October 2025 might deliver the biggest crypto surprise in years. The SEC is reviewing 16 altcoin ETF applications right now. And several decisions land this month.

Two coins stand out from the pack. Solana and Cardano show the strongest fundamentals and institutional interest. Plus, their approval timelines hit within weeks.

If regulators give the green light, these altcoins could see massive price jumps. But the outcome isn’t guaranteed.

Why October Matters for Crypto ETFs

The SEC faces multiple decision deadlines this month. Litecoin’s Canary ETF decision came on October 2. Solana and Litecoin trust conversions hit October 10. WisdomTree’s XRP ETF ruling arrives October 24.

That’s a lot happening fast. And the market is watching closely.

ETF approvals change everything for altcoins. They open the door to institutional money that previously stayed on the sidelines. Traditional investors prefer ETFs over direct crypto purchases. The familiar structure makes them comfortable.

However, political factors could derail timelines. A potential U.S. government shutdown threatens to delay SEC decisions. Moreover, regulators might reject applications if they don’t meet current standards.

Still, analysts see strong approval chances for certain coins. Universal listing standards now streamline the verification process. That benefits projects with solid technical foundations and real-world utility.

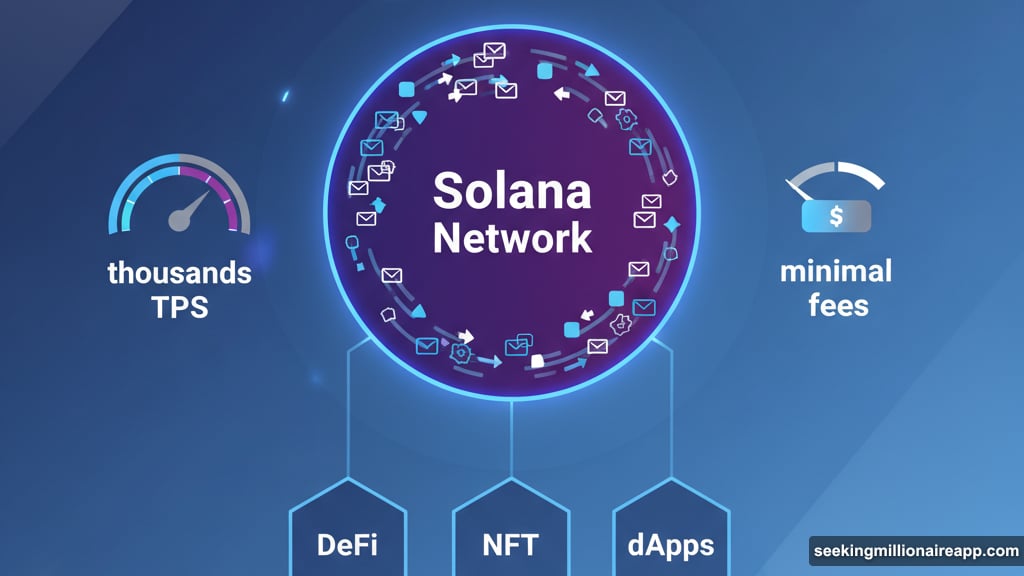

Solana Leads the Pack

Solana dominates DeFi and NFT ecosystems. The network processes thousands of transactions per second with minimal fees. Plus, developer activity remains strong despite past market volatility.

A Solana ETF could attract serious institutional capital. Asset managers already recognize SOL’s technical advantages. The combination of speed, low costs, and growing adoption makes it appealing.

If approved, expect SOL to break through key resistance levels quickly. Institutional buyers typically enter with substantial positions. That buying pressure pushes prices higher.

But remember the risks. Solana experienced network outages in the past. Critics point to centralization concerns around validator concentration. Any technical issues post-ETF approval could trigger sharp selloffs.

Cardano Shows Promise Too

Grayscale’s Cardano ETF application faces its final decision on October 26. That’s the last major ruling of the month. And it could be significant.

Cardano built a loyal community and methodical development approach. The project prioritizes peer-reviewed research and formal verification. That academic rigor attracts certain institutional investors.

Analysts believe ADA could punch through $1.00 if the ETF gets approved. Beyond that, continued positive momentum might push it higher. Market sentiment plays a huge role in these moves.

Yet Cardano faces criticism about slow development pace. Competitors shipped features faster while ADA focused on perfection. Some investors lost patience waiting for promised functionality.

Other Altcoins in the Running

XRP, Chainlink, and Stellar also have ETF applications under review. Each brings different strengths to the table.

XRP benefits from Ripple’s payment network partnerships. Banks and financial institutions already use the technology. However, ongoing regulatory scrutiny creates uncertainty.

Chainlink dominates oracle services for smart contracts. The project provides essential infrastructure for DeFi. But it faces competition from emerging oracle networks.

Stellar targets cross-border payments and financial inclusion. The network processes transactions quickly and cheaply. Still, it hasn’t achieved the mainstream adoption supporters hoped for.

None of these altcoins seem likely to outperform SOL or ADA in the short term. But surprises happen in crypto markets.

What ETF Approval Actually Means

Three major impacts follow ETF approvals. First, institutional money flows into the asset. Pension funds, hedge funds, and family offices gain easy exposure.

Second, market liquidity increases dramatically. More buyers and sellers create tighter spreads. That reduces volatility and improves price discovery.

Third, regulatory legitimacy boosts investor confidence. SEC approval signals that an asset meets certain standards. That matters to risk-averse institutions.

However, the effects aren’t always immediate or dramatic. Institutional investors typically build positions slowly. They avoid moving markets with large single trades.

Moreover, diversification limits the impact on any single coin. Asset managers spread risk across multiple cryptocurrencies. That means no single altcoin captures all the new capital.

The Risks Nobody Talks About

ETF rejections could tank altcoin prices hard. Markets often price in optimistic outcomes ahead of decisions. Disappointment triggers violent selloffs.

Delayed decisions create different problems. Uncertainty keeps buyers on the sidelines. Prices drift lower as traders lose patience.

Broader market conditions matter too. If Bitcoin sells off sharply, altcoins follow. Global economic turmoil could override positive ETF news.

Plus, approvals might arrive with restrictions. Regulators could impose limits on marketing or distribution. Those constraints reduce the positive impact.

My Take on October’s Potential

This month carries real potential for altcoin breakouts. The timing aligns perfectly with multiple decision deadlines. And the quality of applicants seems stronger than previous waves.

Solana and Cardano both deserve attention. Their fundamentals support long-term growth regardless of ETF outcomes. But approval would accelerate price appreciation significantly.

I’m watching Solana more closely. The ecosystem shows genuine user adoption and developer interest. That matters more than fancy marketing or promises.

Yet I’m keeping expectations realistic. Even approved ETFs won’t create overnight millionaires. Institutional accumulation takes months, not days.

The smart play is position sizing appropriately. Don’t bet the farm on October approvals. But having some exposure makes sense if you believe in these projects long-term.