Bitcoin held $90,000 by its fingernails. Ethereum shed 3.5% overnight. The total crypto market cap dropped from $3.24 trillion to $3.05 trillion in less than 24 hours.

What triggered the sell-off? The Federal Reserve delivered its expected 25 basis point rate cut. But Chair Jerome Powell’s warning about “cooling” labor markets and “somewhat elevated” inflation sent a chill through risk assets. Markets read the subtext immediately: stagflation risk is back on the table.

Why Rate Cuts Didn’t Save Crypto

The Fed delivered exactly what traders anticipated. Yet Bitcoin still dropped 2.5% within hours of Powell’s announcement.

The problem wasn’t the cut itself. Markets had priced in the 25 basis point reduction weeks ago. Instead, Powell’s tone turned cautious in ways that undermined the bullish case for risk assets.

He described labor market conditions as “cooling” while noting inflation remains elevated. That combination creates stagflation fears—slow growth paired with persistent price pressures. In that environment, further rate cuts become harder to justify even as economic activity weakens.

Crypto responds poorly to stagflation scenarios. Digital assets thrive when either growth accelerates or monetary policy eases aggressively. A world of weak growth and limited easing support offers neither catalyst.

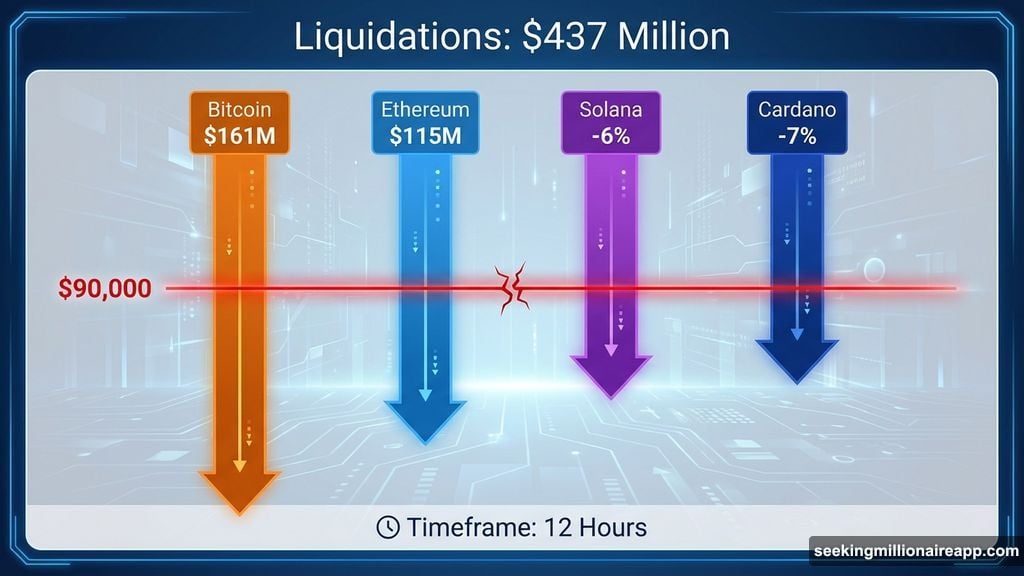

Over $437 million in leveraged positions were liquidated in the 12 hours following Powell’s remarks. Bitcoin accounted for $161 million of those liquidations. That cascade of forced selling amplified the initial decline and caught overleveraged traders on the wrong side of momentum.

Bitcoin’s $90,000 Support Looks Fragile

Bitcoin managed to hold above $90,000 despite heavy selling pressure. But the chart shows weakness building beneath the surface.

The token needs a full daily close above $94,600 to neutralize the recent damage. Without that recovery, the next major support sits at $88,100. A break below $90,000 would likely trigger another wave of liquidations and confirm the pre-Fed bounce has completely faded.

Traders initially bought Bitcoin ahead of the rate cut, expecting the decision to spark fresh momentum. That positioning proved costly. Now those same buyers face stop-loss triggers if $90,000 gives way.

The path higher exists but requires work. Bitcoin must reclaim $94,600 first, then push toward the $98,900 level to rebuild bullish conviction. Until those moves happen, downside risk outweighs upside potential.

Market participants on Polymarket dropped Bitcoin’s probability of hitting $100,000 by year-end to around 30%. That’s down sharply from levels above 50% just days ago. Sentiment shifted fast.

Altcoins Take Bigger Hits Than Bitcoin

Most large-cap altcoins fell harder than Bitcoin over the past 24 hours. Ethereum dropped 3.5%, while Solana declined 6% and Cardano lost 7%.

Pump.fun (PUMP) emerged as today’s biggest loser among the top 100 tokens, falling more than 9%. The token has now dropped nearly 40% over the past month, extending a brutal downtrend that shows no signs of stabilizing.

PUMP trades near $0.0027 and faces critical support at $0.0026. A break below that level opens the door to $0.0024, where the next major floor sits. For bulls, the token needs to reclaim $0.0032 to show early recovery signs. Only a move above $0.0036 would shift momentum meaningfully.

Altcoins typically amplify Bitcoin’s moves in both directions. With BTC under pressure, smaller tokens face compounding selling as traders rotate into cash or stablecoins. That pattern played out yesterday and continues today.

One bright spot: Terra (LUNA)—the new Terra 2.0 chain—surged 44% in 24 hours, extending its seven-day gain past 200%. This isn’t Terra Classic (LUNC), the old chain. The new LUNA has disconnected from broader market weakness, though sustainability remains uncertain given the token’s controversial history.

Market Structure Points to Further Downside Risk

The total crypto market cap dropped from $3.24 trillion to $3.05 trillion, losing nearly $179 billion in value. That decline came fast and broke through what traders had viewed as near-term support.

Right now, the market sits just above the $3.01 trillion level. If that floor breaks, the next strong base doesn’t appear until $2.73 trillion. That would represent another 9% decline from current levels and likely trigger widespread panic.

Recovery requires a close back above $3.24 trillion. That move would confirm buyers have regained control and flip short-term momentum upward. But reaching that level looks difficult without a catalyst to shift sentiment.

The Fed’s hawkish tone removed the most obvious catalyst. Powell made clear that future rate cuts aren’t guaranteed, even if economic data weakens. That leaves crypto without its preferred tailwind: predictable, aggressive monetary easing.

Meanwhile, traditional markets also face pressure. The S&P 500 and Nasdaq both declined following Powell’s remarks, showing risk-off sentiment isn’t limited to digital assets. When stocks and crypto fall together, it confirms broader concerns about growth and policy support.

Three Scenarios That Could Change the Picture

Crypto needs a positive shock to reverse yesterday’s damage. Three potential catalysts could shift momentum:

First, unexpected economic weakness could force the Fed’s hand. If unemployment rises sharply or growth stalls, Powell might have to deliver more dovish guidance despite inflation concerns. Markets would interpret that as a green light for risk assets.

Second, institutional buying could provide a floor. Spot Bitcoin ETFs attracted massive inflows earlier this year. If those flows resume, they could stabilize BTC and rebuild confidence across the crypto complex.

Third, regulatory clarity might emerge faster than expected. The incoming administration has signaled friendlier crypto policies. Concrete announcements on frameworks or approvals could spark optimism independent of Fed policy.

None of these scenarios looks imminent. But they represent the types of developments that could break the current stalemate and give buyers a reason to step in aggressively.

What Traders Should Watch Next

Bitcoin’s $90,000 level remains the most critical short-term marker. As long as BTC holds above that price, the structure stays intact and recovery remains possible. A break below confirms the recent weakness isn’t just noise.

For the broader market, $3.01 trillion defines the current floor. Losing that level would shift the entire crypto complex into a deeper correction and force traders to reassess their year-end positioning.

On the upside, Bitcoin needs $94,600 and the total market cap needs $3.24 trillion. Those are the gates that must open before bulls can claim control again.

Powell’s remarks reminded everyone that rate cuts don’t automatically mean risk-on behavior returns. The Fed delivered easing, but paired it with caution. That combination left crypto caught between hope for support and fear of stagflation. For now, fear is winning.