Tether just confirmed plans for one of crypto’s biggest fundraising rounds ever. The stablecoin giant wants to raise up to $20 billion. That would value the company at roughly $500 billion.

Yes, you read that right. Half a trillion dollars for a company that makes digital tokens pegged to the dollar.

CEO Paolo Ardoino confirmed the news after Bloomberg broke the story. He said Tether is talking with “high-profile key investors” about the deal. But here’s what makes this interesting beyond the eye-popping numbers.

Why This Matters Right Now

Tether issues USDT, the world’s largest stablecoin. Over $172 billion worth circulates across crypto markets. That’s more than twice the size of its closest competitor, Circle’s USDC.

Stablecoins act as the backbone of crypto trading. They let people move money between exchanges without touching traditional banking. Plus, they’ve become crucial for international payments and remittances.

So Tether’s valuation reflects its dominant position in this infrastructure. The company essentially runs the plumbing for a huge chunk of crypto activity.

The timing also matters. President Trump’s pro-crypto stance changed the regulatory landscape. Tether, which faced years of scrutiny, is now planning a major U.S. expansion. The company recently named a CEO for its new U.S. division called USAT.

That division will operate under the GENIUS Act, new legislation designed to regulate stablecoins domestically. In other words, Tether is betting big on a friendlier American market.

The Deal Structure Sounds Unusual

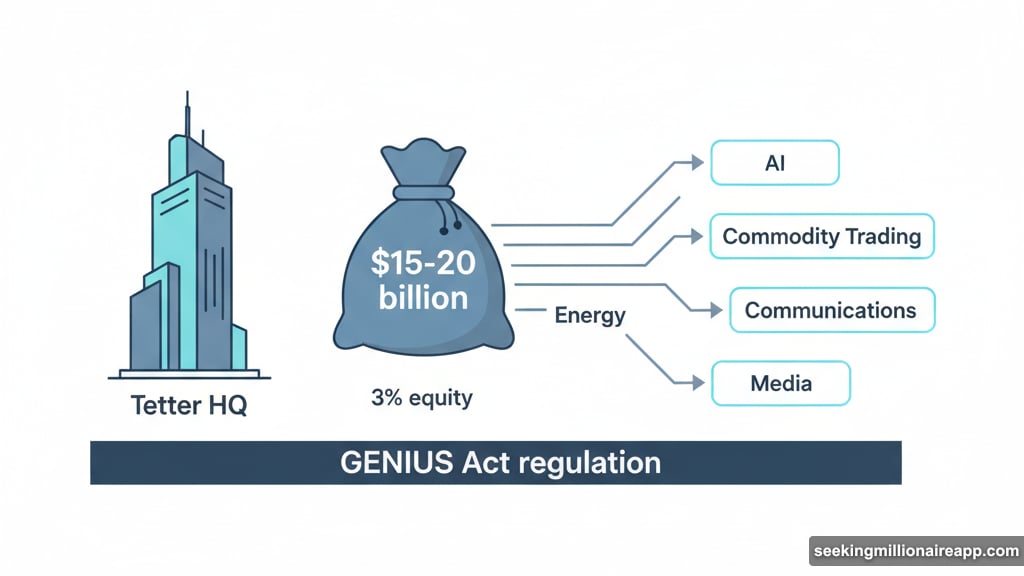

Bloomberg’s sources say Tether wants $15-20 billion for roughly 3% of the company. That’s a private placement deal, not a traditional funding round.

Here’s the math. If they sell 3% for $15 billion, that values the whole company at $500 billion. That puts Tether in rarified air alongside SpaceX and surpassing OpenAI’s recent $300 billion valuation.

But there’s a catch. The talks are still early. One source warned that details could change significantly. The final amount raised and stake sold might look completely different.

Moreover, this involves issuing new equity rather than existing investors cashing out. That matters because it means the money goes directly to Tether for expansion rather than enriching early backers.

Ardoino said the funds would “maximize the scale” of Tether’s strategy across multiple business lines. He specifically mentioned AI, commodity trading, energy, communications, and media alongside their core stablecoin business.

Wait, what? AI and commodity trading? That’s quite a leap from issuing dollar-pegged tokens.

Tether’s Empire Building Plan

Tether has been quietly expanding beyond stablecoins for years. The company invests in energy projects, particularly Bitcoin mining operations. It also dabbles in communications infrastructure and media ventures.

Now they want to scale these efforts dramatically. The fundraising would give them cash to pursue acquisitions and build new products across these sectors.

Think of it like this. Tether generates massive revenue from its stablecoin operations. They hold Treasury bills and other assets backing USDT, earning interest on those holdings. That creates a steady profit stream.

But the stablecoin business has limits. There’s only so much demand for USDT. So Tether is using its war chest to build a diversified empire.

The AI mention is particularly interesting. Every major tech company is pouring money into artificial intelligence right now. Tether apparently wants a piece of that action too.

Whether this strategy makes sense is debatable. Some investors might prefer Tether focus on its core stablecoin business. Others might see the diversification as smart risk management.

The Valuation Raises Questions

Here’s where things get tricky. Is Tether really worth $500 billion?

For context, that’s more than Goldman Sachs, Morgan Stanley, or Charles Schwab. It’s roughly equal to Visa’s market cap. Those are massive, established financial institutions with decades of history.

Tether, meanwhile, faced years of controversy. Regulators accused the company of misleading investors about its reserves. It paid an $18.5 million settlement to New York regulators in 2021. The company also faced questions about its ties to crypto exchange Bitfinex.

Now Tether publishes regular attestations of its reserves. Independent accountants verify the company holds enough assets to back every USDT token. That transparency helped rebuild trust.

Still, $500 billion seems aggressive. Even bull case valuations for stablecoin issuers typically land far below that number. Circle, Tether’s main competitor, raised money at a much lower valuation before going public through a SPAC deal (which later fell apart).

So what explains the sky-high number? A few possibilities emerge.

First, private market valuations don’t always reflect realistic values. Investors sometimes pay premium prices to get into hot deals. They’re betting on future growth rather than current fundamentals.

Second, Tether’s profitability might justify the valuation. The company reportedly generates billions in annual profit from interest on its reserves. If those profits grow as stablecoin adoption increases, the valuation might make sense.

Third, the diversification strategy could add value. If Tether successfully builds businesses in AI, energy, and other sectors, those could be worth substantial amounts.

Or fourth, this could be a negotiating tactic. Tether might be anchoring at a high valuation to give themselves room to negotiate down while still raising money at favorable terms.

What This Means for Crypto Markets

If Tether successfully raises $20 billion at this valuation, it sends a clear signal. Institutional investors believe stablecoins are here to stay.

That could accelerate mainstream adoption. More money flowing into stablecoin infrastructure makes the whole ecosystem more robust. Plus, it could pressure traditional payment companies to move faster on blockchain integration.

However, it also concentrates power in Tether’s hands. The company already dominates stablecoin markets. This funding would give them resources to expand that dominance across multiple sectors.

Competitors like Circle might struggle to keep up. Tether could outspend them on everything from technology development to regulatory compliance to marketing.

From a market stability perspective, Tether’s strength helps and hurts. On one hand, a well-capitalized Tether is less likely to face liquidity problems during market stress. That’s good for everyone who uses USDT.

On the other hand, if problems ever hit Tether, the contagion could spread across crypto markets. That’s the risk of having such a dominant player in critical infrastructure.

The Regulatory Wild Card

Tether’s U.S. expansion plans depend on favorable regulation. The GENIUS Act aims to create a framework for stablecoin issuers. But legislation can change, especially after elections.

Right now, the Trump administration supports crypto innovation. That environment enabled Tether to plan this aggressive expansion. But political winds shift quickly in Washington.

If regulations tighten, Tether’s U.S. plans could face obstacles. The company might have to hold more capital, face stricter oversight, or limit certain activities. Those constraints could impact their ability to deploy the funds raised in this round.

Moreover, international regulators might not share America’s enthusiasm. The EU is implementing strict crypto rules through MiCA legislation. Asian regulators have their own approaches. Tether operates globally, so it has to navigate multiple regulatory regimes simultaneously.

This funding round gives Tether resources to hire lawyers, lobbyists, and compliance experts. That’s probably part of the plan. But money doesn’t guarantee regulatory approval or favorable treatment.

The Bottom Line Nobody Asked For

This fundraising round, if it happens at the reported terms, represents a massive bet on crypto’s future. Tether is positioning itself as more than a stablecoin company. It wants to be a diversified financial and technology conglomerate.

Whether that vision makes sense depends on your view of crypto’s trajectory. Bulls will see this as validation of stablecoins’ importance. Bears will see it as irrational exuberance and excessive valuation.

Personally, I’m skeptical of the $500 billion valuation. Tether’s stablecoin business is valuable, but that number seems to price in a level of success across multiple ventures that’s far from guaranteed. The AI and energy investments might pay off. Or they might prove to be expensive distractions from the core business.

Still, you can’t ignore Tether’s market position. They dominate stablecoin infrastructure. That dominance generates real profits and strategic advantages. If they play their cards right, this funding could cement their leadership for years.

For everyone else in crypto, watch what happens next. If Tether raises at these terms, expect competitors to pursue aggressive fundraising too. The stablecoin wars are heating up.