The crypto market showed strength Thursday with most major assets pushing higher. Solana led the charge while Bitcoin Cash delivered solid gains.

The CoinDesk 20 Index traded at 3,576.17 by afternoon, up 1.3% from Wednesday’s close. That’s a gain of 44.29 points. More importantly, 15 of the 20 assets in the index posted positive returns.

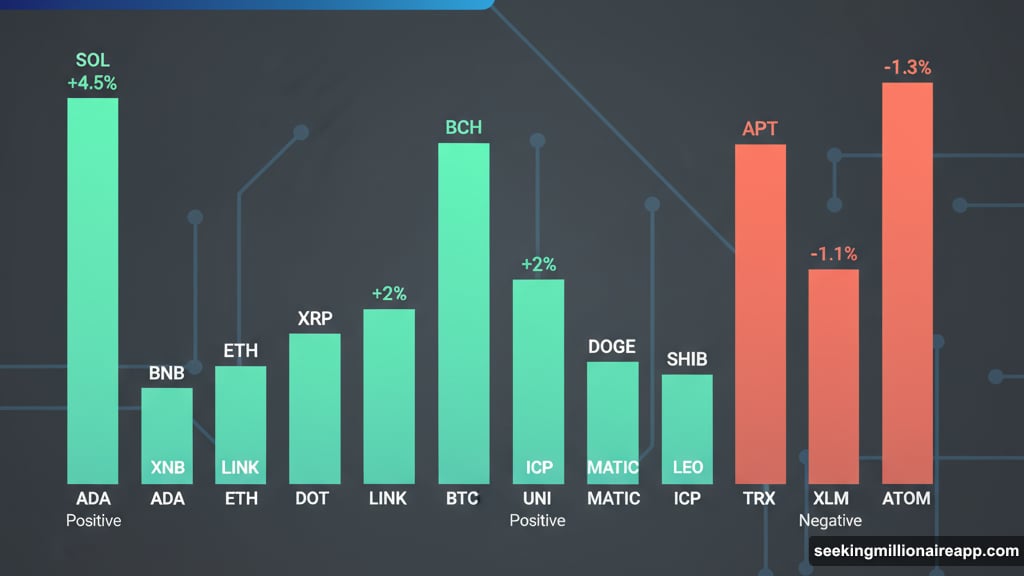

Solana (SOL) topped the leaderboard with a 4.5% jump. Bitcoin Cash (BCH) followed with a 2% gain. On the flip side, Aptos (APT) and Litecoin (LTC) lagged with losses of 1.3% and 1.1% respectively.

What’s Driving Solana’s Strength

Solana’s 4.5% rally stands out in today’s market. The network continues to show strong fundamentals.

Transaction volumes remain robust across Solana-based decentralized applications. Plus, developer activity hasn’t slowed down despite broader market volatility. That suggests real usage, not just speculation.

Meanwhile, the broader crypto market sentiment improved Thursday. Bitcoin held above $110,000 while Ethereum traded around $3,890. Both major assets posted 2%+ gains, creating a supportive environment for altcoins like Solana.

Bitcoin Cash Makes Quiet Gains

Bitcoin Cash flew under the radar with its 2% gain. But that performance matters for portfolio diversification.

BCH often moves differently than other major cryptocurrencies. So when it rallies alongside the broader market, that signals stronger overall momentum. Investors appear to be rotating into multiple assets rather than concentrating in just Bitcoin and Ethereum.

The price action suggests risk appetite is expanding. That’s typically bullish for the crypto market as a whole.

Market Breadth Tells the Real Story

Here’s what really matters. Fifteen of 20 assets traded higher Thursday.

That kind of market breadth indicates genuine strength, not just isolated rallies in a few big names. When most assets move together, it suggests institutional money is flowing into crypto rather than retail traders chasing specific coins.

Historically, broad market rallies tend to last longer than narrow ones. So today’s performance across the CoinDesk 20 might signal sustained momentum ahead.

The Laggards Worth Watching

Aptos dropped 1.3% while Litecoin fell 1.1%. Neither loss looks severe. But both assets underperformed while most of the market rallied.

For Litecoin, the weakness continues a longer pattern. LTC has struggled to keep pace with newer layer-1 blockchains. Age isn’t necessarily a disadvantage in crypto, but Litecoin needs to demonstrate fresh use cases to justify investor attention.

Aptos faces different challenges. The newer blockchain launched with high expectations but hasn’t yet captured significant market share from Solana or other competitors. Today’s decline suggests some investors are losing patience.

What This Means for Traders

Thursday’s price action offers a few clear signals for market participants.

First, Solana’s strength confirms its position as a top-tier blockchain platform. Traders betting on continued SOL momentum have evidence supporting that view. Just remember that crypto moves fast and gains can reverse quickly.

Second, the broad market strength suggests this isn’t just a one-day blip. When 75% of major assets rally together, momentum often continues for several sessions. That doesn’t guarantee profits, but it tilts probabilities in favor of bulls.

Third, the laggards present opportunities for contrarian traders. Aptos and Litecoin trading lower while everything else climbs could signal either temporary weakness or deeper problems. Your call on which interpretation makes sense.

Risk management matters more than ever in these conditions. Strong markets can flip quickly when unexpected news hits. Set stop losses. Take profits when targets hit. Don’t get greedy chasing rallies that already happened.

The CoinDesk 20 Index tracks major cryptocurrencies across multiple exchanges globally. Today’s performance snapshot shows where money is flowing right now. Whether that continues depends on factors nobody can predict with certainty.

Watch Bitcoin’s behavior around $110,000. That level could act as support or resistance depending on how price reacts. Also keep an eye on regulatory news, which continues to drive significant market moves.