November hit hard. Most coins bled value while traders sat frozen, unsure where the market heads next.

But three US-based cryptocurrencies are showing something different. Real signals buried in the noise. One moves opposite to Bitcoin when everyone else follows. Another just printed a textbook reversal pattern. The third attracted sudden whale buying during the dip.

These aren’t moonshot predictions. They’re technical setups worth watching as the market tries to find its footing.

Litecoin Moves Against the Crowd

Litecoin gained 8% over 30 days while Bitcoin dropped 13.5%. That’s rare.

The Pearson correlation coefficient between LTC and BTC sits at –0.01 for the past month. Negative correlation means they move in opposite directions. When Bitcoin tanks, Litecoin holds steady or climbs.

So why does this matter? Most altcoins follow Bitcoin like shadows. When BTC crashes, everything crashes harder. But Litecoin broke that pattern this month, giving it unusual strength.

Plus, the chart shows an inverse head and shoulders pattern forming. The price hovers near $102 right now. A daily close above $119 completes the pattern and opens the path toward $135.

That resistance level capped rallies before. Breaking it would signal real momentum instead of just noise.

The Smart Money Index started curling up on November 13. This indicator tracks how informed traders position themselves. When it turns up while price approaches breakout levels, early buyers are stepping in.

However, failure has consequences. If LTC can’t punch through resistance, support sits at $93. Drop below that and the structure weakens. Fall under $79 and the entire reversal pattern dies.

Solana Flashes Reversal Signal After Heavy Losses

Solana dropped 27% over 30 days. Brutal by any measure.

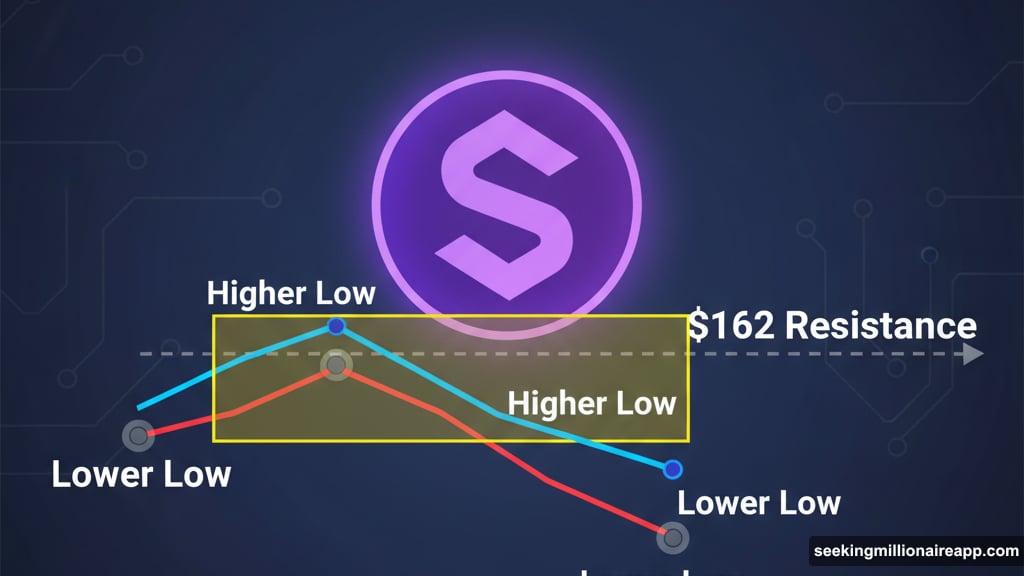

Yet the Relative Strength Index tells a different story. Between November 4 and November 14, SOL’s price made a lower low while RSI made a higher low. That’s called bullish RSI divergence.

This pattern appears when selling momentum fades even as price keeps dropping. It often precedes short-term reversals, though they don’t always last.

For the setup to activate, Solana needs to break $162. That’s strong resistance that held since November 5. Clear that level and $170 comes into view. With stronger momentum, the price could stretch toward $205.

But everything hinges on holding $135 support. Lose that and $126 becomes the next floor. Drop below $126 and the divergence setup fails completely.

The timeframe matters here. This looks like a short-term bounce signal, not a long-term trend change. So traders watching Solana this week should focus on the $162 test.

Chainlink Whales Buy the Dip

Chainlink fell 20% over 30 days and another 10% this past week. Yet whale wallets grew heavier.

Regular whale holdings jumped 8.92% in seven days. The top 100 addresses increased their combined holdings by 1.51%. When large holders buy during price drops instead of selling, they’re positioning for something.

The chart explains their timing. Between October 10 and November 14, LINK’s price made a lower low while RSI made a higher low. Same bullish divergence pattern as Solana.

For this setup to work, Chainlink needs to reclaim $16.10. That’s a 17% move from current levels. Break above that and $17.57 opens up. Close a daily candle above $17.57 and LINK could push toward $21.64 if conditions improve.

The key support sits at $13.72. A daily close below that level breaks the structure and invalidates the bullish signal entirely.

The Bigger Picture

These three coins share something important. They’re not pumping on hype or memes. Instead, they’re showing technical patterns and holder behavior that suggest potential reversals.

Litecoin’s negative correlation with Bitcoin gives it unusual independence. Solana’s RSI divergence hints at fading selling pressure. Chainlink’s whale accumulation shows big money positioning early.

None of this guarantees profits. Markets can break setups and invalidate patterns quickly. But these signals beat blind guessing when trying to spot early moves.

Watch the key levels. $119 for Litecoin, $162 for Solana, $16.10 for Chainlink. Those breakpoints separate setups that work from ones that fail.

The market’s been rough. These three coins might be starting to turn while everyone else waits for Bitcoin to lead. That makes this week especially interesting for traders watching American-based crypto projects.