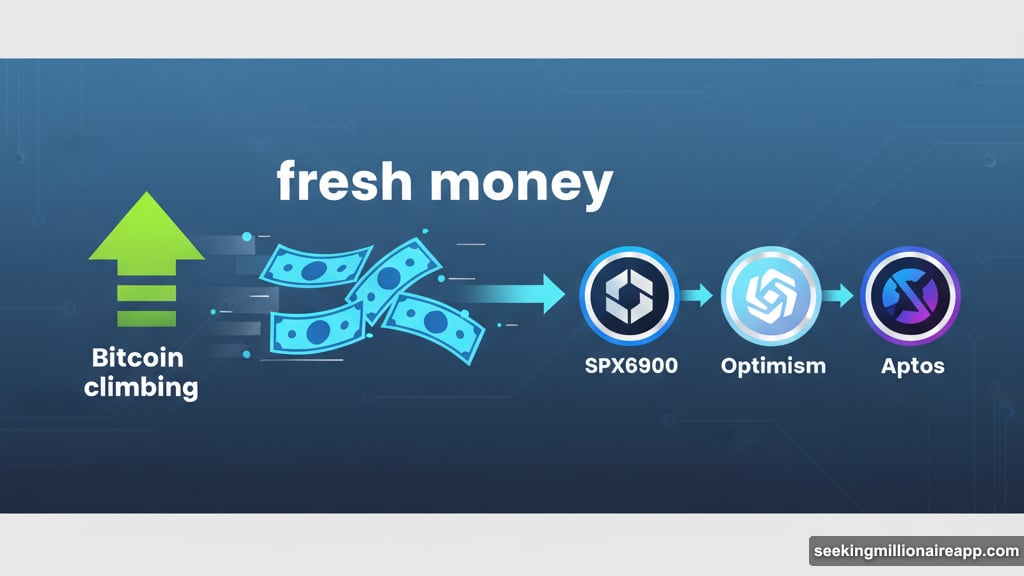

The crypto market’s painting green again. Bitcoin’s climbing, and that’s pulling fresh money into altcoins. The US government shutdown continues dragging on, and traders are betting that means more easy money conditions.

So which altcoins could actually benefit? Three tokens stand out this week, but each comes with specific risks worth understanding before jumping in.

SPX6900 Rides a Wild Rally

SPX trades at $1.62 right now. That’s after a brutal 62% surge in just seven days. The token hit a two-month high and shows no signs of slowing down yet.

What’s driving this? Renewed investor interest, mostly. Plus, the technical setup looks solid. SPX is holding firm above its critical $1.58 support level. That matters because breaking below that point would signal trouble.

Right now, SPX sits about 41% below its all-time high of $2.29 from late July. So there’s room to run if momentum continues. The exponential moving averages confirm the bullish trend, suggesting buyers still control the action.

Here’s what could happen next. If SPX breaks through $1.74 resistance, the path opens toward $2.00. That’s a realistic target based on current momentum and market structure.

But here’s the catch. This rally has been fast and furious. Traders who jumped in early might start taking profits soon. If that happens, SPX could slip below $1.58 support fairly quickly.

A deeper correction might push the price down to $1.39 or lower. That would invalidate the bullish case and signal a temporary reversal. So timing matters a lot with this one.

Optimism Faces a Supply Test

Optimism prepares for a major token unlock this week. Specifically, 4.47 million OP tokens worth more than $3.28 million will hit circulation. That’s a significant supply increase that could trigger selling pressure.

Token unlocks historically create short-term volatility. New tokens entering the market often lead to temporary price drops as early investors cash out. So OP faces a real test in the coming days.

Technical indicators paint a mixed picture. The Parabolic SAR sits below the candlesticks, suggesting OP might consolidate between $0.76 and $0.71. That means buyers still maintain some control despite the unlock threat.

If the market absorbs the new supply without major disruption, OP could hold its current range. But if bearish sentiment builds after the unlock, things could get messy fast.

A break below $0.71 support would signal trouble. That could push OP down to $0.68 or even lower. Such movement would kill the short-term bullish outlook and highlight how sensitive OP is to supply dynamics.

The key question is simple. Will buyers step in to absorb the new tokens, or will sellers overwhelm demand? We’ll find out this week.

Aptos Balances Growth Against Unlock Pressure

Aptos faces an even bigger token unlock this week. Some 11.31 million APT worth nearly $60 million will enter circulation. That’s substantial and introduces real short-term volatility risk.

Despite that threat, Aptos has crushed it lately. The token jumped 24% in the past week to reach $5.31. That’s its highest level in two months, showing genuine momentum behind the project.

The Chaikin Money Flow indicator reveals growing capital inflows. That signals investor confidence remains strong despite the approaching unlock. If buying continues, APT could push past $5.50 and even test $5.73 resistance.

Here’s what makes Aptos interesting. The project has real fundamentals driving adoption. Strong capital inflows suggest investors see long-term value, not just short-term speculation.

But sustained investor participation matters. If inflows diminish after the unlock, APT could struggle maintaining its current strength. A drop below $5.06 might trigger a deeper correction toward $4.79.

That would effectively invalidate the bullish scenario and force traders to reassess. So the coming days will test whether Aptos can maintain momentum despite significant supply pressure.

The Bigger Picture

All three tokens show potential for gains this week. But each faces specific challenges that could derail their momentum quickly.

SPX offers explosive upside potential but carries high risk due to its recent parabolic move. Optimism and Aptos both face token unlocks that historically trigger selling pressure. Yet both show technical strength suggesting buyers might absorb the new supply.

The crypto market remains highly sensitive to macro conditions. The US government shutdown continues supporting risk assets. But that situation could change rapidly if Congress reaches a resolution.

So these opportunities exist right now. But they require careful risk management and close attention to key support levels. Breaking below those levels would signal it’s time to step aside and wait for better entries.

Watch how each token handles its specific challenge this week. That will tell you whether the bullish case remains intact or if correction risk is building. The market always provides clues—you just need to pay attention.