Coinbase just dropped a report that flips the banking industry’s biggest fear on its head. Stablecoins aren’t stealing deposits from American banks. They’re actually extending US dollar dominance to corners of the world traditional banking can’t reach.

Wall Street banks have been sounding alarms for months. They warn that stablecoins will drain trillions from their deposit bases. But Coinbase argues these concerns miss what’s actually happening on the ground.

The data tells a different story than the one banks are selling.

Who Actually Uses Stablecoins

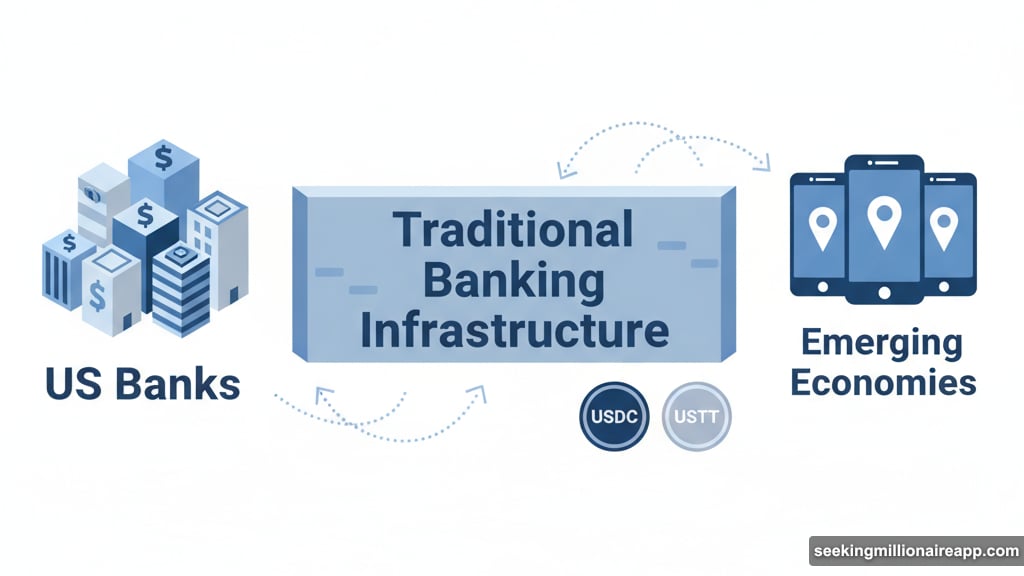

Here’s what banking lobbyists won’t tell you. Most stablecoin demand comes from outside the United States.

International users dominate the market. They’re not Americans hunting for better interest rates. Instead, they’re people in emerging economies seeking basic dollar access.

Why does this matter? Because traditional banking infrastructure simply doesn’t serve these users well. Local currencies face constant depreciation. Banking systems remain inadequate or inaccessible. So stablecoins fill a gap that US banks never bothered to address.

Faryar Shirzad, Coinbase’s Chief Policy Officer, put it bluntly on X. “The ‘stablecoins will destroy bank lending’ narrative ignores reality,” he wrote. Plus, he noted that stablecoins are “doing for payments what money market funds did for savings: forcing innovation through competition.”

That comparison hits hard. When money market funds emerged, banks screamed about deposit flight. Sound familiar? Yet the banking system adapted and survived. Moreover, competition drove genuine improvements in how banks served customers.

The $6.6 Trillion Scare Tactic

Banking associations love throwing around scary numbers. The American Bankers Association, Bank Policy Institute, and Consumer Bankers Association all cite the same figure. They claim stablecoins could drain $6.6 trillion from US banks.

That number comes from an April US Treasury Department study. But here’s what they don’t mention. The study assumed stablecoins would enable universal interest payments to all users. Then it calculated maximum theoretical deposit outflow under that extreme scenario.

However, reality works differently. The GENIUS Act, passed in July, already prohibits interest payments on payment-focused stablecoins. So that doomsday scenario can’t happen under current law.

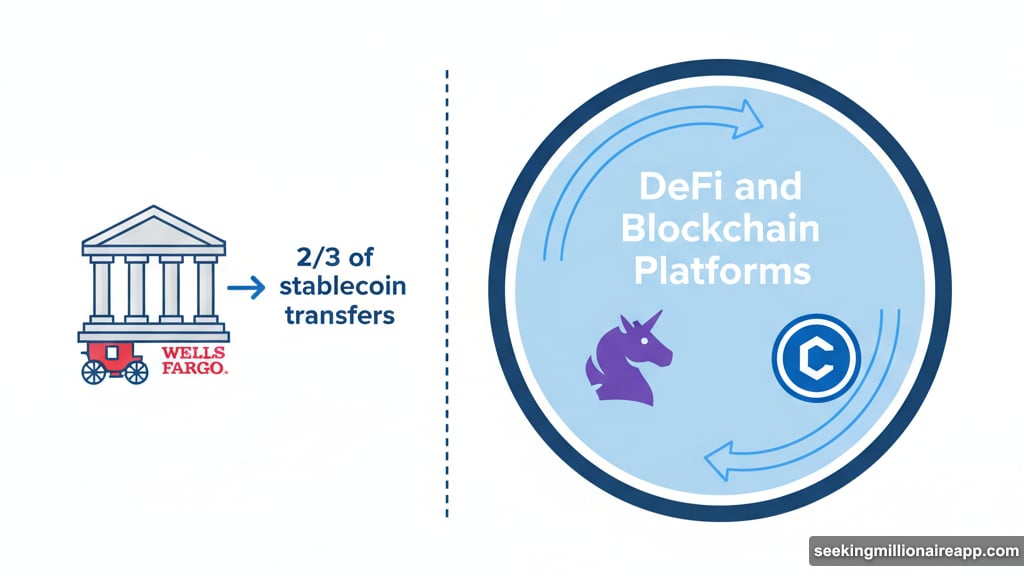

Furthermore, Coinbase’s analysis reveals something crucial. About two-thirds of stablecoin transfers occur within DeFi and blockchain platforms. These transactions happen in a parallel financial system. They’re not competing directly with traditional bank deposits.

Think about it. Someone using USDC to trade on Uniswap isn’t choosing between that and a Wells Fargo savings account. They’re accessing financial services that traditional banks don’t even offer.

A Parallel Financial System Emerges

Stablecoins create something genuinely new. Not a replacement for banking, but a parallel infrastructure.

This matters for US competitiveness. While American banks lobby against stablecoins, other countries race to build digital payment systems. China pushes its digital yuan aggressively. Europe develops its own stablecoin frameworks. India experiments with central bank digital currencies.

Meanwhile, US-backed stablecoins like USDC and USDT already dominate global crypto markets. They extend dollar usage to populations that traditional banking systems can’t or won’t serve.

Shirzad emphasized this strategic angle. “Stablecoins strengthen the dollar’s global role and unlock competitive advantages that the US shouldn’t constrain,” he argued. Plus, he added that banks “could improve their services with stablecoins” rather than treating them as threats.

Consider what stablecoins enable. Faster cross-border payments. Programmable money that executes automatically. 24/7 settlement without bank holidays. Lower fees for remittances.

These aren’t theoretical benefits. Millions of users already rely on stablecoins for real financial needs. Families in Latin America receive remittances in USDC to avoid high transfer fees. Businesses in Africa use stablecoins to preserve value against local currency inflation. Traders globally use them as stable assets for crypto transactions.

Banks Fear Competition, Not Collapse

Here’s the uncomfortable truth banks won’t admit. They don’t fear deposit flight. They fear having to compete.

Traditional banking hasn’t innovated meaningfully in decades. Wire transfers still take days and cost $30. International payments remain expensive and slow. Banks close at 5 PM and stay shut on weekends.

Then stablecoins arrive offering instant, cheap, 24/7 transactions. No wonder banks feel threatened. But that’s market competition, not an existential crisis.

History backs this up. When money market funds emerged in the 1970s, banks made identical arguments. They warned about deposit flight and credit crunches. Yet banks adapted. They improved offerings. The financial system became more efficient.

Shirzad’s comparison to money market funds wasn’t casual. It highlights how financial innovation typically plays out. Incumbents resist. Regulators craft sensible rules. Eventually, competition drives everyone to serve customers better.

What Regulators Should Do

Smart regulation can address legitimate concerns without killing innovation. The GENIUS Act already set important guardrails. It prevents stablecoins from directly competing with bank deposits through interest payments.

But policymakers should recognize stablecoins’ strategic value. They extend dollar dominance globally. They enable financial inclusion. They drive payment innovation. These benefits serve US interests.

So rather than restricting stablecoins to protect banks’ existing business models, regulators should ensure stablecoins operate safely and transparently. That means strong reserve requirements. Clear redemption rights. Regular audits. Consumer protections.

Yet it doesn’t mean forcing stablecoins to look exactly like bank deposits. Different tools serve different purposes. Stablecoins excel at things banks struggle with. Banks excel at things stablecoins can’t do. Both can coexist and strengthen the overall financial system.

The Bigger Picture

Banking lobbyists frame stablecoins as a threat. But step back and the real picture emerges.

Stablecoins extend American financial infrastructure globally. They make dollars accessible to billions who lack traditional banking. They position the US to lead in digital finance while China and other rivals push their alternatives.

Plus, they force banks to innovate. Faster payments. Lower fees. Better service. That’s healthy competition, not a crisis.

The choice facing policymakers is clear. Protect incumbent banks from competition. Or embrace tools that strengthen dollar dominance and serve global users better.

Coinbase argues convincingly for the second path. Banks survived money market funds. They’ll survive stablecoins too. And the US financial system will emerge stronger and more competitive.

The only losers? Banks that refuse to adapt. But that’s how markets work. Innovation doesn’t wait for permission from incumbents who prefer the status quo.