Seeker token hit a wall. After surging 200% post-launch, SKR just lost 25% in 24 hours as the investors who powered the initial rally started heading for the exits.

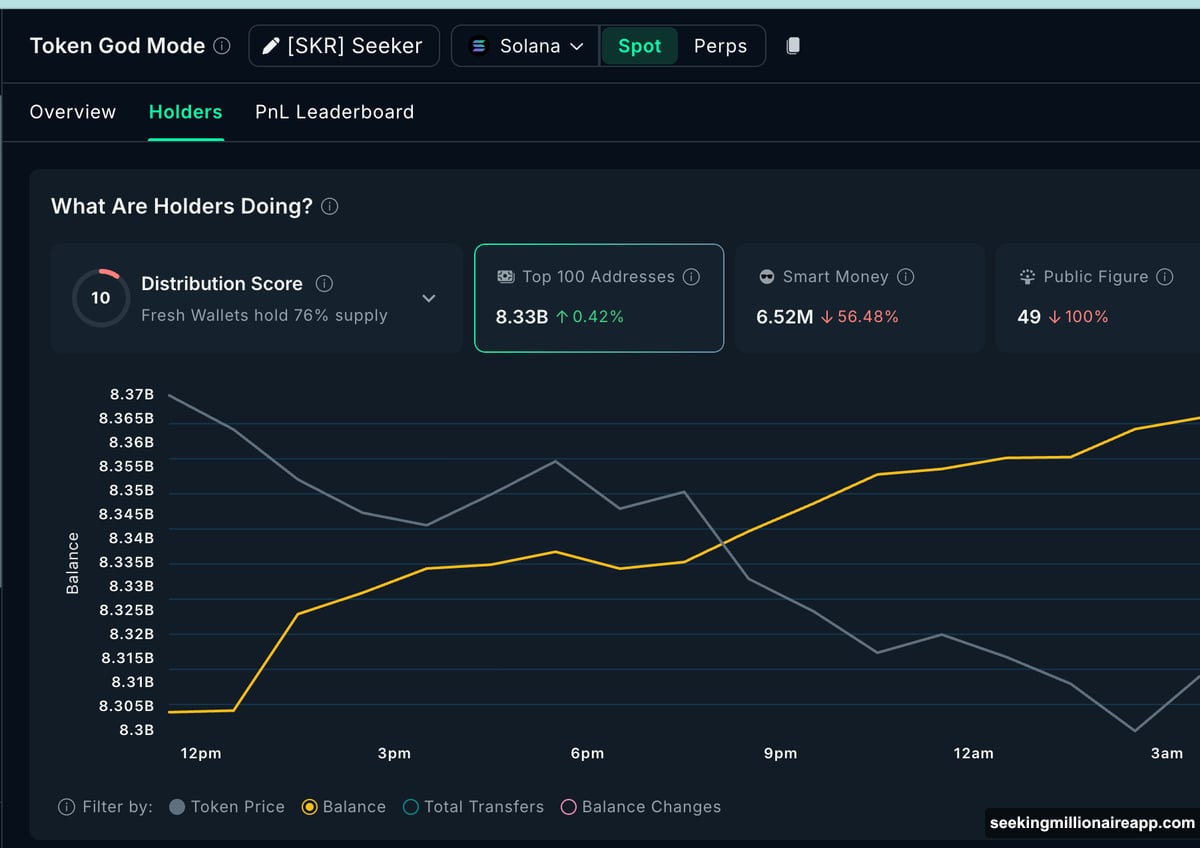

Here’s what changed. Smart money wallets that absorbed early airdrop selling and stabilized the price just slashed their positions by 56%. Meanwhile, whales stepped in and added 16 million tokens during the dip. But exchange inflows tell a different story – 45 million SKR tokens flooded onto trading platforms.

The result? A tug-of-war between opposing forces, with a critical 5% price level now deciding what happens next.

Smart Money Abandoned Ship at the Worst Possible Time

The breakdown started January 24. Seeker’s price slipped below its Volume Weighted Average Price (VWAP) on the one-hour chart.

VWAP represents the average price traders paid, weighted by trading volume. So when price holds above it, buyers control the action. When it breaks below, distribution usually follows instead of healthy consolidation.

That technical break coincided perfectly with smart money behavior. Over 24 hours, these wallets dumped 56.48% of their SKR holdings. Based on on-chain data, this cohort offloaded roughly 8.5 million tokens in a single day.

This wasn’t gradual profit-taking. Instead, it was a decisive exit right after short-term support cracked. Smart money typically moves first. When they step aside after losing VWAP support, it signals the near-term risk-reward no longer looks attractive.

That explains why Seeker’s bounce attempts have failed to gain traction. But smart money selling tells only half the story.

Whales Bought the Dip While Everyone Else Sold

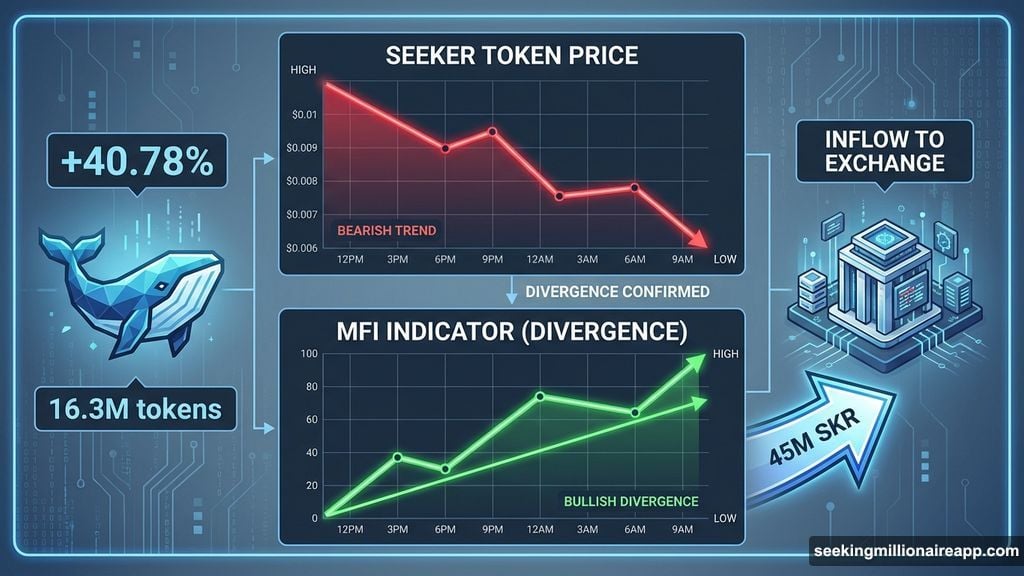

While informed traders exited, whales moved in the opposite direction. From January 23 to 24, Seeker’s price kept falling. Yet the Money Flow Index (MFI) climbed higher over the same period.

MFI tracks buying and selling pressure using both price and volume data. When price drops but MFI rises, it signals accumulation happening beneath the surface. That’s exactly what played out here.

That divergence explains whale behavior perfectly. Over 24 hours, whale holdings jumped 40.78%, lifting their total balance to 56.49 million SKR. So whales added approximately 16.3 million tokens during the pullback.

Unlike smart money, whales aren’t trading short-term chart patterns. Instead, they’re positioning into weakness, which aligns with the MFI dip-buying signal. This creates a sharp contrast in strategy.

Smart money exited after technical support failed. Whales entered as momentum cooled and dip-buying signals appeared. However, whale accumulation doesn’t automatically spark price recovery.

Whales can absorb supply. But they can’t stop a decline if selling pressure keeps building elsewhere. That’s where exchange behavior becomes critical.

Exchange Inflows Keep Breakdown Risk Alive

Despite whale buying, supply pressure remains elevated. Exchange balances surged 10.94% over 24 hours, reaching 453.67 million SKR. That implies roughly 44.8 million tokens moved onto exchanges during this period.

Smart money exits contributed to this flow. Plus, retail profit-taking likely added to the pressure as traders locked in gains from the 200% rally.

This supply shift shows up clearly in volume data. On the four-hour chart, On-Balance Volume (OBV) trended lower from January 21 to 24, even as price remained elevated. OBV tracks whether volume confirms price moves.

When price holds steady but OBV falls, it signals rallies are running on thinning demand rather than strong accumulation. That’s why whale buying hasn’t translated into upside follow-through yet. Moreover, the exchange inflow surge easily trumps whale accumulation numbers.

The technical risk is now clearly defined. On a four-hour closing basis, $0.028 marks the key level – just 5% below current prices. A clean close below it, accompanied by an OBV trendline breakdown, would signal selling pressure is overwhelming accumulation.

That would open downside risk toward $0.012, erasing most of the post-launch gains.

The Levels That Matter Now

On the upside, Seeker needs to reclaim $0.043 to restore confidence. Beyond that, $0.053 remains the most important resistance zone, where prior supply concentrated during the rally.

Without a shift in volume behavior, those levels remain difficult to reach. The structure tells a simple story now.

Smart money stepped aside. Whales accumulated during the dip. Exchanges filled up with tokens. As long as this imbalance persists, Seeker’s price remains vulnerable to further downside.

The next 24 hours will likely decide whether whale accumulation can absorb the selling pressure, or if the exodus of informed traders signals a deeper correction ahead. For now, the $0.028 level holds the answer.

Watch that level closely. A breakdown there changes everything. A hold above it gives whales a chance to prove their accumulation thesis. Either way, the tug-of-war between smart money exits and whale buying just entered its critical phase.