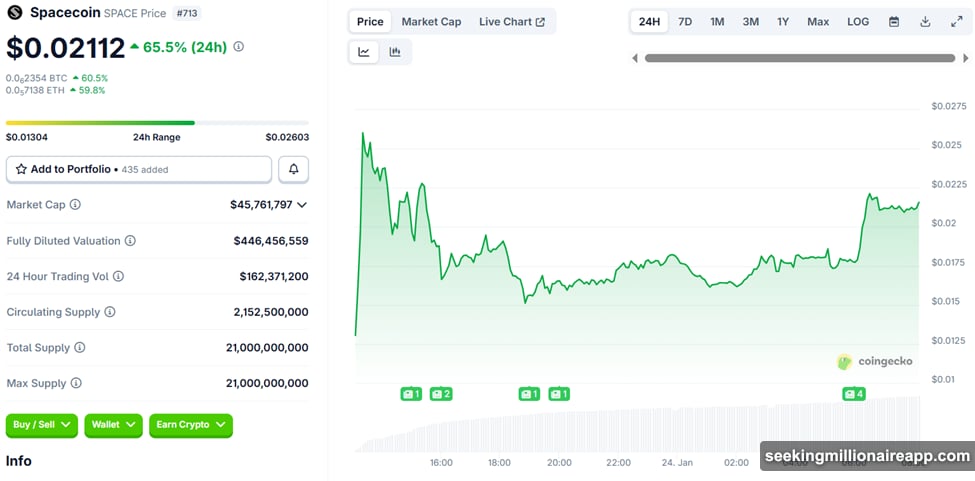

Spacecoin’s SPACE token exploded out of the gate with a 65% rally. The combination of Season 1 airdrop claims, extensive exchange listings, and multi-chain availability drove the initial frenzy.

But here’s the reality. Most airdrop-fueled launches follow a predictable pattern: massive hype, quick pump, then gradual bleed as recipients cash out. Nearly 90% of airdropped tokens fail within three months. So the big question isn’t whether SPACE can maintain this rally—it’s whether the project has enough substance to avoid that statistic.

Broad Exchange Access Fueled Day-One Momentum

SPACE went live across major centralized exchanges simultaneously. Binance listed it on both Alpha and Futures. Kraken added spot trading. OKX offered spot and perpetuals. Plus, KuCoin, MEXC, Bitget, Coinone, Blockchain.com, and Bybit all joined the launch.

This breadth of coverage is rare for new tokens. Most projects launch on one or two platforms and gradually expand. Instead, SPACE gained immediate access to deep liquidity pools and global trading audiences.

Decentralized options launched in parallel. PancakeSwap enabled swaps and liquidity provision. Moreover, Aster DEX sweetened the deal with a $150,000 ASTER reward pool and 15.75 million SPACE tokens for trading campaign participants.

The dual CEX-DEX strategy created multiple entry points for traders. That helped amplify price discovery and trading volume during the critical first 24 hours.

Season 1 Airdrop Targets Early Supporters

The airdrop focused on rewarding genuine community members who engaged before token generation. Eligible participants held specific assets like CTC, WCTC, or designated NFTs. They also completed social missions and event activities during the campaign period.

Spacecoin built in anti-abuse measures to exclude suspicious accounts. This approach aims to direct rewards toward real supporters rather than bot farms gaming the system.

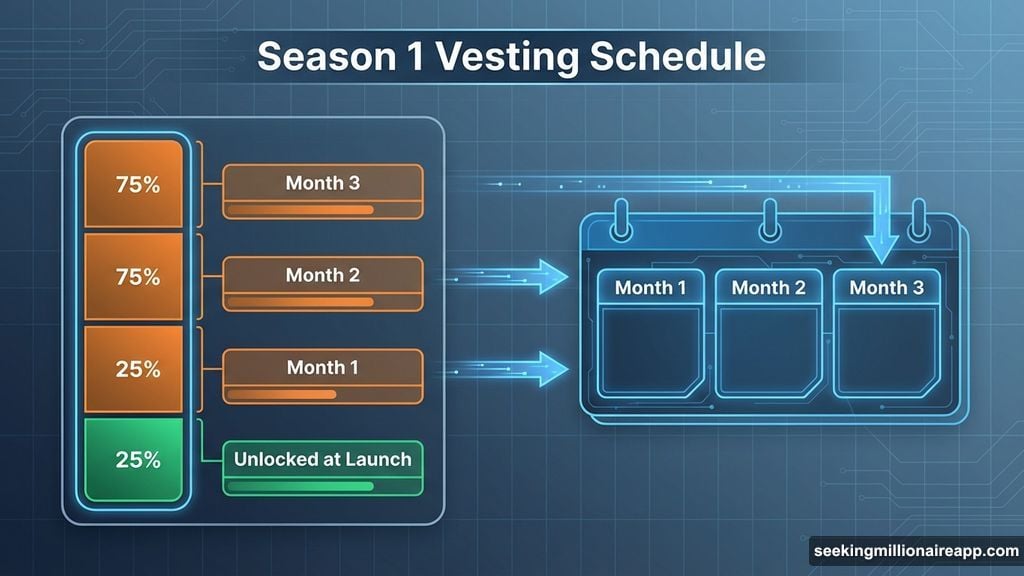

However, the vesting structure reveals potential pressure points. Season 1 recipients got 25% of rewards unlocked at launch. The remaining 75% vests monthly over three months. Season 2 follows similar phased schedules, though those allocations become visible later.

This partial unlock limits immediate supply dumps. Yet staggered releases still create predictable selling windows as recipients cash out vested tokens each month.

Cross-Chain Deployment and Staking Incentives

SPACE launched across multiple blockchain ecosystems simultaneously. Creditcoin serves as the primary network. But Ethereum, Binance Smart Chain, and Base also support the token through Wormhole-powered cross-chain transfers.

The multi-chain approach aligns with Spacecoin’s vision of building decentralized satellite internet without geographic barriers. It also creates flexibility for users to operate on their preferred blockchain.

Plus, Spacecoin introduced a limited-time staking program offering 10% APR for SPACE tokens on Creditcoin. This incentive encourages short-term holding instead of immediate selling.

To reduce friction during claims, Spacecoin distributed 0.01 CTC to eligible wallets. This covers gas fees, removing a common obstacle for smaller participants.

Airdrop Economics Create Predictable Challenges

High trading volumes on launch day often signal speculative froth more than sustainable demand. SPACE hit $0.026 before settling around $0.021—still up 65% but showing signs of profit-taking.

The vesting schedules help control supply. But they also create recurring sell pressure every month as new tranches unlock. Recipients who participated solely for free tokens will likely exit gradually across the vesting period.

Historical data isn’t encouraging. The vast majority of airdropped tokens lose momentum within three months. Early hype drives initial price action. Then reality sets in as speculators move to the next launch and airdrop farmers cash out.

Furthermore, the project’s fundamentals remain largely unproven. Spacecoin positions itself at the intersection of blockchain and satellite infrastructure. That’s an ambitious vision. But delivering on decentralized satellite internet requires capital, partnerships, and technical execution far beyond launching a token.

What Needs to Happen for SPACE to Survive

Spacecoin has solid short-term catalysts. Extensive exchange listings provide liquidity. Staking rewards incentivize holding. Anti-abuse measures filter out some bad actors.

Yet none of that guarantees long-term success. The project needs to demonstrate tangible progress toward its satellite internet vision. Partnerships with telecom providers, hardware deployments, or proof-of-concept networks would signal real development beyond token speculation.

Without those milestones, SPACE risks becoming another overhyped launch that bleeds value as vesting schedules unlock and airdrop recipients exit. The fundamentals might be strong. But right now, price action is driven by speculation and listing momentum—not proven utility.

Maintaining positive price structure through the first three months will be critical. That’s when most airdrop projects die. If Spacecoin survives that window with meaningful development updates, it has a chance. Otherwise, expect the typical airdrop lifecycle: pump, vest, dump, repeat.

The market will decide if this 65% rally marks the beginning of something real or just another token launch that couldn’t escape airdrop economics.