The crypto market just lost $128 billion in 24 hours. Bitcoin is testing $70,000 support, and Zcash crashed 20% in a single day.

This isn’t your typical crypto dip. Instead, it’s a coordinated collapse driven by forced liquidations and macro uncertainty. Plus, the weakness is spreading fast across all major tokens. Let’s break down what’s actually happening and why your portfolio is bleeding.

Liquidation Cascade Drives Sell-Off

The crypto market cap dropped to $2.41 trillion after $128 billion evaporated overnight. However, the real damage came from leveraged traders getting destroyed.

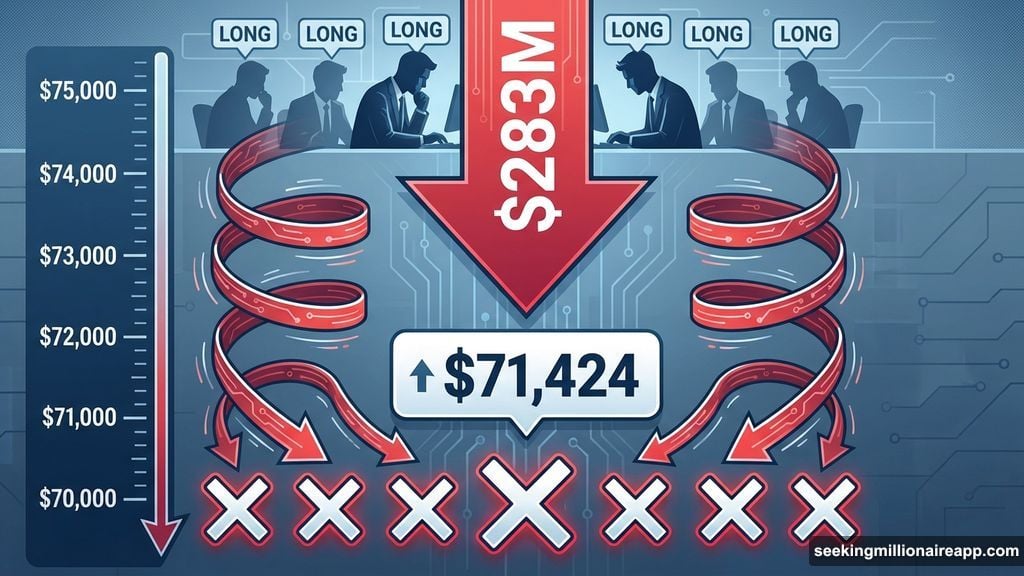

Long liquidations hit $283 million in the last 24 hours. Traders betting on upside got forced out as prices fell. So their automatic sell orders accelerated the decline, creating a vicious downward spiral.

Here’s how it works. When Bitcoin drops, leveraged longs hit their liquidation price. Exchanges automatically close these positions by selling. That selling pushes prices lower, triggering more liquidations. The cycle feeds on itself until leverage gets flushed out.

Risk appetite completely vanished. Investors are responding to macro uncertainty and declining liquidity. Moreover, institutional money is sitting on the sidelines while retail traders absorb the losses.

Bitcoin Tests Critical $70,000 Support

Bitcoin fell to $71,424 at press time. That puts it dangerously close to breaking $70,000, a level it hasn’t seen since December 2024.

This support zone has historically attracted buyers. But momentum indicators keep weakening. Plus, the selling pressure shows no signs of stopping. If $70,000 breaks, Bitcoin faces a 14-month low.

The next support sits at $65,360. A drop there would trigger another wave of liquidations. Furthermore, it would confirm the bear market structure that many analysts feared.

Yet holding $70,000 remains possible. Strong buyers could step in at this psychological level. Reclaiming $75,000 would be the first sign of recovery momentum. Still, that requires a shift in sentiment that’s nowhere in sight right now.

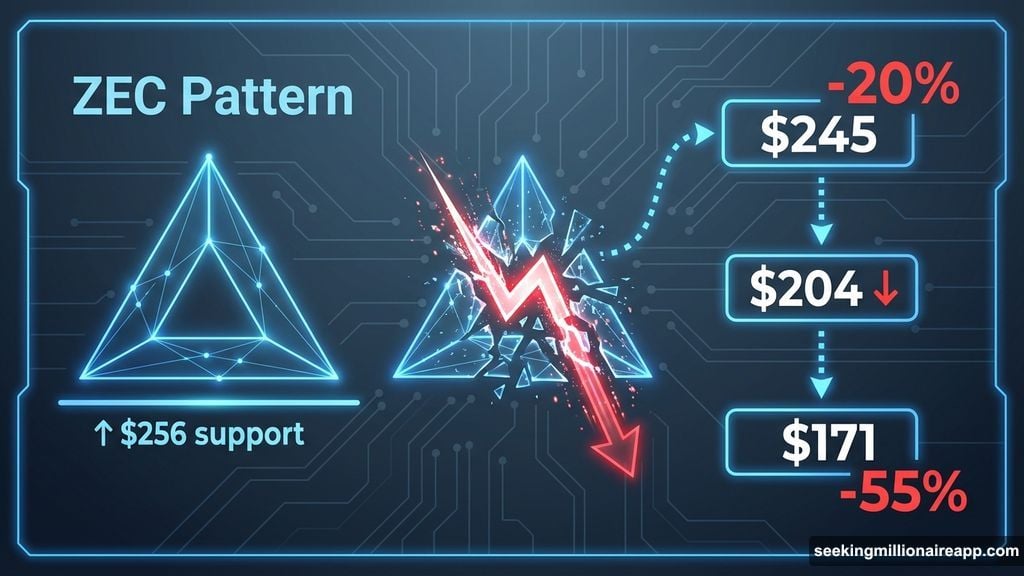

Zcash Crashes 20% as Triangle Breakdown Accelerates

Zcash emerged as the day’s worst performer, dropping 20% to $245. This confirms the bearish triangle pattern that broke down in mid-January.

The token lost critical $256 support. Now it’s exposed to a drop toward $204. In fact, technical analysis suggests a potential fall to $171 if selling continues. That would complete a devastating 55% decline from recent highs.

Rising outflows show investors are fleeing ZEC. The bearish setup remains firmly intact. Moreover, no meaningful support exists between current levels and $204.

A bounce from $204 could halt the decline. Flipping $256 back to support would signal renewed strength. But that requires buying pressure that simply isn’t there. Until market conditions improve, ZEC faces continued downside risk.

Regulatory Uncertainty Adds to Pressure

Behind the price action, regulatory concerns are mounting. The CLARITY Act debate has sparked fears about increased surveillance in crypto markets.

CME Group is exploring launching its own crypto-style token. CEO Terry Duffy confirmed focus on margin and tokenized collateral use cases. This signals institutional interest but also hints at a controlled, regulated future for crypto.

Banks and crypto firms are battling over stablecoin yield disputes. Meanwhile, the broader privacy implications get ignored. If the CLARITY Act passes, it could normalize Bank Secrecy Act-style surveillance across the crypto industry.

These regulatory developments add uncertainty during an already fragile market period. Institutional players may be waiting for clarity before deploying capital. That leaves retail investors holding the bag as prices fall.

Weekend Risk Looms Large

If liquidation pressure continues into the weekend, the market could test $2.36 trillion support. A breakdown there would extend losses toward $2.30 trillion.

Weekend trading typically brings lower liquidity. That means larger price swings from smaller trading volumes. Plus, fewer institutional traders are active to stabilize markets.

Recovery remains possible if conditions improve. Stronger inflows and stabilizing derivatives data could support a rebound. But right now, the momentum is firmly bearish. Every bounce gets sold, and support levels keep breaking.

The crypto market faces a critical test. Either buyers step in at current support levels, or we’re heading for a deeper correction. The next 48 hours will tell which way this goes.