Jupiter just announced plans for its own stablecoin. The Solana-based decentralized exchange will roll out JupUSD by year’s end.

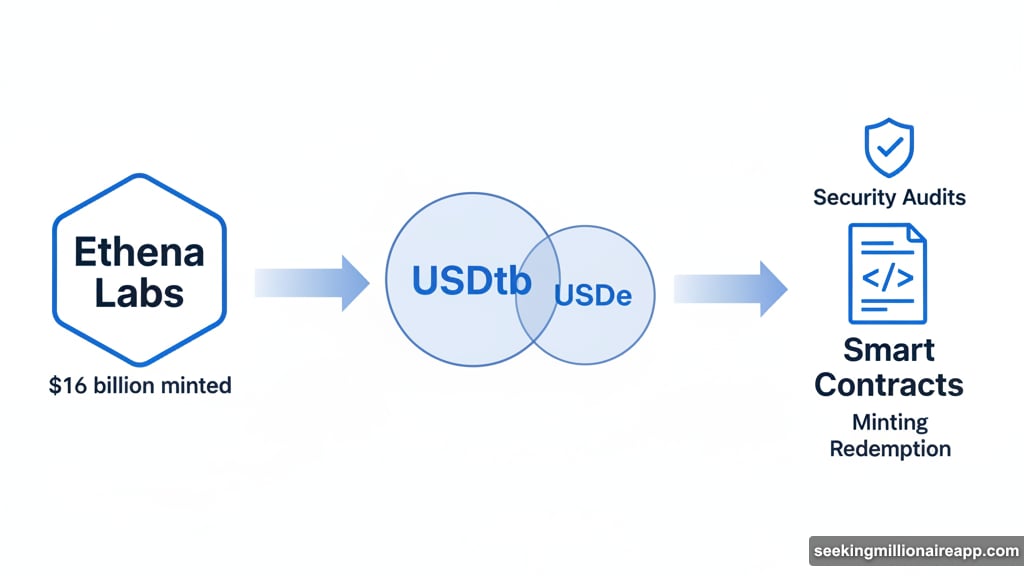

This marks a major strategic shift for Jupiter, which currently leads all Solana protocols with $3.58 billion in total value locked. Now they’re betting big on the stablecoin market. Plus, they’re partnering with Ethena Labs, which already minted over $16 billion in stablecoins.

What Makes JupUSD Different

JupUSD will live exclusively on Solana. That’s important. Most stablecoins spread across multiple blockchains, but Jupiter designed this one specifically for Solana’s ecosystem.

The token will integrate tightly with Jupiter’s existing products. That includes their perpetuals platform, lending markets, and trading interfaces. So users won’t need to bounce between different tokens for different Jupiter services.

But here’s the interesting part. JupUSD gets fully backed by Ethena Labs’ USDtb stablecoin. And USDtb itself? It’s backed by treasury funds including BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL).

That creates layers of institutional backing rarely seen in crypto stablecoins. Jupiter essentially leverages BlackRock’s infrastructure without building their own from scratch.

The Ethena Labs Partnership

Ethena Labs brings serious credentials to this collaboration. They’ve already proven they can scale stablecoin operations to $16 billion. That’s not trivial in an industry where most projects collapse under growth pressure.

The partnership structure matters too. Initially, JupUSD will be 100% collateralized by USDtb. That means every JupUSD token has equivalent backing in traditional financial instruments.

However, Jupiter plans to expand the collateral base. They want to add USDe as a secondary backing asset. Why? To boost yield potential for JupUSD holders.

This dual-collateral approach lets Jupiter balance stability with returns. USDtb provides rock-solid backing. Meanwhile, USDe could generate additional yield to pass along to users.

Technical Development Timeline

Jupiter’s team is building smart contracts for minting and redemption right now. These contracts will let users create new JupUSD by depositing collateral, or burn JupUSD to withdraw backing assets.

Multiple security audits are scheduled before launch. That’s crucial. Smart contract vulnerabilities have destroyed countless crypto projects. So Jupiter isn’t rushing this despite their year-end deadline.

The development approach shows maturity. Many projects announce first, build later. Jupiter reversed that order. They announced after development was already underway.

Why Jupiter’s Position Matters

Jupiter dominates Solana’s DeFi landscape. Their decentralized exchange aggregator routes trades across multiple liquidity sources to get users the best prices. Over time, they expanded into perpetual futures, lending, and other services.

That existing user base gives JupUSD instant distribution. Jupiter doesn’t need to convince people to try a new platform. They’re adding functionality to services users already trust.

The $3.58 billion in total value locked proves Jupiter can manage large amounts of capital safely. That track record matters when you’re asking users to trust a new stablecoin.

Moreover, Jupiter’s integration across Solana creates natural use cases. Trade on Jupiter using JupUSD. Lend it through Jupiter’s lending markets. Use it as collateral for perpetual positions. The ecosystem reinforces itself.

Stablecoin Market Competition

Jupiter enters a crowded market. USDT and USDC dominate with billions in circulation each. Newer entrants like Ethena’s USDe already carved out niches.

But Solana lacks a native stablecoin with Jupiter’s distribution power. Most stablecoins on Solana are bridged versions of tokens launched elsewhere. That creates friction and dependency on bridge security.

JupUSD could become the default stablecoin for Solana’s DeFi ecosystem. If Jupiter integrates it as the preferred trading pair and collateral asset, network effects kick in fast.

The BlackRock backing adds credibility traditional finance respects. That matters as crypto tries to attract institutional capital. A stablecoin backed by treasury funds feels safer than one backed by crypto-native assets alone.

Yield Potential and Risks

Adding USDe as secondary collateral introduces complexity. USDe generates yield through Ethena’s delta-neutral arbitrage strategies. That could provide attractive returns for JupUSD holders.

However, yield generation always carries risk. Delta-neutral strategies aren’t guaranteed to remain profitable. Market conditions change. Funding rates fluctuate. What works today might fail tomorrow.

Jupiter’s gradual approach makes sense. Launch with ultra-safe USDtb backing first. Prove the system works. Then slowly introduce yield-generating collateral as users gain confidence.

This mirrors how traditional finance operates. Build trust through conservative practices before taking calculated risks. The crypto industry could learn from this approach.

Regulatory Considerations

Stablecoins face increasing regulatory scrutiny globally. The U.S. Congress debated stablecoin legislation. Europe implemented MiCA regulations. Other jurisdictions watch closely.

Jupiter’s structure through Ethena Labs and BlackRock’s BUIDL fund suggests they considered compliance. Treasury-backed stablecoins align with regulatory preferences better than algorithmic or crypto-collateralized alternatives.

That said, regulations keep evolving. What’s acceptable today might require changes tomorrow. Jupiter will need to stay flexible and maintain compliance across jurisdictions.

The partnership with established institutions provides some regulatory cover. BlackRock understands compliance. Ethena Labs already navigated these waters. Jupiter benefits from their experience.

What This Means for Solana

Solana’s ecosystem keeps maturing. First came basic DeFi protocols. Then NFTs exploded. Now established players like Jupiter launch infrastructure projects like stablecoins.

That maturation attracts more capital and developers. Investors prefer ecosystems with robust infrastructure. JupUSD adds another piece to Solana’s DeFi stack.

The launch also validates Ethena’s multi-chain strategy. They started on Ethereum but expanded to support Solana projects. Success here could lead to more partnerships across different chains.

Finally, competition benefits users. More stablecoin options on Solana mean better rates, more features, and stronger incentives to attract liquidity.

Jupiter’s JupUSD launch represents calculated risk-taking backed by solid partnerships. The year-end timeline feels aggressive but achievable given their resources. Whether it succeeds depends on execution, security, and whether users embrace yet another stablecoin in an already crowded market.