The crypto market hit pause. Bitcoin’s momentum slowed. Altcoins lost direction. Now three tokens face critical catalysts that could determine their next move.

Filecoin, Zilliqa, and Avalanche all have major developments landing this week. But here’s the catch. None of these announcements guarantee upward movement. Instead, they create volatility windows where prices could surge or collapse based on trader reaction.

Let’s examine what’s coming and what it means for your portfolio.

Filecoin Teases Mystery Announcement

Filecoin dropped a vague hint about “major news” this week. No details. No timeline. Just enough information to make traders nervous.

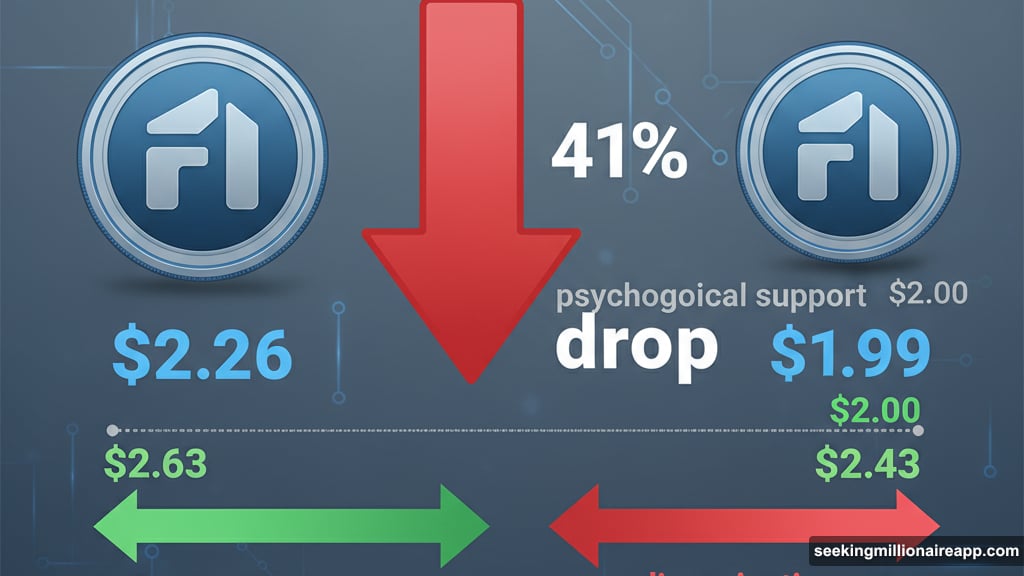

The token sits at $1.99 after plummeting 41% in ten days. That’s brutal by any measure. Plus, FIL briefly dipped below the psychological $2.00 support level, triggering stop losses and amplifying selling pressure.

Technical indicators show extreme weakness. But mystery announcements create unpredictable price action. If the news delivers substance, FIL could bounce back above $2.26 and potentially reach $2.63.

However, disappointing news would likely push FIL toward $1.68. Breaking that support opens the door to $1.46, extending the downtrend and trapping late buyers.

The risk-reward ratio here depends entirely on information nobody has yet. That’s speculation, not investing. So approach with caution.

Zilliqa Mainnet Upgrade Changes Staking Rules

Zilliqa trades at $0.0069 after falling 13% this week. The token hovers just below resistance, testing whether buyers have any appetite left.

The upcoming 0.19.0 Mainnet Upgrade adds flexibility for stakers and improves network liveness. Those changes matter for long-term holders who care about protocol efficiency. But do they matter enough to reverse selling pressure?

Technical signals show mixed messages. The Parabolic SAR indicator suggests an emerging uptrend. Yet volume remains weak, indicating limited conviction from either bulls or bears.

If traders respond positively to the upgrade, ZIL could push toward $0.0074. Sustained momentum might carry it to $0.0082. That’s a modest gain, not a moonshot.

Failed momentum sends ZIL dropping to $0.0063. Breaking below that level exposes $0.0058 as the next stop. At that point, the bullish thesis dies completely.

Staking improvements alone rarely drive significant price action. The upgrade needs to coincide with broader market strength to generate meaningful gains.

Avalanche Granite Upgrade Attempts Recovery

AVAX sits at $15.61 after bleeding for a month straight. Sellers dominated every rally attempt. Buyers disappeared. Now the Granite upgrade arrives as a potential catalyst for reversal.

The MACD indicator shows slight bullish momentum building. It hasn’t crossed bearish yet, suggesting sellers are losing steam. That’s a small positive signal in an otherwise grim chart.

Avalanche’s Granite upgrade enhances network performance. The technical improvements could attract renewed developer interest and push AVAX above $16.25 resistance. Breaking that level opens a path toward $18.27.

But network upgrades don’t always translate to price gains. If market conditions deteriorate or the upgrade fails to impress, AVAX could slip through $14.89 support and head toward $13.40.

The downtrend line remains intact. AVAX needs both the successful upgrade and favorable market conditions to break free. One without the other probably isn’t enough.

Catalysts Create Volatility, Not Guarantees

All three tokens share a common problem. They’re betting on catalysts to reverse downtrends that fundamentals couldn’t stop.

Filecoin’s mystery announcement creates speculation but no clarity. Zilliqa’s staking improvements matter for the network but rarely move prices. Avalanche’s upgrade is substantial but arrives during weak market conditions.

Plus, altcoins currently lack the momentum they enjoyed during bull runs. Bitcoin dominance stays elevated. Capital rotates away from smaller tokens. That environment makes recovery difficult regardless of positive developments.

Smart traders watch these catalysts but don’t overcommit. Announcements create volatility windows. Sometimes that volatility pushes prices higher. More often, it just amplifies existing trends.

Position sizing matters more than usual this week. These tokens could move 20% in either direction based on news and market reaction. That’s opportunity for nimble traders and risk for buy-and-hold investors.

The altcoin market needs broader strength to sustain individual rallies. Without that foundation, even positive catalysts often fail to generate lasting gains.