The Federal Reserve’s latest proposal could reshape how crypto companies access U.S. payment systems. And stablecoin issuers might be the biggest winners.

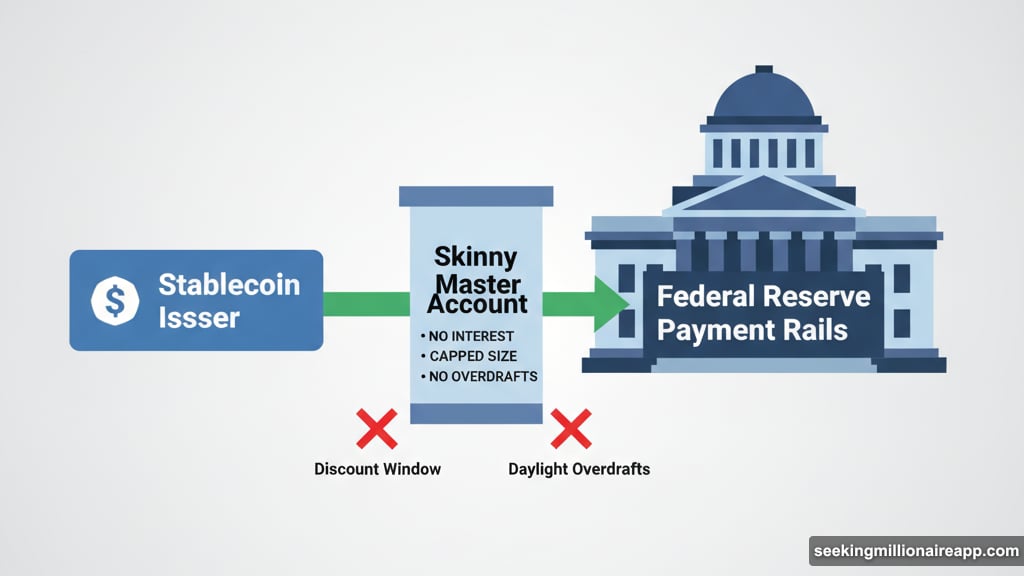

Fed Governor Christopher Waller unveiled a “skinny master account” concept this week. The idea? Give crypto firms direct access to Fed payment rails without the full privileges of traditional banks. That’s a potential game-changer for companies that have spent years trying to get through the Fed’s front door.

What Actually Changes

Traditional Fed master accounts grant banks complete access to the central bank’s infrastructure. Waller’s skinny version strips out the extras.

Here’s what crypto firms would get: Direct connection to Fed payment rails. That means faster settlements and no middleman bank taking a cut.

But there are serious limitations. These skinny accounts wouldn’t earn interest on balances. The Fed would cap account sizes. Plus, firms couldn’t access daylight overdrafts or discount window borrowing. If your balance hits zero, payments stop cold.

Think of it like having a debit card instead of a credit line. You can only spend what you have. No borrowing privileges whatsoever.

Why Stablecoin Firms Win Big

Stablecoin issuers already operate like narrow banks. They hold fully-backed reserves and facilitate payments without lending money. So the skinny account limitations? Not really limitations for them.

Linda Jeng from Digital Self Labs pointed out the obvious connection. Stablecoin companies don’t need lending capabilities. They just need reliable payment infrastructure.

Currently, stablecoin volumes hit $19.4 billion year-to-date in 2025. That’s massive growth for an industry still working through intermediary banks. Direct Fed access would eliminate friction and reduce costs dramatically.

Moreover, the GENIUS Act doesn’t currently grant stablecoin issuers direct Fed access. Waller’s proposal fills that gap perfectly. It would integrate these firms into the U.S. monetary system while maintaining Fed oversight.

The Custodia Problem Gets Solved

Companies like Custodia have fought for years to access Fed master accounts. The traditional approval process remains opaque and slow. Multiple firms have applications pending with no clear timeline.

Meanwhile, these companies need banking relationships to function. They pay intermediary banks for access to payment systems. Those costs get passed to customers.

Skinny master accounts would bypass that entire mess. Approved firms get direct Fed access through a streamlined process designed specifically for payment-focused crypto businesses.

Former World Bank President David Malpass sees this as crucial for dollar dominance. “There’s a global competition for market share in stablecoins,” he said at a recent payments summit. Direct Fed access would help U.S.-based stablecoin issuers compete internationally.

What the Fed Gains

Waller’s proposal isn’t just about helping crypto firms. The Fed gets something valuable too: control.

Right now, stablecoin growth happens largely outside Fed supervision. Billions flow through these systems with limited central bank oversight. That creates systemic risk concerns.

Skinny master accounts would pull stablecoin activity into Fed view. The central bank could monitor payment volumes in real-time. It would gain tools to manage potential crises before they spread.

Plus, balance caps and zero-interest policies limit Fed balance sheet exposure. The central bank maintains control over how much crypto activity touches its infrastructure.

That’s smart regulatory design. Give the industry what it needs while maintaining guardrails.

Implementation Timeline Uncertain

Waller called this a “prototype idea” during his speech at the Fed’s Payments Innovation Conference. Translation: Don’t expect immediate changes.

The Fed will engage stakeholders and examine potential drawbacks. That process typically takes months, possibly years. Financial regulators move deliberately, especially when creating new account categories.

However, Waller said “you will be hearing more about this shortly.” That suggests internal discussions are already progressing. The Fed wouldn’t float trial balloons without some preliminary work done.

Still, expect a lengthy comment period. Traditional banks will likely push back. They benefit from their intermediary role with crypto firms. Direct Fed access threatens that revenue stream.

Global Competition Heats Up

While the U.S. debates skinny master accounts, other countries are moving faster. Kyrgyzstan just launched a national stablecoin pegged to its Som currency. The country also legally recognized its central bank digital currency.

That’s aggressive crypto infrastructure development from a relatively small economy. Larger nations are watching closely.

The U.S. maintains stablecoin dominance through USDT and USDC. Both are dollar-pegged and widely used globally. But that dominance isn’t guaranteed forever.

European regulators are developing comprehensive crypto frameworks. Asian countries are experimenting with digital currencies. The U.S. needs infrastructure that keeps dollar-backed stablecoins competitive.

Waller’s proposal addresses that competitive pressure. It gives U.S. firms advantages while maintaining regulatory oversight. That balance could determine whether dollar stablecoins remain the global standard.

Narrow Banking Returns

Jeng’s comparison to narrow banks reveals deeper implications. The narrow banking concept has floated around financial circles for decades.

Traditional banks take deposits and make loans. That creates systemic risk through maturity transformation. Narrow banks would only facilitate payments using fully-backed reserves.

Regulators have consistently rejected narrow banking proposals. They worry about disrupting traditional banking models and reducing credit availability.

But stablecoin issuers already function as de facto narrow banks. They exist outside traditional banking frameworks. Waller’s proposal acknowledges that reality instead of fighting it.

This could open doors for other narrow banking applications. Once the Fed creates infrastructure for payment-only accounts, other firms might qualify. That would represent a significant shift in U.S. banking philosophy.

Risk Controls Matter

The Fed’s proposed limitations aren’t arbitrary. They protect both the central bank and the broader financial system.

Zero interest on balances discourages using skinny accounts as savings vehicles. These accounts exist for payment processing, not investment. No interest means no incentive to park large sums long-term.

Balance caps limit how much exposure the Fed has to any single firm. If a stablecoin issuer fails, the Fed’s losses are capped. That’s crucial for maintaining central bank independence and financial stability.

No overdraft access prevents firms from leveraging Fed credit. Traditional banks can borrow during the day and settle later. Skinny account holders can’t. That removes systemic risk from Fed infrastructure.

These limitations make skinny accounts viable politically. Congress and traditional banks can’t claim the Fed is giving crypto firms unfair advantages. The playing field remains different by design.

What Comes Next

Watch for the Fed to release formal proposals in coming months. Those documents will include specific eligibility requirements and operational details.

Stablecoin lobbying groups will push for broad access. Traditional banks will advocate for strict limitations. The final rules will reflect compromise between these positions.

Meanwhile, stablecoin growth continues regardless. Payment volumes keep climbing. More companies launch dollar-backed tokens. The market isn’t waiting for regulatory clarity.

Waller’s proposal acknowledges that reality. The Fed can either integrate stablecoin activity into its systems or watch it grow outside regulatory reach. Integration makes more sense from both oversight and competitiveness perspectives.

The skinny master account concept represents practical problem-solving. It’s not perfect. But it addresses real issues facing both the crypto industry and financial regulators. That’s progress worth watching.