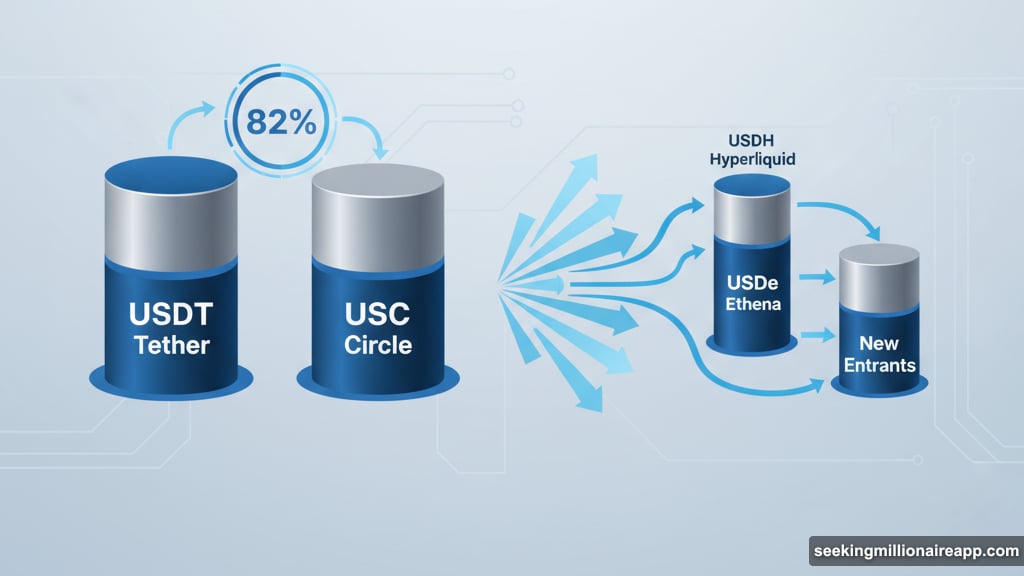

The two giants controlling 82% of the stablecoin market face unprecedented threats. From unexpected competitors to regulatory pressure, their dominance isn’t looking as permanent as it once did.

For years, Tether’s USDT and Circle’s USDC seemed untouchable. First-mover advantages, exchange partnerships, and massive liquidity kept challengers at bay. But Stablecoin Summer changed everything. Now the duopoly faces attacks from all sides.

Ecosystem players want their cut of reserve revenue. Regulators demand compliance that threatens core business models. Banks and fintech giants prepare to enter the market. The question isn’t whether Tether and Circle will face competition anymore. It’s whether they can survive it.

Exchanges Are Turning on Their Creators

Centralized exchanges built the stablecoin giants. Coinbase gave Circle its 50% revenue share from USDC reserves. Binance and Bitfinex did similar work for Tether. That symbiotic relationship just ended.

Hyperliquid fired the opening shot. The decentralized exchange held $5.97 billion in USDC deposits by July 2025. That’s nearly 10% of total USDC supply. At a conservative 4% return, Circle earned roughly $240 million annually from those reserves alone.

Hyperliquid wanted that money. So they launched USDH, their own compliant stablecoin, in partnership with Native Markets. Circle’s response was immediate: they deployed native USDC on HyperEVM and invested directly in HYPE tokens to maintain their position.

But the damage was done. Other platforms saw the playbook and followed suit.

Binance partnered with Ethena Labs to integrate USDe stablecoin deeply into their platform. Users can now earn rewards on USDe holdings, including within portfolio margin for futures trading. The initial 12% APR offer drove over $2 billion in USDe deposits to Binance.

Moreover, USDe’s total market cap jumped from $6 billion in January to $14 billion by October. That growth came directly from USDT and USDC market share. Bybit saw similar results after integrating USDe, with usage actually surpassing USDC on their platform.

The pattern is clear. Platforms that previously acted as distribution channels now want to become issuers. They control user relationships and can offer better yields by keeping reserve revenue in-house.

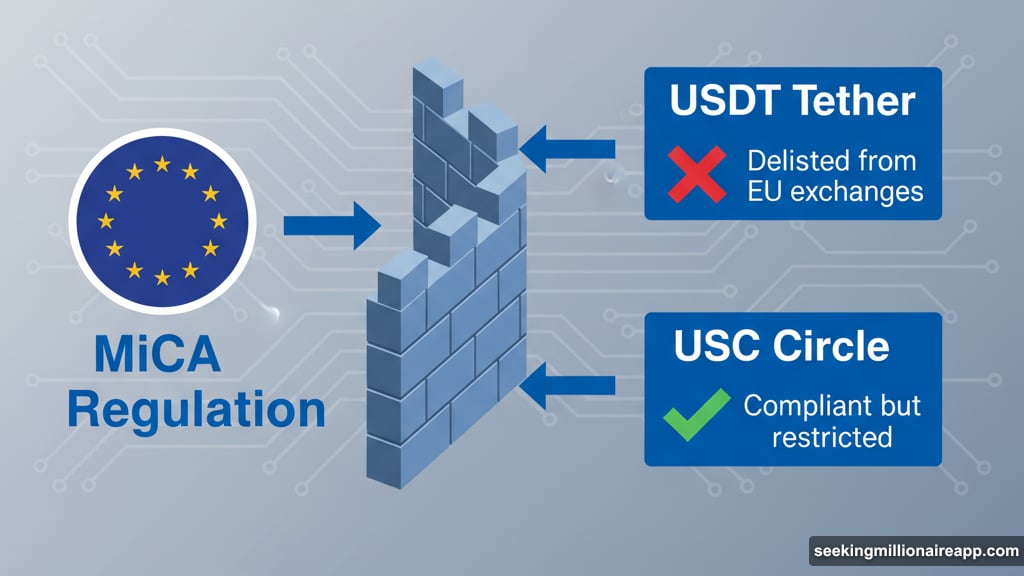

Regulatory Walls Are Closing In

Europe’s MiCA regulation forced Tether to make a choice. Comply with restrictions or abandon the market. Tether chose to leave. CEO Paolo Ardoino called the regulation too restrictive and dangerous.

As a result, European centralized exchanges delisted USDT. Users lost vital on- and off-ramps. Tether’s Europe exposure was relatively small, but the precedent matters. When major markets demand compliance, you either adapt or exit.

Circle complied with MiCA. But compliance came with costs. Under the regulation, USDC classifies as an e-money token. That means Circle cannot legally pay yield to EU holders. The value proposition weakens when users can’t earn returns.

Meanwhile, the US GENIUS Act threatens similar disruptions. In its current form, Tether’s USDT is non-compliant. That means US exchange delistings similar to Europe. Stablecoins also cannot directly pay holders interest under the proposed framework.

Banks are lobbying to extend the ban to all reward programs. If successful, that eliminates one of the main competitive advantages newer stablecoins leverage to win market share.

Tether responded by launching USA₮, their US-compliant offering issued by Anchorage Digital. Former White House crypto advisor Bo Hines leads it as CEO. The move hedges their bets: maintain profitable offshore USDT while adding regulated USA₮ for compliant markets.

But splitting products dilutes network effects. Users and platforms now need to choose between versions. Liquidity fragments. Integration complexity increases. These problems benefit challengers with simpler, unified offerings.

Banks and Fintechs Are Entering the Fight

Bank of America confirmed plans to launch a dollar-backed stablecoin. So did Citigroup. JPMorgan Chase and Wells Fargo are actively exploring similar initiatives. These aren’t crypto startups with regulatory uncertainty. They’re established financial institutions with existing compliance infrastructure.

PayPal already launched their stablecoin. Revolut and Robinhood prepare to follow. These fintech giants bring massive user bases and seamless fiat integration. They don’t need centralized exchanges as on-ramps because they are the on-ramps.

The competitive dynamics shift dramatically when banks enter. They access lower-cost capital than Circle or Tether. Regulatory compliance is part of their core business, not an added burden. Customer acquisition costs approach zero when you already bank hundreds of millions of users.

Plus, banks want to prevent deposit flight. When stablecoin reward programs offer significantly higher returns than savings accounts, customers move money. Banks have strong incentive to compete directly rather than lose deposits.

This explains their lobbying against reward programs. If those programs stay legal, banks need to offer competitive yields. If they succeed in banning rewards, banks can launch stablecoins without matching high returns that eat into margins.

Market Share Is Already Slipping

Numbers tell the story clearly. On January 1, 2025, USDT and USDC controlled 88% of the $181 billion stablecoin market. By October 9, the total market grew 50% to $313 billion. But the duopoly’s share fell to 82%.

That 6% decline represents roughly $19 billion in market cap that went to competitors instead. In absolute terms, Tether and Circle still grew. But their growth rate lagged the overall market significantly.

USDe climbed from $6 billion to $14 billion market cap in ten months. Paxos’s USDG gained ground through exchange partnerships. Smaller players collectively captured meaningful share.

The trend line matters more than the current numbers. If competition continues intensifying while regulations fragment the market, that 6% decline could accelerate. Network effects work in reverse too. When platforms and users diversify stablecoin holdings, the dominant players lose pricing power and partnership leverage.

Can Tether and Circle Adapt Fast Enough?

Both companies recognize the threats. Recent executive hires signal urgency. Regulated product launches in Europe and the US show willingness to comply where necessary. Strategic partnerships and technical integrations demonstrate they understand the need to evolve.

But adaptation faces limits. Their core business model depends on earning reserve revenue themselves. That model breaks when major distribution partners become competitors. Regulatory compliance reduces profitability and constrains product flexibility.

Meanwhile, challengers attack with focused advantages. Native blockchain stablecoins like USDH offer seamless integration for specific ecosystems. Bank-issued stablecoins provide trust and regulatory certainty. Yield-bearing stablecoins like USDe attract users with better returns.

Tether and Circle must defend against all these threats simultaneously. They need to maintain exchange partnerships while those same exchanges launch competing products. They need regulatory compliance without sacrificing the features users value. They need to match competitor yields while facing the same interest rate environment.

That’s an incredibly difficult position. Success isn’t impossible, but it requires perfect execution across multiple fronts. One misstep accelerates market share loss.

The stablecoin market entered a new phase. Dominance no longer flows from being first or biggest. It comes from adapting fastest to fragmented, competitive conditions. Tether and Circle have resources and experience. Whether that’s enough remains the defining question of 2025.