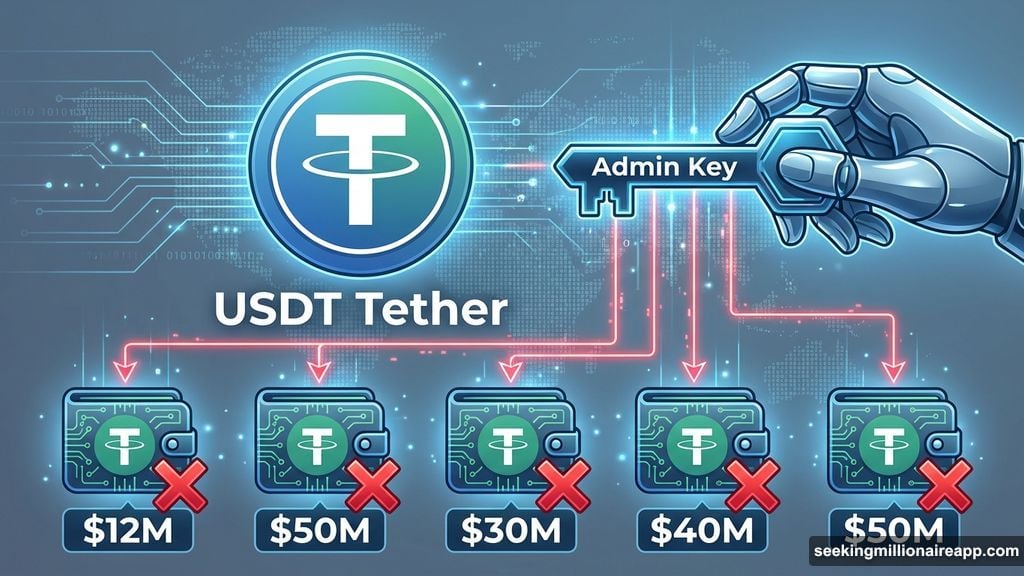

Stablecoin issuer Tether just wiped $182 million off the ledger in a single day. Five Tron wallets got hit with instant freezes during the last 24 hours.

Here’s the part that should worry you. These funds didn’t disappear because of a hack or smart contract bug. Tether chose to freeze them. And they didn’t need a court order.

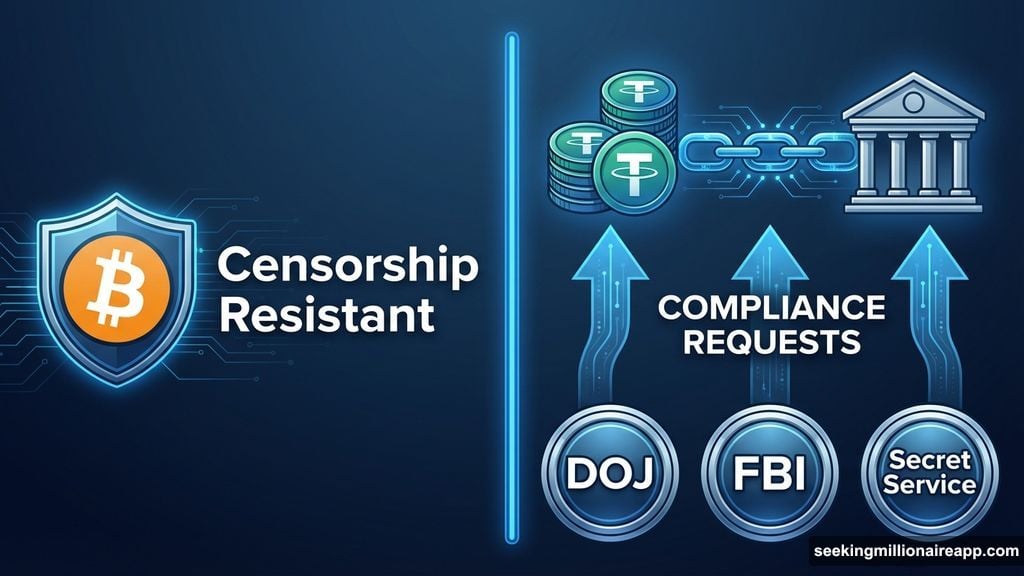

This reveals something uncomfortable about crypto’s backbone. While Bitcoin was built to resist censorship, the stablecoins powering 60% of the market work exactly like traditional banks. One company holds admin keys that let them freeze anyone’s money instantly.

Five Wallets Vanished Without Warning

Blockchain tracker Whale Alert caught the freezes on January 11. The targeted wallets held between $12 million and $50 million each. All sat on the Tron network.

Tether hasn’t explained why these specific accounts got frozen. That’s normal for them. But the scale suggests either law enforcement coordination or response to a major security threat.

The speed matters too. These weren’t gradual restrictions or warnings. One minute the wallets held funds. The next minute? Blacklisted.

Stablecoins Became the New Criminal Currency

Remember when Bitcoin dominated darknet markets? Those days ended. Criminal networks switched to stablecoins because they’re faster and more liquid.

The numbers tell the story. According to Chainalysis data, stablecoins represented 84% of all illicit transaction volume by late 2025. That’s a massive shift from Bitcoin’s former dominance.

Plus, the trend keeps accelerating. Forensic firm AMLBot found that Tether froze approximately $3.3 billion in assets between 2023 and 2025. During that period, they blacklisted 7,268 unique wallet addresses.

Most freezes hit Ethereum and Tron networks. That’s where Tether’s deepest liquidity lives. So that’s where criminals gravitate.

Tether Works With Feds Whether You Like It

Tether maintains aggressive compliance with US authorities. They regularly fulfill requests from the Department of Justice, FBI, and Secret Service.

This isn’t occasional cooperation. It’s standard operating procedure. Tether built infrastructure specifically to freeze funds at the smart contract level. They can execute instantly without user consent or judicial review.

Here’s what bothers me about this setup. Tether operates as judge and executioner. They decide which wallets get frozen based on requests from law enforcement. But users have no visibility into the decision process.

Moreover, mistakes happen. What if Tether freezes the wrong wallet? What if law enforcement targets someone who later proves innocent? The frozen funds stay locked while appeals drag through courts.

The Centralization Nobody Talks About

Crypto promised freedom from centralized control. Bitcoin delivered on that vision. But the stablecoin economy works differently.

Tether controls nearly 60% of the $308 billion stablecoin market according to DeFiLlama data. USDT’s market cap sits at $187 billion. That concentration creates systemic risk.

Think about what this means. Most crypto trading pairs against USDT. Most DeFi protocols use USDT for liquidity. Most cross-border payments move through USDT. And one company can freeze any of those funds instantly.

Circle’s USDC operates similarly. So does Paxos with USDP. Every major stablecoin issuer maintains blacklist capabilities. The entire foundation of crypto trading depends on centralized gatekeepers.

Market Doesn’t Care About Freeze Risk

Here’s the weird part. Despite billions in frozen assets and thousands of blacklisted addresses, USDT’s dominance hasn’t shrunk. The token keeps growing.

Users apparently accept the tradeoff. They want dollar stability and instant settlement more than they fear potential freezes. Or maybe they assume freezes only hit criminals and won’t affect them.

That confidence might be misplaced. As regulatory pressure increases, the definition of “illicit activity” expands. Today it’s ransomware and dark market vendors. Tomorrow? Could be anything regulators dislike.

What This Means for Crypto’s Future

Stablecoins solved crypto’s volatility problem. But they created a new centralization problem. We traded price stability for institutional control.

The solution isn’t obvious. Algorithmic stablecoins like Terra failed catastrophically. Decentralized collateralized stablecoins like DAI remain small. USDT and USDC dominate because they work reliably.

So we’re stuck with this compromise. The crypto economy runs on centralized stablecoins that can freeze funds instantly. And that reality contradicts everything crypto originally promised.

Choose your stablecoin carefully. Understand that “your” funds aren’t truly yours if an issuer can freeze them without warning. And remember that every USDT transaction depends on Tether’s continued cooperation and competence.

The $182 million frozen this week proves the system works as designed. Whether that design serves crypto’s original vision? That’s a different question entirely.