Three major token unlock events hit the crypto market this week. Together, they’ll inject over $70 million worth of new tokens into circulation.

Token unlocks matter because they flood markets with fresh supply. That creates selling pressure. So prices often drop when large unlocks happen.

Here’s what’s coming and why you should pay attention.

Ethena Drops 172 Million Tokens Wednesday

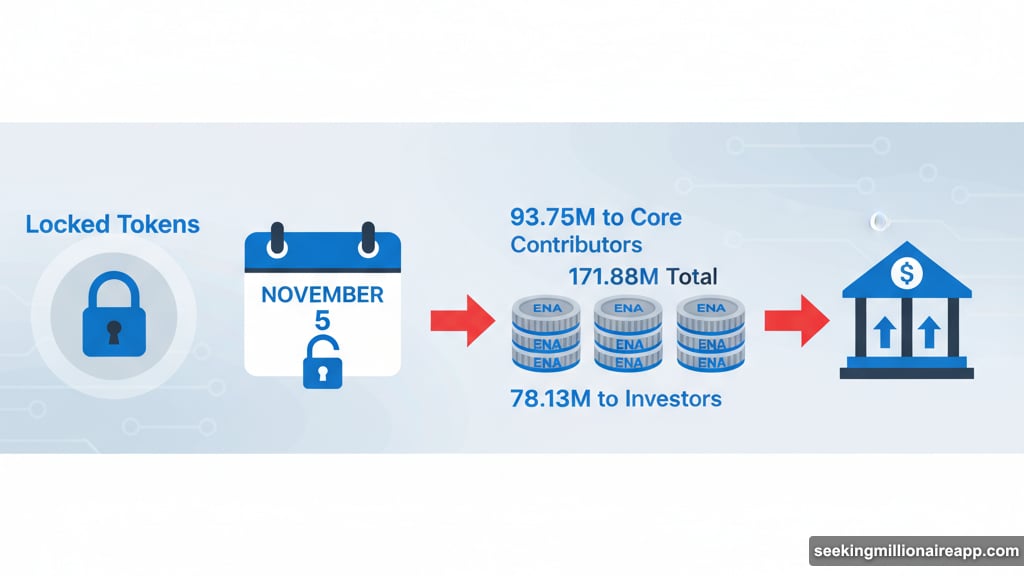

Ethena (ENA) releases the biggest unlock this week. On November 5, the protocol unlocks 171.88 million tokens worth $61.5 million.

That’s 1.15% of the total supply hitting markets at once. More importantly, it represents 2.52% of the current circulating supply. Plus, that’s enough to move prices significantly.

Where do these tokens go? Core contributors get 93.75 million ENA. Investors receive the remaining 78.13 million. Both groups can sell immediately if they choose.

Ethena builds synthetic stablecoins on Ethereum. Their main product is USDe, a crypto-native alternative to traditional stablecoins. The protocol already released 40.63 million tokens to its Foundation just days ago on November 2.

So we’re seeing consecutive large unlocks in a short window. That compounds the potential price impact.

Memecoin Releases 3.45 Billion Tokens Today

Memecoin (MEME) unlocks 3.45 billion tokens on November 3. The unlock is worth approximately $5.15 million.

This represents 5% of the total supply. However, it accounts for nearly 6% of the circulating supply. That’s a substantial increase in available tokens.

Here’s the interesting part. The team reserves the entire unlock for community airdrops. Nobody’s selling these tokens immediately. Instead, they’ll distribute them to users over time.

Memecoin openly embraces being a meme token with zero utility. No roadmap. No promises. Just community vibes and internet culture. Yet the project maintains a $58.77 billion circulating supply.

The airdrop strategy might soften immediate price impact. But eventually, those tokens reach the market when recipients sell.

Movement Adds 50 Million Tokens Next Weekend

Movement (MOVE) unlocks 50 million tokens on November 9. The release is worth about $3.2 million.

That’s 0.5% of total supply and 1.89% of circulating supply. Smaller than the other two unlocks this week. But still meaningful for price action.

Movement uses Meta’s Move programming language for blockchain applications. The network focuses on high-performance, secure development with faster transactions and better scalability.

The protocol directs all unlocked tokens to ecosystem and community initiatives. So like Memecoin, these tokens won’t hit exchanges immediately. Instead, they support network growth and user rewards.

Why Token Unlocks Matter for Traders

Token unlocks create predictable selling pressure. Teams, investors, and contributors often sell some tokens to take profits or cover costs.

Even when unlocks go to communities or ecosystems, those tokens eventually circulate. Recipients sell them. That increases supply available for trading.

Markets typically price in known unlocks beforehand. Prices often drop in the days leading up to large releases. Then they stabilize or recover afterward once the uncertainty passes.

However, unexpected selling can amplify downward pressure. If major holders dump large quantities quickly, prices can crash harder than anticipated.

Three other projects also unlock tokens this week. BounceBit (BB), RedStone (RED), and Space and Time (SXT) will release smaller amounts. Combined with the major three, total new supply exceeds $312 million this week.

What This Means for Your Portfolio

Watch these unlock dates if you hold any affected tokens. Prices might dip temporarily as new supply enters circulation.

For traders, unlocks create opportunities. Buy the dip after initial selling pressure. Or short before large releases and cover after the dump.

For long-term holders, unlocks test conviction. Temporary price drops don’t necessarily reflect project fundamentals. But increased supply does dilute existing holdings.

The smart move? Track unlock schedules for tokens you own. Understand where new supply goes. And decide beforehand whether you’ll hold through volatility or trade around it.

Token unlocks happen constantly in crypto. They’re scheduled events, not surprises. Yet many investors ignore them until prices move. Don’t be that investor.