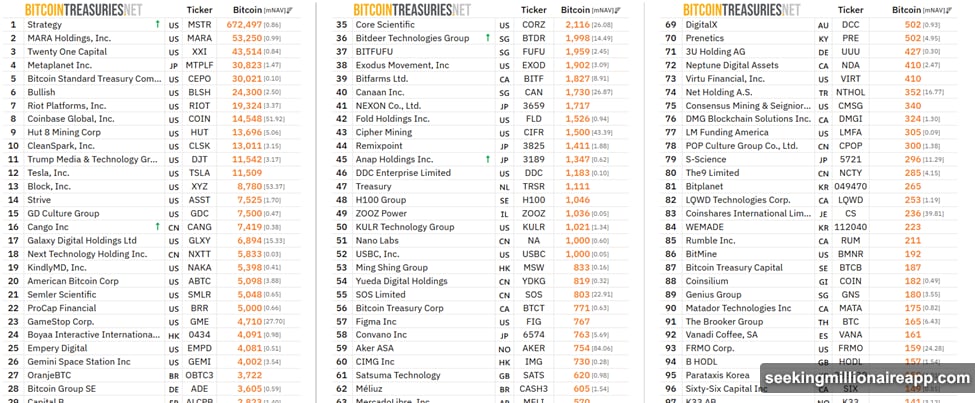

Strategy owns more Bitcoin than any public company on Earth. They’ve stacked 672,497 BTC worth roughly $50 billion. Sounds impressive until you dig into the actual returns.

Gold advocate Peter Schiff just threw cold water on Strategy’s massive Bitcoin accumulation. His complaint? The numbers don’t match the hype. Five years of buying Bitcoin delivered just 16% paper profits. That’s barely 3% per year on average.

Meanwhile, Tom Lee’s BitMine takes a different path. They’re loading up on Ethereum instead, now holding over 4 million ETH tokens. Two diverging strategies. Both betting big on crypto. But which approach actually works?

Strategy Keeps Stacking Sats Despite Criticism

Last week, Strategy bought another 1,229 BTC for $108.8 million. They paid an average price of $88,568 per coin. That brings their total haul to 672,497 Bitcoin acquired at an average cost of $74,997 each.

Strategy reports a 23.2% Bitcoin yield for 2025 so far. But zoom out to five years and the picture changes. Their unrealized profit sits at $8.31 billion, which equals roughly 16% total gain over that period.

Here’s where Schiff pounces. He argues that 16% over five years translates to about 3% annually. Traditional assets crushed those returns during the same timeframe. Stocks, bonds, even gold outperformed on a risk-adjusted basis.

“Strategy would have been much better off had they bought just about any other asset instead of Bitcoin,” Schiff wrote. He’s framing the Bitcoin bet as inefficient capital allocation, questioning whether the opportunity cost justified the strategy.

Still, Strategy keeps buying. They haven’t sold a single Bitcoin. This reflects conviction that BTC serves as a superior long-term store of value, regardless of short-term comparisons to other assets.

BitMine Goes All-In on Ethereum Holdings

While Strategy doubles down on Bitcoin, Tom Lee’s BitMine Immersion takes the Ethereum route. Last week alone, BitMine purchased 44,463 ETH for roughly $130 million.

BitMine now holds 4,110,525 Ether tokens valued at $12.02 billion. That represents 3.41% of Ethereum’s total supply. Plus, they’ve staked an additional 408,627 ETH through their upcoming MAVAN staking solution launching in Q1 2026.

BitMine’s total holdings reach $13.2 billion when you add cash and other investments. Major players back them. Cathie Wood’s ARK, Founders Fund, Pantera, Galaxy Digital, and Kraken all invested. Personal backer Tom Lee adds another vote of confidence.

The company trades heavily too. Average daily volume hits $980 million, ranking #47 among 5,704 listed US stocks. BitMine built serious liquidity fast.

Their annual stockholder meeting happens January 15, 2026 at the Wynn Las Vegas. Key proposals aim to hit their “Alchemy of 5%” strategic plan for ETH accumulation. BitMine targets $1 million per day in Ethereum staking yield once MAVAN launches.

The Real Question: Which Strategy Wins?

Two giant public companies. Two different crypto bets. Strategy accumulates Bitcoin. BitMine loads Ethereum. Both companies signal institutional confidence in digital assets.

But Schiff’s critique exposes the tension. Holding for long-term gains sounds great. Yet investors also need to evaluate actual performance versus alternatives. A 3% annual return looks weak when the S&P 500 averaged double-digit gains during the same period.

Strategy’s approach reflects belief that Bitcoin’s value proposition extends beyond near-term returns. They view BTC as protection against monetary inflation and currency debasement. Traditional return metrics might miss this point entirely.

BitMine’s Ethereum bet carries different assumptions. They’re banking on staking rewards and Ethereum’s role in DeFi and smart contracts. Their MAVAN staking solution targets consistent yield generation, not just price appreciation.

Neither strategy guarantees success. Bitcoin could surge and vindicate Strategy’s patience. Or it could stagnate, proving Schiff right about opportunity cost. Ethereum might dominate smart contract platforms and reward BitMine’s conviction. Or competing chains could erode ETH’s market position.

What the Numbers Actually Tell Us

Strip away the tribal narratives and focus on facts. Strategy holds $50 billion in Bitcoin with 16% unrealized gains over five years. BitMine holds $12 billion in Ethereum with aggressive staking plans launching soon.

Both companies raised massive capital from sophisticated institutional investors. ARK, Pantera, Galaxy, Founders Fund, Kraken—these aren’t retail gamblers. They bet serious money on crypto exposure through public companies.

Yet Schiff’s math checks out too. A 3% average annual return looks underwhelming compared to traditional asset classes during a bull market for stocks and even gold. Strategy’s opportunity cost might exceed their gains if Bitcoin doesn’t surge from current levels.

BitMine’s staking approach adds another variable. If MAVAN delivers the promised yield, BitMine generates consistent income regardless of ETH price action. That could offset weak price performance in ways Strategy’s buy-and-hold approach cannot.

The broader institutional crypto debate continues. Some players favor Bitcoin’s digital gold narrative. Others bet on Ethereum’s smart contract ecosystem. A few diversify across multiple chains. Nobody knows which approach wins over the next decade.

Both Strategy and BitMine demonstrate institutional appetite for crypto exposure. Whether that appetite proves wise depends on execution and market conditions nobody can predict with certainty.