January’s second week brings critical network upgrades and protocol changes. Three altcoins stand out with catalysts that could drive significant price action in the coming days.

Network transitions, mainnet updates, and real-world adoption announcements often spark volatility. So let’s examine which tokens deserve attention and what specific events might trigger movement.

Mantle Preps Ethereum Fusaka Integration

Mantle is rolling out its first major network upgrade of 2026 this week. The mainnet update brings full compatibility with Ethereum’s Fusaka upgrade, potentially improving scalability and on-chain utility.

The altcoin currently trades near $0.99 after recent weakness. But early buying pressure suggests traders anticipate the upgrade’s impact. Mantle needs to break decisively above $1.04 to recover its 14% recent loss.

Clearing that resistance opens a path toward $1.11. That would signal renewed bullish momentum and confirm technical strength. However, failure at $1.04 risks a slide back toward the all-time low near $0.94.

The upgrade could attract new users and boost network activity. Yet market confidence must materialize quickly. Otherwise, selling pressure may overwhelm any technical improvement from the Fusaka integration.

MANTRA Forces Token Migration Deadline

MANTRA is executing a critical infrastructure shift. Users must migrate ERC20 OM tokens to MANTRA Chain before January 15, 2026. After that deadline, the ERC20 version faces managed depreciation.

This consolidation aims to establish MANTRA Chain-native OM as the sole canonical token. Such structural changes often create short-term catalysts by reducing fragmentation and improving liquidity concentration.

OM currently trades near $0.078, showing early-month strength. The token needs to reclaim $0.083 to support further upside momentum. Breaking that level would validate the bullish case as migration progresses.

But risks remain present. Chaikin Money Flow already signals capital outflows, indicating active selling pressure. If buying interest weakens, OM could slip below $0.077 support.

A sustained breakdown there exposes the token to deeper losses toward $0.072. That would invalidate the bullish thesis entirely. So the next few days become critical as the migration deadline approaches.

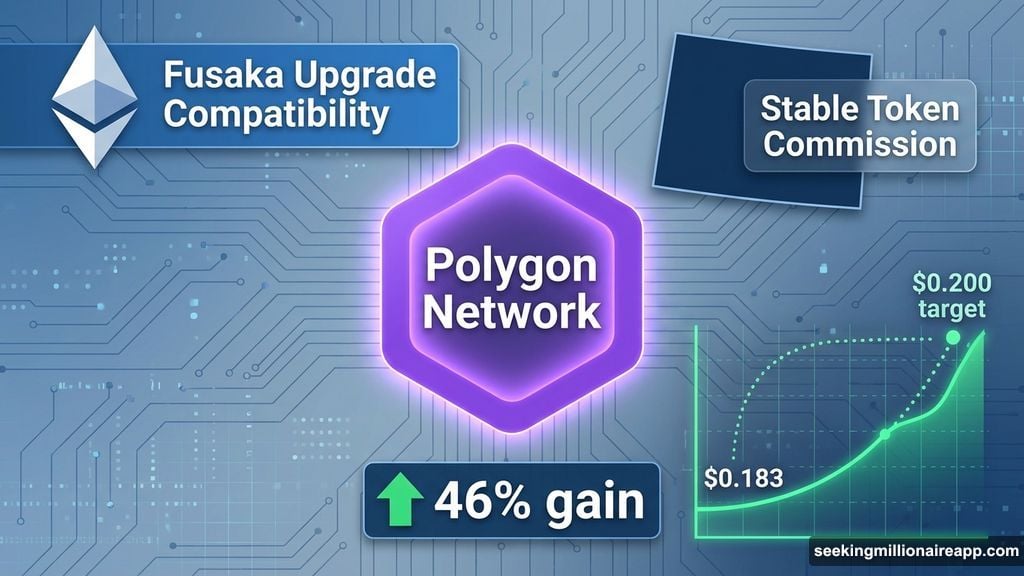

Polygon Gains Wyoming Stablecoin Mandate

Polygon delivered the week’s strongest performance after Wyoming’s Stable Token Commission selected it to host the state’s first stablecoin. The announcement boosted institutional credibility and visibility significantly.

This real-world blockchain adoption drove POL up 46% before a 12% pullback over 48 hours. The correction followed failure to breach $0.183 and flip the 200-day EMA into support.

POL needs to secure that level to signal macro bullishness. Achieving it opens a path toward $0.200 if selling pressure stays contained. The Wyoming development positions Polygon as a key beneficiary of government blockchain adoption.

Yet downside risk increases if holders rush to lock in profits. POL could retreat toward $0.138, a critical support zone. Breaking below that level would also push price under the 50-day EMA.

Such a move invalidates the bullish setup entirely. It would expose POL to a deeper slide toward $0.119. So despite the strong catalyst, profit-taking risks remain elevated after the rapid 46% surge.

Watch for Confirmation Signals

These three altcoins face critical junctures this week. Mantle’s upgrade, MANTRA’s migration, and Polygon’s government partnership all represent legitimate catalysts.

But catalysts alone don’t guarantee sustained rallies. Each token must hold key technical levels to validate bullish momentum. Failure to do so risks swift reversals that erase recent gains.

Monitor volume and price action closely. Decisive breaks above resistance confirm strength. Rejection at those levels suggests taking profits makes sense. The week ahead determines whether these catalysts translate into sustained upward movement.