Solana just got its biggest endorsement yet from traditional finance. And it’s not coming from crypto twitter.

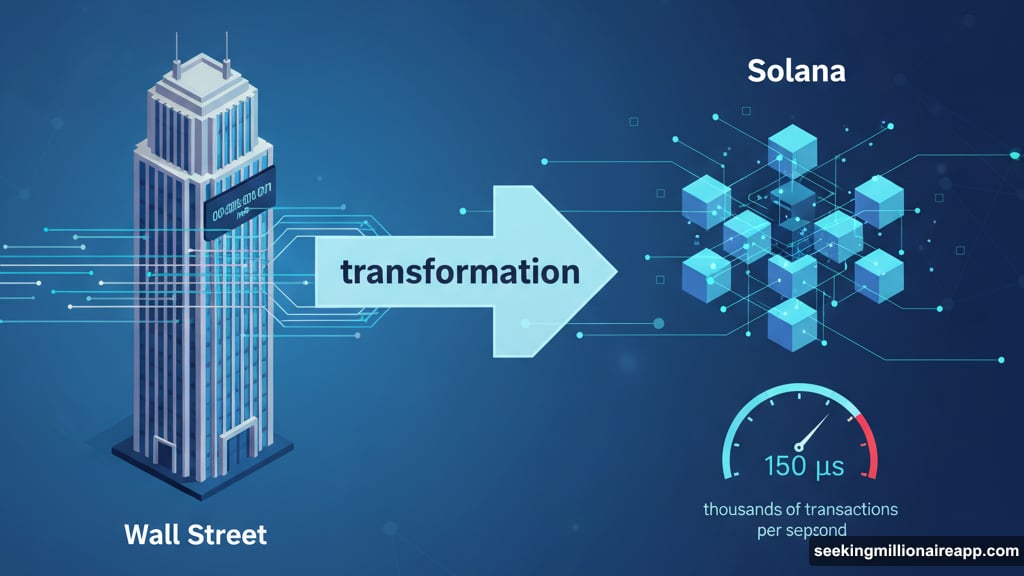

Matthew Hougan, Chief Investment Officer at Bitwise, told Solana Labs that the blockchain represents “the new Wall Street.” That’s a bold claim from someone managing billions in institutional crypto assets. But his reasoning reveals why major investors are suddenly paying attention to SOL.

The timing matters. Financial giants from BlackRock to the Bank of England now admit blockchain could reshape markets. So when investors ask which platform will capture that transformation, Hougan says Solana’s technical advantages make it stand out.

Why Traditional Finance Suddenly Cares

Something shifted in 2025. Leaders who once dismissed crypto now acknowledge its potential.

Hougan pointed to recent statements from the SEC chair, Bank of England governor, and BlackRock CEO. All three signaled that stablecoins and tokenization will disrupt payments and securities. That’s remarkable given their previous skepticism.

However, acknowledging the technology exists differs from betting on specific platforms. Investors need to choose winners. And that’s where Solana enters the conversation.

Traditional finance values speed and reliability. Markets move in milliseconds. Settlement delays cost money. So when Hougan evaluates blockchains for institutional use, he focuses on performance metrics that Wall Street understands.

The Numbers That Matter

Solana recently improved settlement times from 400 microseconds to 150 microseconds. For context, that’s faster than you can blink.

Most people don’t notice microseconds. But traders do. High-frequency trading firms fight for every millisecond of advantage. So a blockchain that settles transactions in 150 microseconds speaks their language.

Plus, Solana handles higher throughput than competitors. The network processes thousands of transactions per second without breaking. That scalability matters when moving billions in assets.

Then there’s finality. Once Solana confirms a transaction, it’s done. No waiting. No reversals. For financial institutions accustomed to instant execution, this feels natural.

Hougan called these features “extraordinarily attractive” for investors evaluating blockchain exposure. He said the technical edge resonates strongly with market participants who understand trading infrastructure.

“The New Wall Street” Narrative

Calling Solana “the new Wall Street” sounds like marketing hype. But Hougan backed it with specifics.

Wall Street represents speed, scale, and institutional-grade infrastructure. Solana delivers all three. Moreover, it does so at costs traditional finance can’t match.

Transaction fees on Solana remain near zero even during peak activity. Compare that to legacy payment systems charging percentage-based fees. Or Ethereum’s gas costs during network congestion.

The narrative appears to work. Hougan predicted “substantial flows” into Solana as this story spreads among institutional investors. And he’s seeing early signs already.

Meanwhile, the broader crypto market shows mixed signals. Bitcoin consolidates above $60,000. Ethereum struggles with scaling debates. Yet Solana keeps attracting developers and projects.

Recent Price Action Reveals Caution

Despite the bullish talk, SOL’s price shows investors remain cautious. Technical analysis from October 3-4 revealed consolidation within a narrow range.

SOL traded between $228.19 and $237.04 over 23 hours. That’s just an $8.40 spread. Moreover, trading volume collapsed through the period.

Volume peaked at 3.29 million units early on October 3. But by the end of analysis, it dropped to just 42,637 units. That suggests participants stepped away, waiting for clearer signals.

Then the support broke. In the final hour analyzed, SOL fell from $229.84 to $228.94 as volume surged. The busiest single minute saw 18,011 units trade at 14:01 UTC on October 4.

Rising volume during a breakdown typically signals larger sellers entering. So near-term momentum may favor bears unless support holds.

The Bigger Question Nobody’s Asking

Here’s what bugs me about this whole narrative. Hougan’s right about Solana’s technical advantages. The blockchain genuinely performs better than most alternatives.

But “the new Wall Street” implies replacing the old one. That’s a massive claim. Wall Street didn’t build its dominance on technology alone. Regulation, relationships, and trust took decades.

Can Solana really capture institutional markets at scale? Or will traditional finance build their own permissioned blockchains instead?

BlackRock’s already experimenting with tokenization on multiple chains. They don’t seem committed to any single platform yet. So Solana might win technical comparisons but still lose market share to closed systems.

Still, Hougan’s prediction about substantial flows matters. Bitwise manages real institutional money. If they’re positioning for Solana growth, other firms might follow. And in markets, perception often becomes reality.