WSPN Checkout launched this week, and it’s the most unexciting blockchain news you’ll hear all month. That’s actually the point.

Stablecoins are finally growing up. Instead of volatile crypto speculation, they’re becoming basic payment plumbing. WSPN’s new platform lets online stores accept stablecoin payments from customers while settling in traditional currency through licensed payment processors. No drama, no hype, just infrastructure.

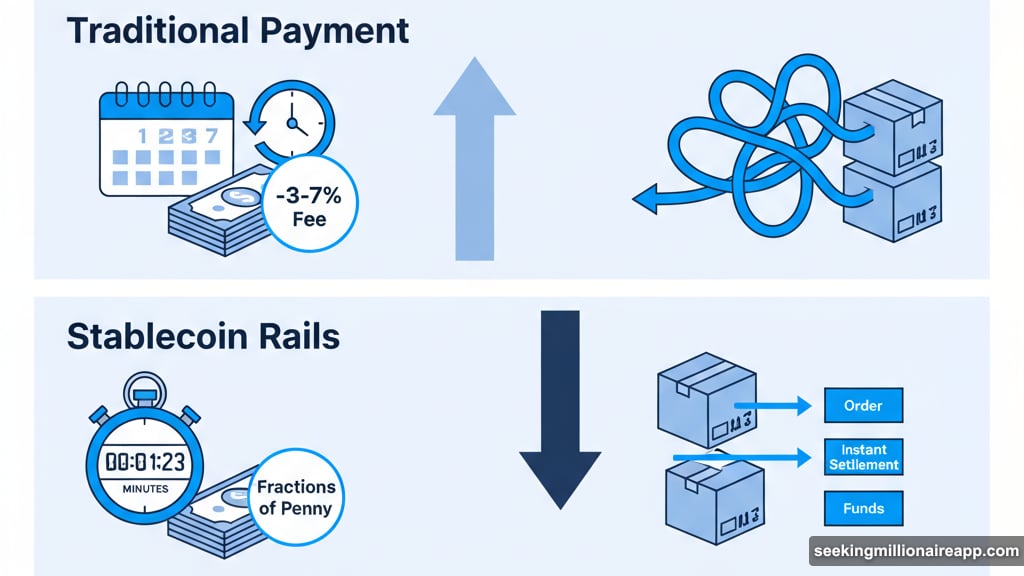

This matters because e-commerce payment systems are expensive and slow. Most merchants wait 3-7 days for cross-border settlements while paying 3-7% in fees. Meanwhile, currency fluctuations eat into already thin margins. WSPN Checkout aims to fix these headaches using blockchain rails without forcing merchants to care about blockchain.

The Productization Strategy Nobody’s Talking About

WSPN isn’t selling crypto dreams. They’re packaging stablecoins into boring financial products.

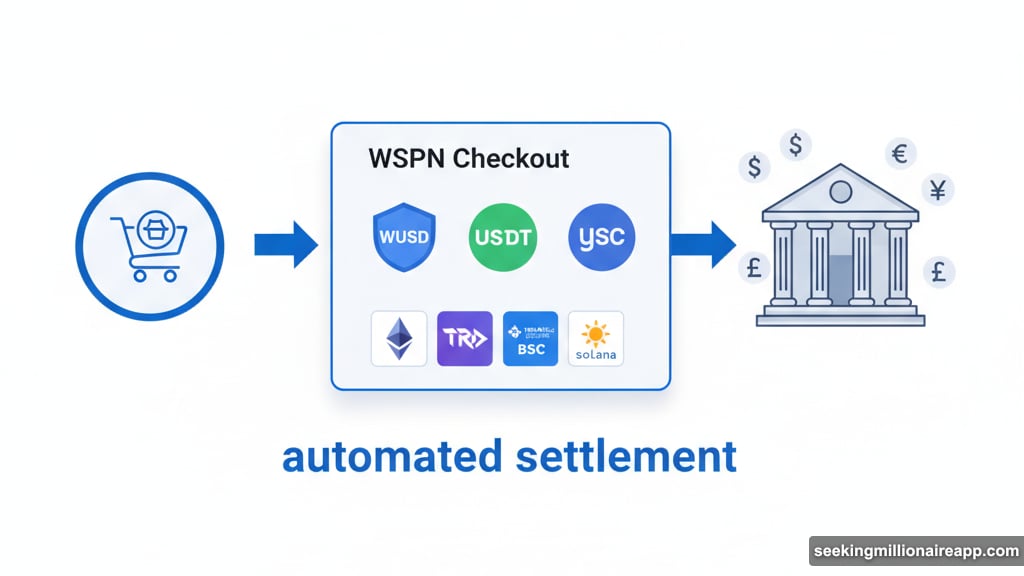

Think about it. Merchants don’t want revolutionary blockchain technology. They want payments that clear faster and cost less. So WSPN built exactly that—a checkout system that accepts WUSD, USDT, and USDC across Ethereum, TRON, BSC, and Solana networks while handling all the crypto complexity behind the scenes.

The platform includes automated settlement, reconciliation tools, and API integration. Plus, merchants can deploy it within seven business days. That’s faster than most traditional payment processor onboarding.

But here’s the clever bit. WSPN partners with licensed payment service providers to handle regulatory compliance and merchant acquiring. Stores get stablecoin payment benefits without navigating crypto regulation themselves. Smart.

Real-Time Settlement Changes Everything

Three to seven business days for payment settlement sounds normal. Until you realize how badly it constrains cash flow.

Small e-commerce businesses often can’t reorder inventory until previous sales settle. That creates a painful cycle where growth gets throttled by payment timing. Larger merchants face the same problem at scale—millions of dollars sitting in payment limbo.

Stablecoin rails solve this immediately. Transactions settle in minutes, not days. For businesses operating on tight margins, that’s transformative. More available capital means faster inventory turns, better supplier negotiations, and reduced need for expensive bridge financing.

Moreover, settlement speed compounds with cost savings. Traditional payment processors charge 3-7% per transaction. Blockchain networks charge fractions of a penny. Even accounting for conversion fees and partner margins, merchants save substantially.

The $5 Trillion Question

Market projections estimate stablecoin payments will reach $5 trillion by 2027. That’s aggressive but not absurd.

Stablecoins already process hundreds of billions in quarterly volume. Most of that happens in crypto trading and DeFi protocols. But as payment infrastructure matures, real-world commerce adoption accelerates. WSPN Checkout represents exactly this transition—moving stablecoins from speculative instruments to utility payments.

The 72% compound annual growth rate from 2021-2027 reflects this shift. Early adopters were crypto natives who understood blockchain mechanics. Now platforms like WSPN abstract away complexity, opening stablecoin payments to mainstream merchants who just want better settlement terms.

Still, challenges remain. Regulatory clarity varies wildly across jurisdictions. Consumer adoption lags behind infrastructure availability. Plus, most shoppers don’t hold stablecoins yet, limiting immediate payment volume. WSPN’s partnership strategy addresses this by enabling flexible settlement—customers can pay in stablecoins while merchants receive traditional currency.

Beyond E-Commerce

WSPN Checkout is just the beginning. The company plans to embed stablecoin technology across multiple scenarios including supply chain financing, treasury management, payroll, and remittances.

That makes sense. The same infrastructure that speeds up e-commerce payments works equally well for paying international contractors or managing corporate treasuries. Stablecoins shine anywhere traditional finance creates friction through slow settlement or high fees.

Take cross-border payroll. Companies hiring global talent often lose 5-10% to intermediary banks and currency conversion. Stablecoin rails bypass those intermediaries entirely. Workers receive payment faster while employers pay less in fees. Both sides win.

Treasury management presents another opportunity. Companies holding cash across multiple currencies face constant exchange rate risk. Stablecoins pegged to dollars provide stable value while maintaining blockchain’s programmability benefits. Finance teams can automate complex payment flows that would require manual intervention in traditional banking.

The Compliance Moat

WSPN’s partnership with licensed payment service providers isn’t just regulatory box-checking. It’s their competitive advantage.

Crypto payment startups usually take two paths. Either they ignore regulation and risk shutdown, or they spend years obtaining licenses in every jurisdiction. WSPN chose a third option—partner with entities that already have licenses. This lets them move fast while maintaining compliance.

For merchants, this matters enormously. Accepting payments through unlicensed providers creates legal liability. Even if technology works perfectly, regulatory uncertainty keeps enterprises away. WSPN’s licensed partnership model removes this barrier. Merchants get cutting-edge payment infrastructure with traditional regulatory protection.

Plus, WUSD itself maintains full dollar backing and 1:1 peg transparency. That’s table stakes for enterprise adoption. Companies won’t accept stablecoins without verified reserves and clear redemption mechanisms. WSPN provides both.

What This Actually Means for Online Stores

Forget blockchain buzzwords. Here’s the practical impact for e-commerce merchants.

First, faster access to revenue. Sales settle within minutes instead of days. That improves cash flow immediately. Second, lower transaction costs. Blockchain rails cost significantly less than traditional payment networks. Third, reduced currency risk for international sales. Stablecoins eliminate exchange rate uncertainty.

But implementation requires careful consideration. Merchants must evaluate whether their customer base holds stablecoins. Early adopters in crypto-adjacent verticals—gaming, digital goods, tech services—will see highest adoption. Traditional retail may need more time.

Moreover, treasury management becomes more complex. Receiving stablecoin payments means deciding whether to hold them or convert immediately to fiat. That creates new operational questions around timing, conversion strategies, and accounting treatment.

Still, for merchants struggling with slow settlements and high fees, WSPN Checkout offers a compelling alternative. The seven-day deployment timeline lowers barriers to experimentation. Companies can test stablecoin acceptance without massive upfront investment.

The Infrastructure Bet

WSPN’s strategy reflects a broader market shift. Crypto is maturing from speculative asset to financial infrastructure.

This transition isn’t glamorous. Nobody writes breathless headlines about payment plumbing. But infrastructure determines which innovations actually scale. Bitcoin proved blockchain works. Ethereum demonstrated programmability. Now stablecoins are enabling practical applications beyond speculation.

WSPN Checkout succeeds if merchants adopt it without caring about underlying blockchain technology. That’s the real test—does this solve merchant problems better than existing solutions? If yes, adoption follows regardless of whether merchants embrace crypto culture.

The coming years will determine whether stablecoins become standard payment rails or remain a niche instrument. WSPN is betting on standardization. They’re building boring infrastructure for everyday commerce. If that sounds unexciting, you’re getting the point.

Post Title:

Meta Description: