Regulators banned interest payments on stablecoins. Smart move to protect traditional banks. Terrible enforcement plan.

The prohibition appears in nearly every major jurisdiction. The GENIUS Act in the U.S. bans it. MiCA in Europe blocks it. Hong Kong and Singapore wrote similar rules.

But here’s the problem. The restriction assumes stablecoin issuers control what users do with their coins. They don’t.

Rewards That Look Like Interest

Some crypto exchanges already cracked the code. They don’t call it “interest.” Instead, they offer “rewards” that pay roughly the same rates.

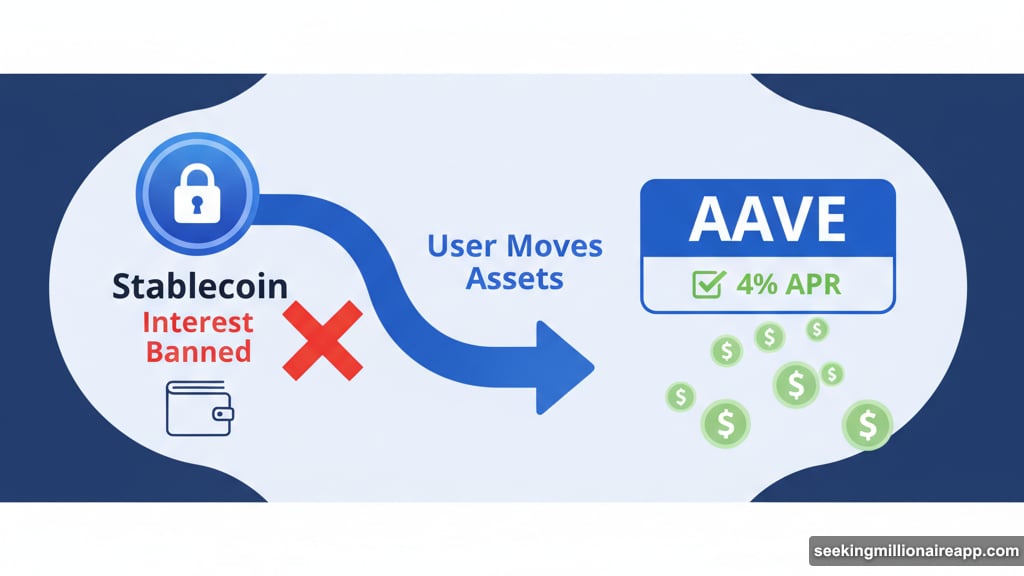

Plus, users can simply move assets into yield-bearing protocols like AAVE. Takes seconds. Some payment services automate the entire process.

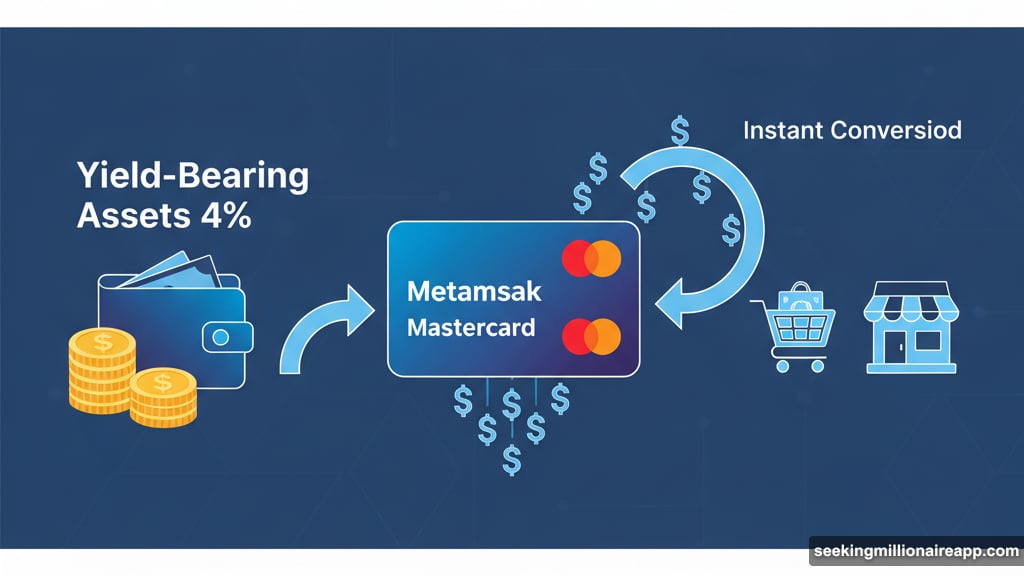

Take Metamask’s Mastercard debit card. It instantly converts your yield-bearing assets when you make a purchase. So you never stop earning returns. Your stablecoins just sit in DeFi earning 4% while you shop.

European regulators have broader powers under MiCA. They can crack down on rewards programs and automated portfolio tools. But enforcement gets messy fast.

Stablecoins Work Like Cash, Not Bank Deposits

Here’s why the ban won’t stick. Regulators classify stablecoins as “bearer assets.” That means they work like physical cash.

You own them completely. You control them fully. You move them wherever you want.

Bank deposits work differently. The bank maintains partial control over your funds. Regulators can restrict what banks do with deposits.

But regulators can’t stop you from plugging your stablecoins into DeFi protocols. Those protocols pay interest. And nobody needs permission from the stablecoin issuer to use them.

The Math Makes Workarounds Worth It

Current interest rates in the U.S. and Europe hover around 3-4%. Even small balances generate meaningful returns.

Take $1,000 earning 4% APR for 28 days. That’s $3.07 in interest. Transaction fees on efficient blockchains cost less than that.

So moving assets in and out of yield-bearing protocols makes financial sense. At least until interest rates drop back to zero.

That creates a new problem though. Imagine millions of users moving billions in stablecoins every month. Large liquidations when bills come due. Massive purchases when paychecks arrive.

Right now, onchain volumes remain small compared to traditional banking. But that’s changing fast.

Ethereum Already Handles The Volume

The Ethereum ecosystem processes about 400,000 complex DeFi transactions daily. Plus, Layer 2 networks provide enormous excess capacity.

In a few years, billions of automated transactions look completely feasible. Technology isn’t the bottleneck anymore.

If regulators somehow enforce the interest ban effectively, deposit tokens might benefit. JPMorgan Chase champions these as an alternative to stablecoins.

Deposit tokens represent claims on actual bank deposits. Since they’re tied to bank accounts, they can legally pay interest. But they come with restrictions.

JPMC’s pilot uses standard ERC-20 tokens. However, transfers only work between approved clients and partners. So you get yield but sacrifice the permissionless nature that makes crypto valuable.

This Fight Already Happened Once

Fights over bank deposit interest aren’t new. After the 1929 crash, the U.S. government banned interest on current accounts in the Banking Act of 1933.

That prohibition lasted until 1972. Then Consumer Savings Bank of Worcester, Massachusetts found a workaround. They created “Negotiable Order of Withdrawal” accounts. Basically savings accounts linked to checking accounts.

Within years, every bank offered similar products nationwide. Why did it take so long? Banks lacked the computer systems to automate the process.

No such barrier exists in blockchain. The technology to circumvent interest bans already works perfectly.

Why Repeat Past Mistakes?

The restriction on stablecoin interest looks easy to defeat. Automated tools already exist. DeFi protocols stand ready to accept deposits.

So why are regulators choosing to repeat history? Why not just let stablecoin providers pay interest like banks do?

Traditional banks worried about losing deposits to stablecoins. Fair concern. But prohibition creates messier outcomes than simple competition.

Users will find workarounds. Technology enables those workarounds instantly. And automated switching between stablecoins and yield protocols could destabilize markets more than direct interest payments ever would.

The smarter path seems obvious. Allow stablecoin interest. Regulate it properly. Let market forces determine who wins.

Instead, we’re setting up an enforcement nightmare that benefits nobody except DeFi protocol operators.