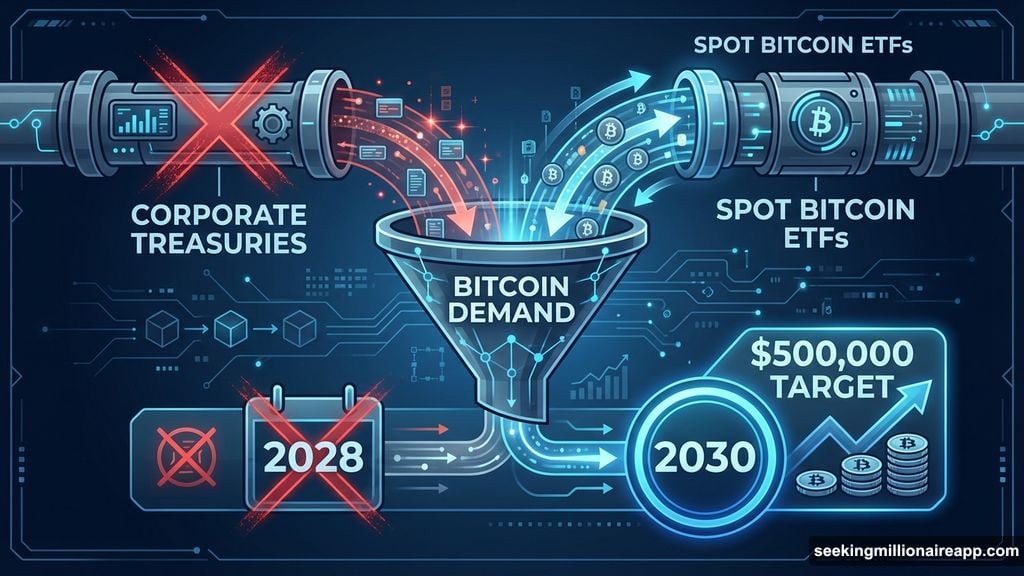

Standard Chartered just pulled the plug on its aggressive Bitcoin predictions. The banking giant cut its long-term price targets and pushed its $500,000 forecast back two years. The reason? A massive buyer category disappeared.

Corporate treasury buying is basically over. That’s not speculation. It’s the bank’s official stance. And without those billion-dollar institutional purchases propping up demand, Bitcoin’s next phase looks a lot more fragile.

The Corporate Buyer Problem

Digital asset treasury companies led Bitcoin’s charge in 2024. These firms raised capital specifically to buy BTC and hold it on corporate balance sheets. They became predictable, aggressive buyers that absorbed supply consistently.

Now those purchases have stopped. Geoff Kendrick, Standard Chartered’s Head of Digital Asset Research, says valuations no longer support further expansion. The metric these companies use to justify buying, mNAV (market value to net asset value), doesn’t work anymore at current prices.

So these firms aren’t selling their holdings. But they’re not buying either. That matters because corporate treasuries provided a steady bid that helped drive Bitcoin from $40,000 to over $100,000. Without them, the market lost a crucial support mechanism.

ETFs Carry the Weight Alone

Bitcoin’s future now rests entirely on ETF inflows. That’s a much narrower foundation than most investors realize.

The spot Bitcoin ETFs launched in January 2024 pulled in billions during their first months. But inflows have slowed considerably. Plus, ETF buyers behave differently than corporate treasuries. They react to broader market conditions, pull back during volatility, and lack the conviction of companies building long-term Bitcoin positions.

Kendrick notes that ETF buying is “likely to be slower than earlier expected.” Translation: Don’t expect the explosive growth rates Bitcoin saw when both ETFs and corporate treasuries were buying simultaneously.

Standard Chartered still believes portfolio managers remain underweight Bitcoin compared to optimal allocations. But shifting institutional money takes time. Investment committees move slowly. Due diligence processes stretch for months. So even if the long-term thesis holds, the path there got longer and bumpier.

New Price Targets Reflect Reality

Standard Chartered pushed its $500,000 Bitcoin target from 2028 to 2030. That’s a two-year delay that reflects the loss of corporate buying momentum.

The bank also lowered its year-end forecasts for 2026 through 2029, though it didn’t publish specific numbers in this update. The message is clear: Bitcoin’s upside trajectory flattened considerably.

Kendrick insists this isn’t a crypto winter. He calls it “just a cold breeze.” But that feels like splitting hairs when you’re delaying moon predictions by 24 months.

Bitcoin currently trades around $94,000 after breaking a week-long stagnation period. That’s roughly 36% below its October peak of $147,000. Standard Chartered argues this drawdown fits historical patterns rather than signaling structural collapse. Previous pullbacks since ETF launches showed similar magnitude.

The Halving Cycle Myth

Standard Chartered explicitly rejects the traditional halving narrative. Many Bitcoin maximalists point to the April 2024 halving as the catalyst for the next bull run. The theory says reduced supply always drives prices higher 12-18 months post-halving.

Kendrick dismisses this framework entirely. “We do not share the view that the halving cycle is still valid,” he stated. Instead, he believes ETF demand dynamics now dominate price action more than supply-side mechanics.

That’s a significant departure from crypto conventional wisdom. If halving cycles no longer predict Bitcoin’s trajectory, then the roadmap most investors use for timing entries and exits just became obsolete.

What This Means for Your Portfolio

Bitcoin isn’t crashing. But its next growth phase will likely be slower and more dependent on traditional finance infrastructure than crypto natives prefer to admit.

The loss of corporate treasury buying removes a unique demand source that didn’t care about price volatility or market sentiment. Those buyers had multi-year mandates and bought through drawdowns. ETF investors don’t have that same conviction or time horizon.

So expect choppier price action and longer consolidation periods. The explosive rallies driven by coordinated corporate buying probably won’t repeat. Instead, Bitcoin needs to grind higher on the back of gradual institutional adoption through ETFs.

That’s not necessarily bearish. It’s just different. And slower. Standard Chartered still expects Bitcoin to reach $500,000 eventually, driven by portfolio rebalancing as institutions recognize their underweight positioning relative to gold.

But “eventually” now means 2030 instead of 2028. In crypto terms, that’s an eternity. Adjust your expectations accordingly.