The GENIUS Act turned stablecoins from regulatory gray zone into legitimate financial infrastructure. And the numbers prove companies are paying attention.

Stablecoins could handle 10% of global transactions by 2030. That’s $4.2 trillion in annual value moving through digital tokens pegged to the dollar. No longer a crypto curiosity, these assets are becoming essential plumbing for modern finance.

But here’s what matters most. The regulatory clarity everyone demanded finally arrived. So now the question shifts from “are stablecoins legal?” to “how fast can we deploy them?”

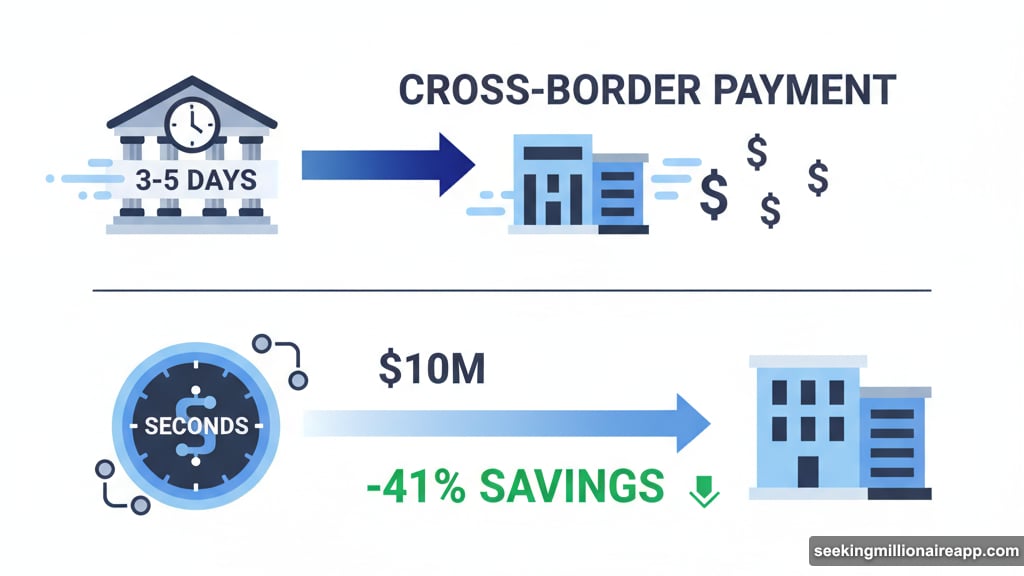

Cross-Border Payments Drive Real Savings

Companies using stablecoins for international transfers report serious cost cuts. In fact, 41% save more than 10% compared to traditional wire transfers.

Think about that number. A company moving $10 million monthly across borders saves over $1 million annually just by switching payment rails. Plus, the money arrives in seconds instead of days.

Three benefits drive adoption across the board. Lower transaction costs top the list, obviously. But speed and improved liquidity matter almost as much. Traditional cross-border payments lock up capital for days during settlement. Stablecoins settle instantly.

Trade tariff uncertainty makes this even more valuable. When import costs jump unexpectedly, companies need faster ways to move money and negotiate terms. Stablecoins deliver that flexibility.

Moreover, 100% of surveyed financial institutions already knew about stablecoins before the GENIUS Act passed. This wasn’t education—it was waiting for permission.

Banks Finally Have Their Roadmap

Only 15% of financial institutions currently offer stablecoin services. Yet 57% are actively building plans to launch offerings.

What’s driving the rush? Client demand. Over half of banks cite customer requests as the primary motivator for exploring stablecoin infrastructure.

Most banks are taking a practical approach. Instead of building everything in-house, 53% plan hybrid models combining internal systems with vendor partnerships. Another 46% expect to rely on third-party wallet providers for custody.

The motivations mirror what corporations already discovered. Faster settlement times and cost reduction each attracted 65% of bank respondents. But 59% also see new revenue opportunities, and 52% view stablecoins as competitive differentiation.

Here’s the interesting part. Only 16% of all institutions plan to issue their own stablecoin. Most banks prefer providing on-ramp and off-ramp services—converting between traditional money and digital tokens—rather than creating new currencies.

That makes sense. Issuing a stablecoin means maintaining reserves, handling redemptions, and managing regulatory compliance. Providing infrastructure for existing stablecoins is simpler and less risky.

GENIUS Act Changes the Reserve Game

The legislation requires stablecoins to be backed by real-world assets. In practice, that means U.S. Treasuries become the primary reserve backing.

This creates a fascinating circular effect. More stablecoin adoption means more demand for Treasury bonds. That demand strengthens the dollar’s position as the global reserve currency. Which in turn makes dollar-pegged stablecoins more attractive internationally.

Current stablecoin market cap sits around $300 billion. That’s up 66% in just 12 months. And Tether alone represents 60% of that total, mostly backed by short-term Treasury bills.

Now multiply that by projected growth. If stablecoins reach $2 trillion in value by 2030, the Treasury reserve requirement could create hundreds of billions in new government debt demand.

That’s not speculation. It’s basic math about how reserve-backed tokens work at scale.

What Took So Long

Before GENIUS Act passage, 73% of respondents cited regulatory uncertainty as their biggest concern. Companies wanted to adopt stablecoins but couldn’t justify the legal risk.

Traditional payment systems may be slow and expensive. But they’re also predictable and clearly regulated. Stablecoins offered better economics but unclear legal status.

The GENIUS Act removed that blocker. Now institutions know the rules. They understand reserve requirements, redemption rights, and compliance obligations.

Plus, the framework legitimizes stablecoins without crushing innovation. Companies can experiment with different business models while staying within clear boundaries.

Early adopters already proved the technology works. PayPal moved $27 trillion in payment volume during 2024. Stablecoins handled slightly more—$27 trillion—in the same period. That parity signals stablecoins aren’t fringe anymore.

The Real Competition Starts Now

With regulatory clarity settled, the focus shifts to execution. Which banks will build the best infrastructure? Which stablecoins will dominate corporate usage? How will traditional payment networks respond?

USDC and Tether currently dominate. But dozens of competitors are launching with GENIUS Act compliance baked in from day one. Some will offer better yields. Others promise superior transparency or faster settlement.

Traditional payment giants won’t sit idle either. Visa and Mastercard already tested stablecoin settlement. Swift explored blockchain integration. These established players have distribution advantages that pure crypto startups can’t match.

So the next 18 months determine market structure. Early movers gain network effects. But established players bring trust and existing relationships.

Two Risks Nobody Talks About

First, stablecoins create new concentration risk. If one issuer dominates and faces problems, the entire market could freeze. Remember when Silicon Valley Bank collapsed? The fear of stablecoin de-pegging during that crisis briefly paralyzed crypto markets.

Second, stablecoins depend entirely on trust in reserves. The GENIUS Act mandates transparency. But verifying reserves at scale remains difficult. Audit standards, proof-of-reserves protocols, and real-time reporting still need refinement.

These aren’t reasons to avoid stablecoins. They’re just honest acknowledgments that this technology is still maturing. The infrastructure works. But edge cases and stress tests will reveal weaknesses over time.

What Financial Advisors Should Know

Clients will start asking about stablecoins for international transactions, portfolio diversification, and yield opportunities. Understanding how these assets work matters for providing competent advice.

Stablecoins aren’t investments in the traditional sense. They’re utility tokens designed to maintain 1:1 parity with the dollar. But they enable access to decentralized finance protocols that may offer yields above traditional savings accounts.

The risk profile sits between cash and money market funds. Properly regulated, fully reserved stablecoins should be extremely safe. But operational risks, smart contract vulnerabilities, and issuer credit risk all exist.

For now, stick with the largest, most transparent issuers. USDC from Circle and USDT from Tether dominate for good reason—they have the deepest liquidity and longest track records.

Just remember that “stable” doesn’t mean “guaranteed.” These are private liabilities, not FDIC-insured deposits. Treat them accordingly.