A little-known privacy token on Solana just jumped 60% in 24 hours. Most traders had never heard of GHOST before this week.

What triggered the surge? GhostWareOS announced GhostSwap, a new cross-chain DEX that promises something Solana desperately lacks: real privacy. But digging deeper reveals a messier picture than the hype suggests.

GhostSwap Promises What Solana Can’t Deliver Alone

Solana is fast. It’s cheap. But it’s also completely transparent. Every transaction sits visible on-chain for anyone to analyze.

That’s where GhostWareOS steps in. The project bills itself as “Solana’s privacy layer,” offering anonymous payments and stealth transfers on a blockchain that otherwise exposes everything.

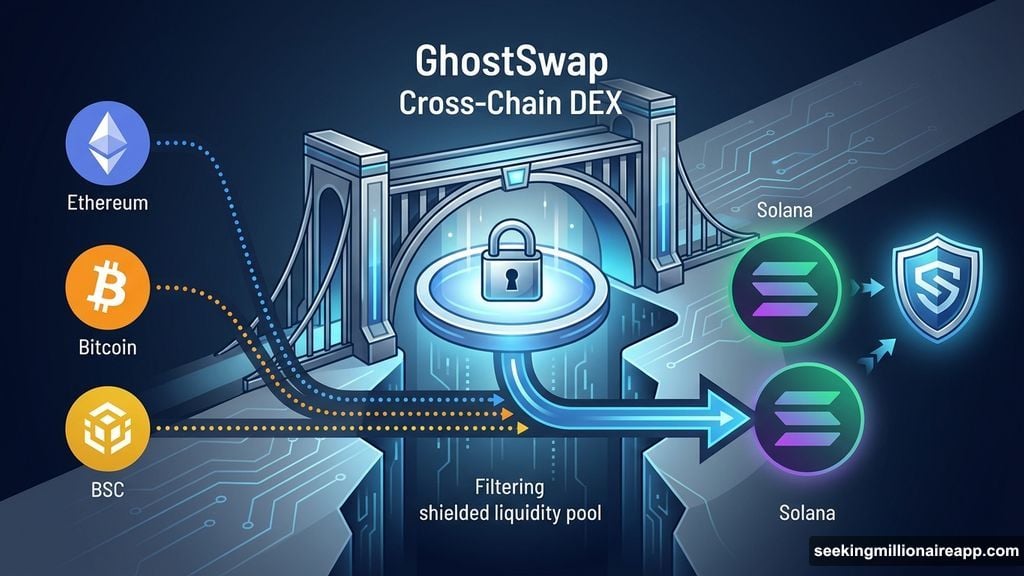

GhostSwap takes this concept further. The new product launches next week as a cross-chain bridge and DEX. Unlike normal bridges that leave clear transaction trails, GhostSwap claims it will break the link between deposits and withdrawals entirely.

Here’s how it works. Users swap assets from other blockchains into Solana. But instead of creating visible wallet connections, GhostSwap routes funds through shielded liquidity pools. The system uses atomic swaps to prevent anyone from tracing where money came from or where it’s going.

That’s the pitch anyway. Whether it delivers is another question.

GHOST Price Jumped on Product Hype, Not Proven Tech

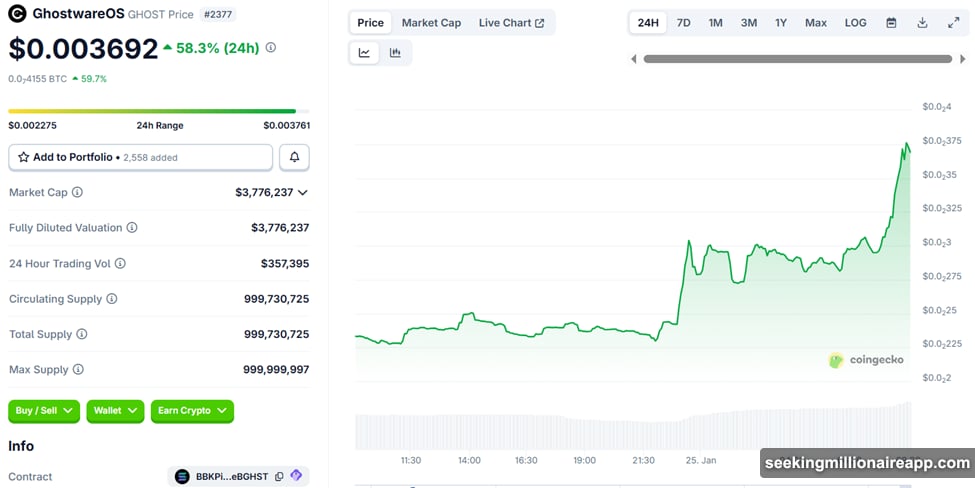

As of this writing, GHOST traded at $0.003692, up 58.3% in 24 hours. The token skyrocketed immediately after the GhostSwap announcement hit social media.

Traders piled in fast. Speculation spread that GhostWare is building a full privacy stack beyond just payments. But momentum like this often precedes reality by months or years.

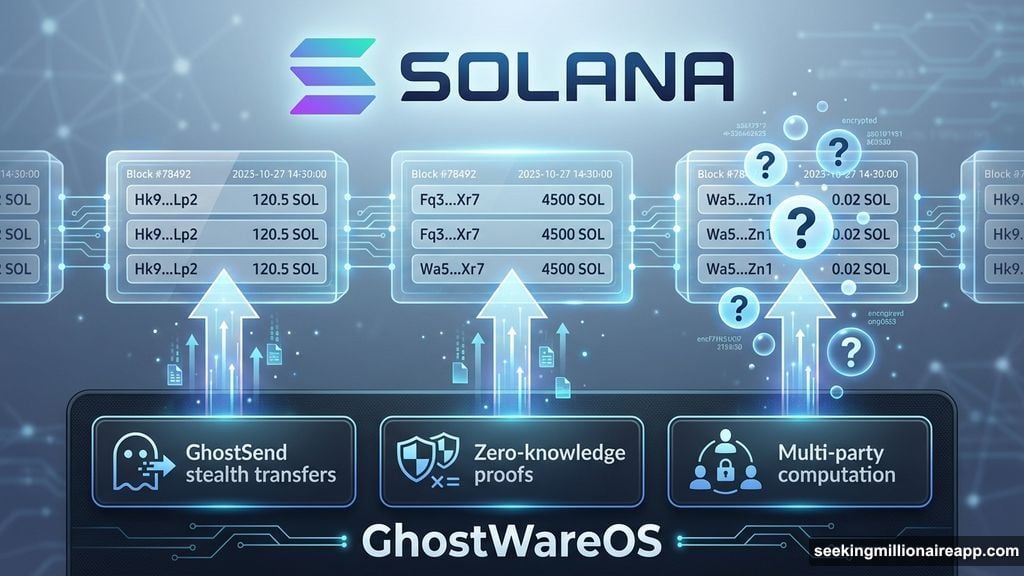

Moreover, the rally came after GhostWare published its 2026 roadmap on January 21. That document outlined ambitious plans including GhostSend for sender-initiated stealth transfers, enterprise payroll integrations, and partnerships with on-chain payment providers like Zebec.

The roadmap reads impressively. It promises multi-hop routing, metadata scrubbing, zero-knowledge proofs, and multi-party computation. These are serious privacy technologies when implemented correctly.

Yet none of this tech exists in production yet. The 60% pump reflects hope and speculation, not working products.

Solana’s Infrastructure Raises Serious Doubts

GhostWare’s biggest problem isn’t its vision. It’s the blockchain underneath.

Solana claims 65,000 transactions per second. Real-world performance tells a different story. Independent analysis shows Solana processes around 700-1,400 actual TPS under normal conditions. That’s still fast, but nowhere near the marketing claims.

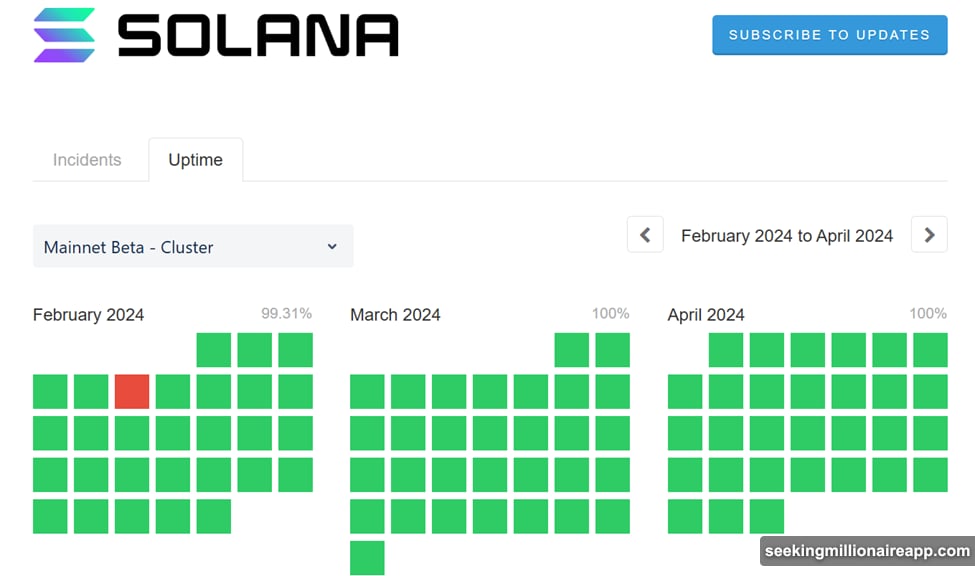

Plus, Solana has suffered seven major outages in five years. While the network stabilized through late 2025 and early 2026, those outages damaged trust. Privacy infrastructure requires rock-solid uptime. Users can’t afford their stealth payments getting stuck when the chain halts.

Then there’s the ZK verification challenge. Zero-knowledge proofs sound elegant in whitepapers. But they’re computationally expensive and prone to bugs in practice. Solana’s architecture wasn’t designed with ZK verification as a priority. Bolting privacy tech onto a speed-optimized chain creates technical debt.

Regulatory Crosshairs Target Privacy Cryptos

Beyond technical limits, GhostWare faces regulatory pressure that could kill the project before it scales.

Privacy coins attract scrutiny. Regulators worldwide are tightening rules around anonymous transactions. The EU’s MiCA framework, US Treasury guidance, and global AML standards all push against financial privacy tools.

GhostSwap’s cross-chain bridge functionality makes this worse. Authorities view bridges as money laundering risks. Adding privacy features on top creates a regulatory nightmare. One enforcement action could shut down GhostWare’s exchange partnerships or freeze liquidity pools.

The project markets itself for “humanitarian use cases” and “activist funding.” Noble goals. But those exact use cases trigger regulatory alarms. Governments don’t distinguish between activists and criminals when evaluating privacy tech.

So GhostWare is betting regulators will leave Solana’s privacy layer alone. History suggests that’s optimistic.

Enterprise Adoption Sounds Good But Faces Hurdles

GhostWare’s roadmap emphasizes enterprise integration. The team claims partnerships with Zebec for private payroll and unnamed NGOs for stablecoin remittances.

That sounds promising. Businesses need payment privacy for competitive reasons. Nonprofits operating in hostile regions need transaction anonymity for safety.

However, enterprises move slowly. They require legal certainty, audit trails, and compliance infrastructure. Privacy tools that hide everything create compliance headaches. Most companies won’t adopt GhostWare until regulators explicitly approve it.

Moreover, Solana’s enterprise adoption remains limited despite years of effort. If major corporations haven’t embraced transparent Solana transactions, why would they suddenly adopt shielded ones that carry regulatory risk?

The enterprise narrative helps justify GHOST’s valuation. But actual adoption will take years if it happens at all.

This Rally Follows a Familiar Crypto Pattern

Step back and the picture becomes clear. GHOST pumped 60% on announcement hype for products that don’t exist yet, built on infrastructure with known limitations, targeting use cases that face regulatory opposition.

This is textbook crypto speculation. Projects announce ambitious roadmaps. Traders pile in hoping for quick gains. Then reality arrives and prices crash.

That doesn’t mean GhostWare will fail. Privacy infrastructure on Solana solves real problems. The tech could work if executed well. But sustainable utility and hype-driven pumps are different things.

Smart traders know the difference. They’re probably taking profits now before momentum fades.

The 60% surge reflects excitement, not achievement. GhostSwap hasn’t launched yet. Enterprise partnerships aren’t signed. Zero-knowledge proofs aren’t implemented. Regulatory approval doesn’t exist.

Until those pieces fall into place, GHOST remains a bet on potential, not a proven privacy solution. And potential-based rallies rarely end well for late arrivals.