Crypto and stocks shot higher after the US Supreme Court blocked Trump’s sweeping global tariffs. The ruling landed on February 20, 2026, and markets responded almost instantly.

The court found that Trump overstepped his authority. Specifically, he used emergency powers to impose broad tariffs without getting Congress to sign off first. That move, the justices decided, was unconstitutional. So now Congress gets that power back.

Trade Uncertainty Just Got Wiped Off the Board

Tariffs work like taxes on imported goods. When businesses face unpredictable tariff threats, they slow hiring, delay investments, and pass costs onto consumers. That uncertainty had been hanging over markets for months.

The Supreme Court’s decision removes that specific threat entirely. Any future tariffs of similar scope now need explicit congressional approval. That’s a much higher bar and a much slower process than a presidential executive order.

For investors, this means fewer sudden policy shocks. Markets hate surprises more than almost anything else. So fewer surprise tariffs means more stability, and more stability means more confidence to buy risk assets.

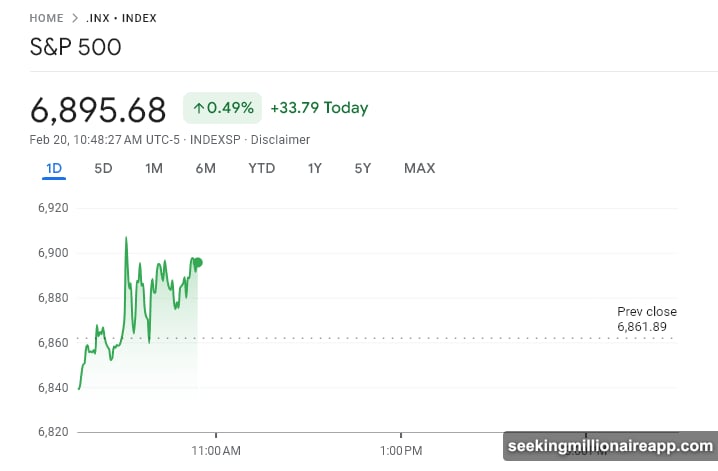

Stocks Climbed Fast on the News

The S&P 500 gained about 0.40% following the ruling. The Nasdaq did even better, climbing roughly 0.70%. Technology stocks led the charge, which makes sense given that tech supply chains are heavily exposed to international trade.

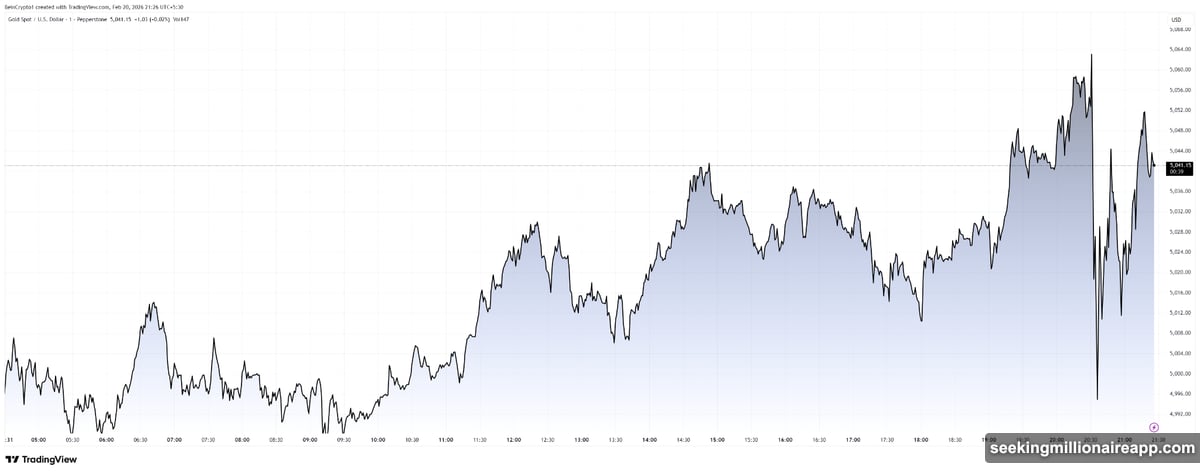

Meanwhile, gold briefly dipped before recovering. That’s a classic signal. When fear drops, investors move out of safe-haven assets and back into riskier ones. Gold going down while stocks go up is basically the market saying, “We feel better now.”

Both moves confirm the same story: investors see this ruling as genuinely good news for economic stability.

Bitcoin and Crypto Turned Green Too

The global crypto market cap climbed to about $2.38 trillion following the announcement. Bitcoin was trading near $67,000 after a stretch of recent volatility.

This makes a lot of sense when you think about how crypto actually behaves. Bitcoin and other digital assets are extremely sensitive to global liquidity conditions and investor confidence. When macroeconomic fear rises, capital flows out of risky assets. When it fades, that capital flows right back in.

Reduced tariff risk lowers inflation expectations. Lower inflation expectations support looser monetary conditions. Looser conditions mean more liquidity floating around in the system. And more liquidity tends to find its way into crypto.

Plus, two of Trump’s own appointed justices voted to block the emergency-powers framework. That detail matters. It suggests the legal case for these tariffs was genuinely weak, not just a close partisan call.

What the Ruling Means Going Forward

This decision reshapes how US trade policy gets made, at least for now. Presidents can no longer unilaterally impose sweeping global tariffs through emergency declarations. Congress needs to be involved.

That slows the process considerably. But for markets, slower and more predictable trade policy is generally better than fast and chaotic. Businesses can plan. Investors can model scenarios. Supply chains can stabilize.

For crypto specifically, the removal of this macro threat is straightforwardly positive. Geopolitical risks absolutely still exist. Global trade tensions haven’t vanished overnight. But one of the biggest near-term unknowns just got resolved in the most market-friendly way possible.

The recovery in both crypto and equities following the ruling suggests investors had been pricing in serious tariff risk. Now that risk is gone, and asset prices are adjusting to reflect that new reality. Whether this momentum holds depends on what comes next out of Washington, but for today at least, markets got the outcome they were hoping for.