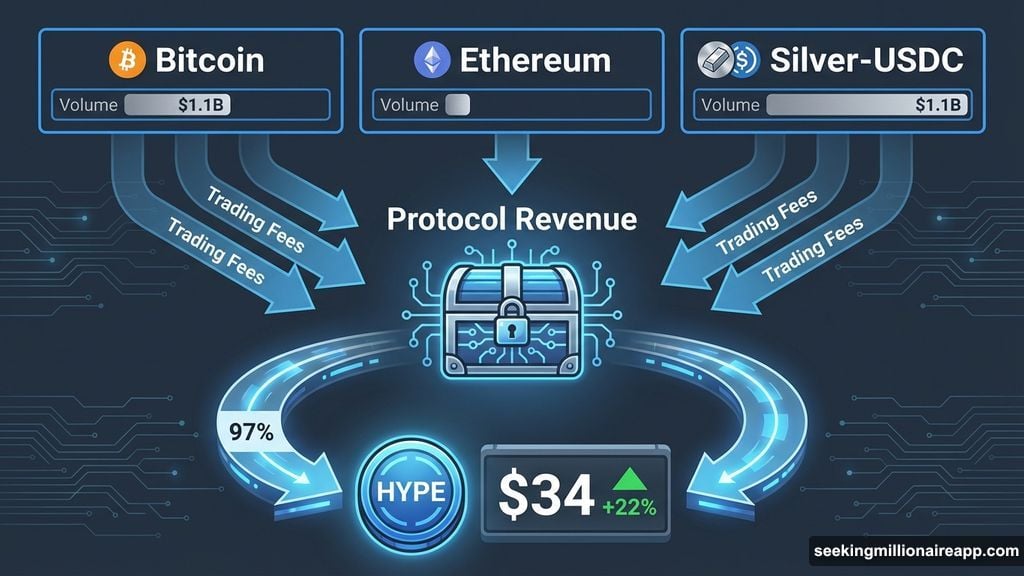

Silver Volume Hit $1.1 Billion on One Exchange

Hyperliquid’s Silver-USDC perpetual futures market exploded with activity. Trading volume reached $1.1 billion in a single day. That made silver the third most-traded asset on the platform, behind only Bitcoin and Ethereum.

This isn’t a fluke. Silver trading has dominated Hyperliquid’s newer HIP-3 markets for weeks. Open interest across these markets hit a record $900 million today. Just a month ago, that figure stood at $260 million.

So why does this matter for HYPE price? The answer lies in how these markets generate revenue and where that money flows.

HIP-3 Markets Feed HYPE Buybacks

Hyperliquid activated HIP-3 in October 2025. This upgrade changed how perpetual futures markets get created on the platform. Now anyone can deploy their own perpetual market by staking at least 500,000 HYPE tokens.

But here’s the key mechanism. These HIP-3 markets split trading fees 50/50. Half goes to whoever deployed the market. The other half flows to Hyperliquid’s protocol treasury.

That protocol revenue matters because of what happens next. Hyperliquid’s Assistance Fund takes roughly 97% of collected fees and uses them to buy back HYPE tokens from the open market. More trading volume means more fees. More fees mean more buyback pressure. More buybacks typically support price appreciation.

The Math Behind the Surge

Let’s break down the numbers. Silver generated $1.15 billion in daily volume. That’s roughly equivalent to Hyperliquid’s entire Ethereum perpetual market.

Trading fees from that volume flow into the protocol treasury. Then those fees fund systematic HYPE buybacks that reduce circulating supply. The cycle creates organic buying pressure whenever HIP-3 markets see increased activity.

FalconX estimates this dynamic could drive 67% upside for HYPE in 2026. That’s not speculation. It’s based on the direct relationship between fee generation and buyback mechanics.

Analyst McKenna pointed out the scale of activity. “HIP-3 has beaten the previous day’s all-time high in volume and we’re not even halfway through the day,” he wrote. That acceleration in trading activity directly translates to stronger buyback support for HYPE.

Why Silver Trading Exploded

Commodities trading in crypto isn’t new. But Hyperliquid’s permissionless market creation made launching a silver perpetual extremely easy.

Traditional crypto exchanges require listing approvals and integration work. HIP-3 removed those barriers. Anyone with enough HYPE tokens can deploy a market for any asset, including commodities like silver.

Silver became popular because it offers unique characteristics. The metal shows less correlation to crypto markets than most altcoins. Plus, macro factors like inflation concerns and industrial demand create trading opportunities independent of Bitcoin’s price action.

Traders discovered Hyperliquid offered deep liquidity for silver futures. Jeff, a platform analyst, noted that Hyperliquid has “quietly achieved an important milestone of becoming the most liquid venue for crypto price discovery in the world.”

That liquidity attracted more traders. More traders generated more volume. More volume produced more fees. And more fees meant stronger HYPE buybacks.

Broader Market Context Matters

HYPE didn’t rise in isolation. The broader crypto market gained nearly 1% over the same period. Bitcoin and Ethereum both showed strength.

But HYPE outperformed significantly. While most top 100 cryptocurrencies posted modest gains, HYPE jumped 22%. That outsized move suggests factors beyond general market sentiment.

Daily trading volume for HYPE surged 93% to over $800 million. That’s not just price appreciation. It reflects genuine interest and buying pressure, likely driven by traders recognizing the HIP-3 revenue dynamic.

The token reached $34 today, its highest price since early December. At current levels around $33.36, HYPE has reclaimed significant ground after recent market volatility.

The HIP-3 Revolution Continues

Hyperliquid’s market structure creates something unusual in crypto. Most exchanges earn fees but don’t directly support their native tokens through buybacks. Hyperliquid does both.

HIP-3 markets expanded the platform’s addressable market. Instead of just crypto perpetuals, Hyperliquid now hosts futures for commodities, stocks, and other assets. Each new market adds potential revenue streams.

Silver emerged as the breakout success. But dozens of other HIP-3 markets exist. As more traders discover these offerings, fee generation should continue growing. That means sustained buyback pressure for HYPE regardless of broader crypto market conditions.

The system aligns incentives well. Market deployers earn half the fees, so they promote their markets. Traders get access to unique assets with strong liquidity. And HYPE holders benefit from systematic buybacks funded by all that activity.

Sustainability Questions Remain

This model works brilliantly during periods of high trading activity. But what happens when volatility drops and volume dries up?

Buyback pressure depends entirely on fee generation. If traders lose interest in HIP-3 markets, revenue falls. Lower revenue means weaker buybacks. And weaker buybacks remove key price support.

Silver’s popularity could fade as macro conditions change. The commodity trades heavily based on inflation expectations and industrial demand. If those factors shift, silver volume might crater.

Moreover, requiring 500,000 HYPE tokens to deploy markets creates a high barrier. That limits how many new markets launch. Fewer new markets mean slower growth in fee-generating activity.

Still, the early results look impressive. Hyperliquid found product-market fit with HIP-3. Traders want permissionless access to diverse perpetual markets. And the protocol’s economic model converts that demand directly into HYPE price support.

The silver surge proves the mechanism works. Now the question becomes whether Hyperliquid can sustain and expand this success across more asset classes.