Trading stocks on blockchain used to be a gimmick. Not anymore.

Block Scholes just dropped a report showing tokenized equities actually work now. Real volume. Tight spreads. Price action that tracks traditional markets during trading hours. Plus, Bitget’s Universal Exchange model is pushing this from experiment to everyday reality.

So what changed? Three things happened at once that finally made tokenized stocks viable.

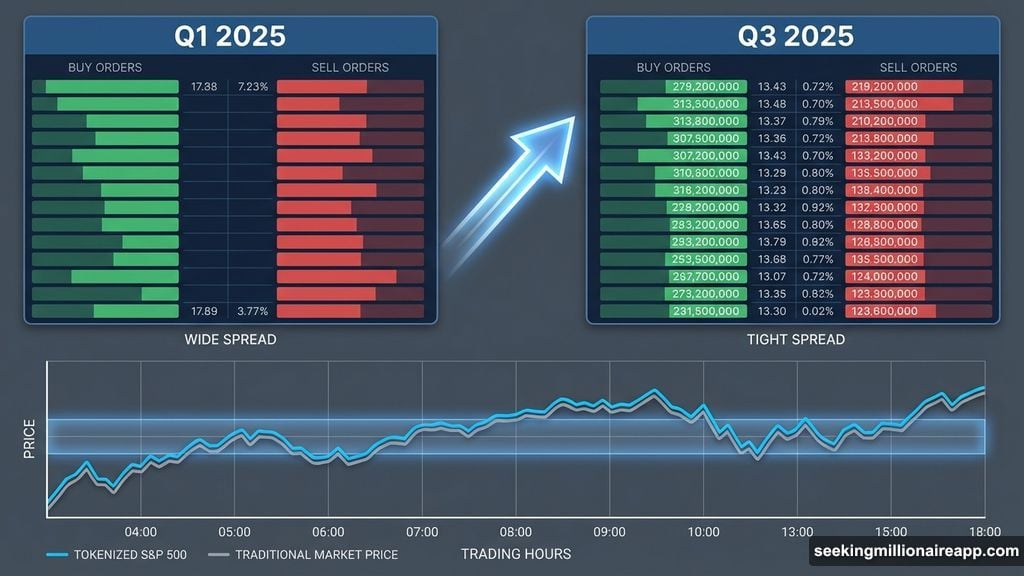

Liquidity Finally Showed Up

Tokenized stocks struggled for years because nobody wanted to trade them. Thin order books meant huge spreads. Huge spreads scared away traders. Classic chicken-and-egg problem.

That changed in Q3 2025. According to Block Scholes, tokenized equities tracking the S&P 500, major tech stocks, and ETFs saw meaningful adoption. Why? Exchanges like Bitget brought actual liquidity to the market.

Here’s what that looks like in practice. During regular market hours, tokenized stocks now track their traditional counterparts within narrow intraday spreads. Not perfect. But close enough that arbitrage opportunities stay small. That’s the sign of a functioning market.

Moreover, improved liquidity means price discovery actually works. You can buy or sell without moving the market against yourself. For retail traders, that’s the difference between a useful product and an expensive experiment.

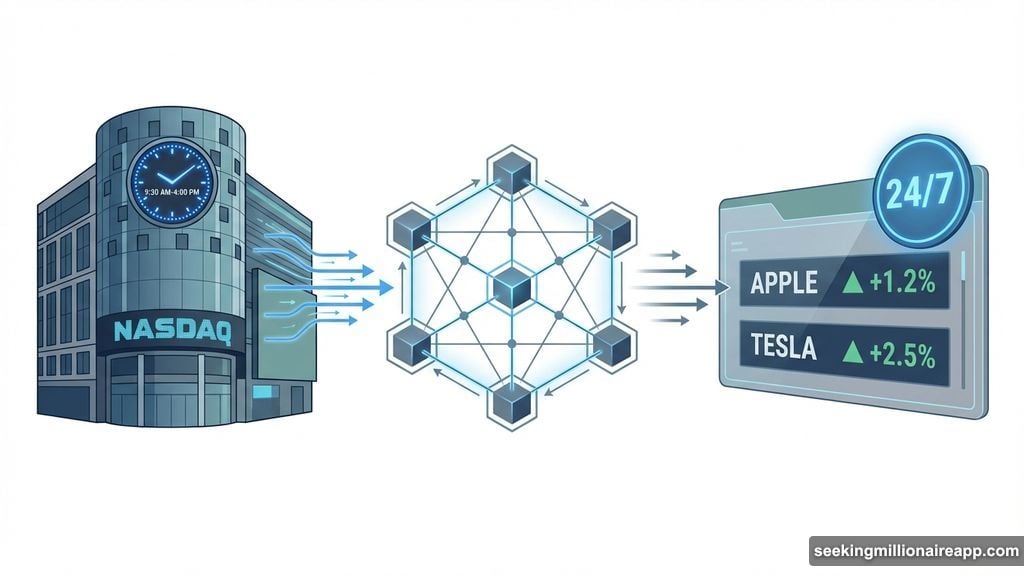

24/7 Trading Creates Real Demand

Traditional stock markets close. Blockchain markets don’t. Turns out, people want that.

The Block Scholes report shows price deviations widen overnight and on weekends when U.S. markets shut down. Why? Minting and redemption of tokenized shares pauses when the underlying market closes. So you get pure crypto-style price discovery during off-hours.

But that’s actually the point. Traders want exposure to Apple or Tesla even when NASDAQ is closed. Maybe news breaks at 2 AM. Maybe you’re in Asia and U.S. trading hours are inconvenient. Tokenized stocks solve that problem.

Plus, the 24/7 availability matters more than most people realize. Traditional brokers force you to wait until 9:30 AM Eastern to react to overnight news. Tokenized markets let you act immediately. That’s not a gimmick. That’s a genuine structural advantage.

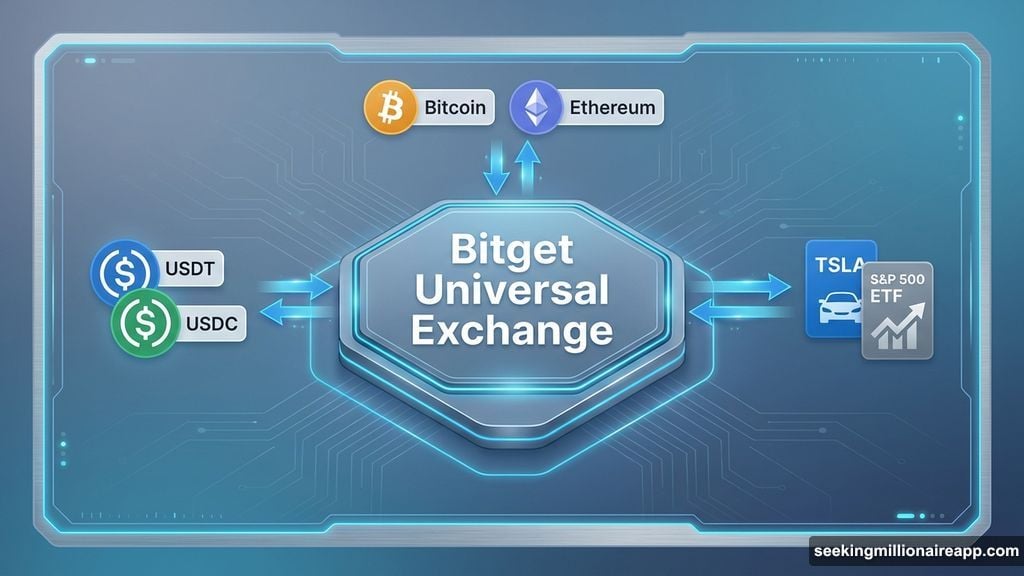

Bitget’s Universal Exchange Removes Friction

Here’s what made this shift possible. Bitget built what they call a Universal Exchange (UEX). One platform. Crypto, stablecoins, and tokenized traditional assets all in the same trading environment.

Why does that matter? Because managing separate crypto and stock accounts is annoying. Most traders already hold stablecoins. Now they can use those directly to buy tokenized Tesla or S&P 500 exposure without converting to fiat or opening a traditional brokerage account.

Gracy Chen, Bitget’s CEO, explained it simply: “Tokenization only works if access is simple and markets are liquid.” That’s exactly right. The technology existed for years. But without easy access and decent liquidity, nobody used it.

The UEX model integrates spot trading, derivatives, and tokenized stocks into one interface. You manage everything through a single wallet. Fund positions with stablecoins. Switch between crypto and stocks without friction. That removes the barriers that kept tokenized equities niche.

The User Base Already Exists

Block Scholes found something interesting. Most traders using tokenized stocks already hold crypto assets. This isn’t attracting an entirely new audience. It’s giving existing crypto traders access to traditional markets.

That makes sense. If you’re comfortable with blockchain wallets and on-chain settlement, tokenized stocks feel natural. You’re not learning a new system. You’re extending what you already do into new asset classes.

For exchanges, this is huge. The customer acquisition cost is essentially zero. Crypto traders want more things to trade. Tokenized stocks give them that without requiring education about how blockchain works. They already understand the infrastructure.

Moreover, this overlap positions exchanges perfectly for institutional adoption. As traditional finance explores on-chain settlement and custody, they’ll look for platforms that already have liquidity and users. Exchanges that built this infrastructure early have a massive head start.

Stablecoins Paved the Way

Thabib Rahman from Block Scholes made a key point. Stablecoins were the first step in on-chain tokenization. They proved blockchain could handle real-world asset value at scale.

Stablecoin volume exploded in 2025. USDC and USDT moved trillions of dollars. That infrastructure—wallets, exchanges, settlement rails—now supports tokenized stocks without requiring new technology. The plumbing already exists.

Plus, stablecoins created regulatory precedent. Regulators learned to distinguish between speculative crypto tokens and blockchain-based representations of real-world value. That makes approvals for tokenized equities easier. The hard regulatory battles happened with stablecoins.

So tokenized stocks aren’t starting from zero. They’re leveraging mature infrastructure and clearer regulatory frameworks. That’s why adoption happened faster than most people expected.

Spreads Tell the Real Story

Market quality comes down to spreads. Tight spreads mean efficient markets. Wide spreads mean you’re getting ripped off.

Block Scholes data shows tokenized stocks maintain relatively tight spreads during traditional trading hours. Outside those hours, spreads widen. But that’s expected when the underlying market is closed and minting pauses.

What matters is the trend. Spreads are tightening as volume grows. More liquidity means better prices. Better prices attract more traders. The flywheel is turning.

For comparison, early cryptocurrency markets had massive spreads. Bitcoin might trade 5% higher on one exchange than another. That arbitrage opportunity disappeared as markets matured. Tokenized stocks are following the same path, just faster because the infrastructure already exists.

Institutions Are Watching Closely

Rahman noted that 2025 saw growing institutional participation. A crypto-friendly U.S. administration helped. But the real driver was infrastructure maturity.

Institutions care about custody, settlement, and regulatory compliance. Blockchain offers advantages in all three areas. Instant settlement. Transparent custody. Programmable compliance. These aren’t theoretical benefits. They reduce operational costs and risk.

Major financial players are testing tokenized assets internally. Some are building pilot programs. Others are partnering with exchanges like Bitget to access existing liquidity. Either way, institutional interest is accelerating.

Plus, institutions move slowly. They need to see proof before committing capital. The fact that tokenized stocks now have consistent volume and reasonable spreads removes a major objection. The market exists. Now it’s about scaling participation.

What Comes Next in 2026

Block Scholes predicts tokenized real-world assets will be a major narrative in 2026. Not just stocks. Commodities, treasuries, index products—anything with clear pricing and settlement.

The technology is ready. The regulatory framework is clarifying. The user base exists. Now it’s about product expansion and institutional adoption.

Bitget’s integration of tokenized stocks from Ondo Finance and xStocks shows where this is heading. More providers will tokenize more assets. Exchanges will compete on liquidity and user experience. Traders will gain access to global markets through a single interface.

However, this market is still early. Rahman emphasized that tokenized assets are in a nascent phase. Infrastructure exists, but it needs refinement. Pricing mechanisms work, but they need optimization. The foundation is solid. Now comes the building phase.

The Convergence Nobody Predicted

Five years ago, crypto and traditional finance seemed like separate worlds. Blockchain advocates wanted to replace banks. Traditional finance dismissed crypto as speculation.

Tokenized stocks represent something different. Not replacement. Integration. Blockchain’s speed and accessibility combined with traditional market depth and regulatory clarity.

That convergence is happening faster than anyone expected. Crypto exchanges are becoming gateways to traditional markets. Traditional assets are moving on-chain. The line between “crypto trading” and “stock trading” is blurring.

For traders, this is excellent news. More assets. Better access. Lower friction. Whether you’re in New York or Singapore, you can trade the same markets with the same tools.

Bitget’s Universal Exchange model might be the clearest example of where this is heading. One platform. All assets. 24/7 access. That wasn’t possible five years ago. Now it’s normal. And it’s just getting started.